Uranium 2023: Revenge of the Nerds (Dec 2023)

As value investors, we frequently find ourselves investing in companies and industries that are out of favor with the mainstream investing crowd. It feels like we’re always sitting at the unpopular kids’ table in the high school cafeteria. While the “cool” kids in their letterman jackets (or the metaphorical equivalent in our industry: the finance bro fleece vest) are gathered around their tables talking about how much more Nvidia stock they are buying or seeking out the next AI play, we’re researching resource companies, emerging markets, and cyclically depressed industries like nerds prepping for their next trip to Comicon.

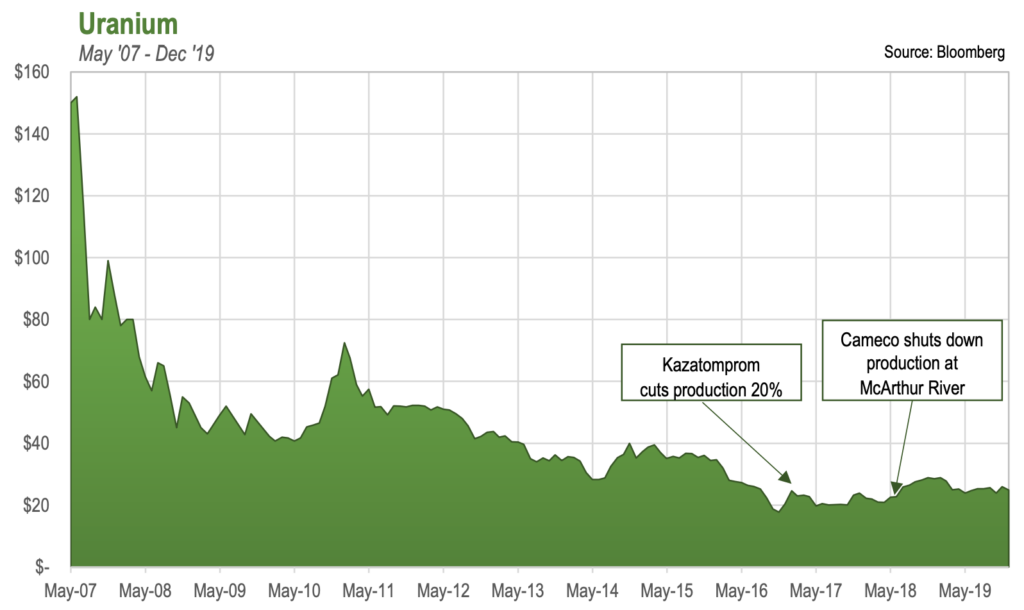

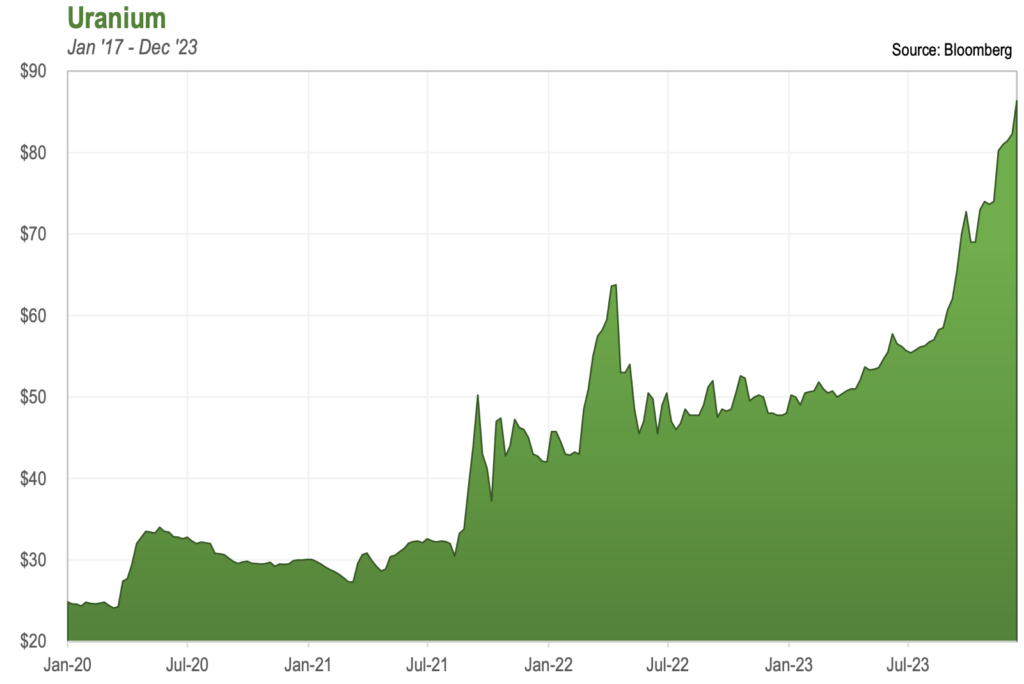

When we last published a commentary on uranium three years ago, it was definitely in the “uncool” category. Uranium was languishing in the $20-30/lb range, and it seemed like our thesis might never play out. Big miners with some of the lowest costs in the industry had reduced production materially with only small, short-term effects on the spot price.

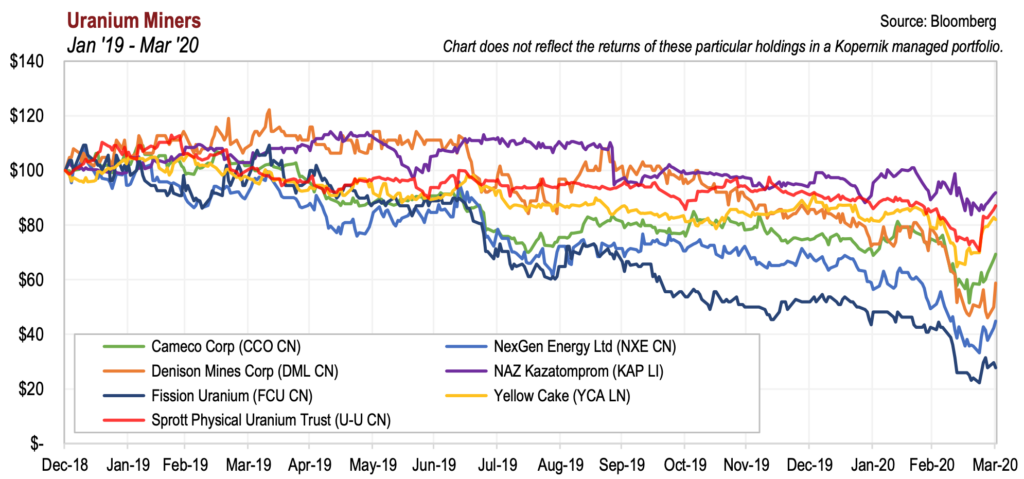

By the time Covid hit in 2020 (and we updated our uranium whitepaper), the miners had fallen 20-30% over the previous year. It felt like we were doomed to be stuck at the outcast table forever. Actually, it was even worse than that. With 10% of Kopernik’s portfolio invested in uranium stocks, even the other uranium bulls thought we were a bit crazy and should sit by ourselves.

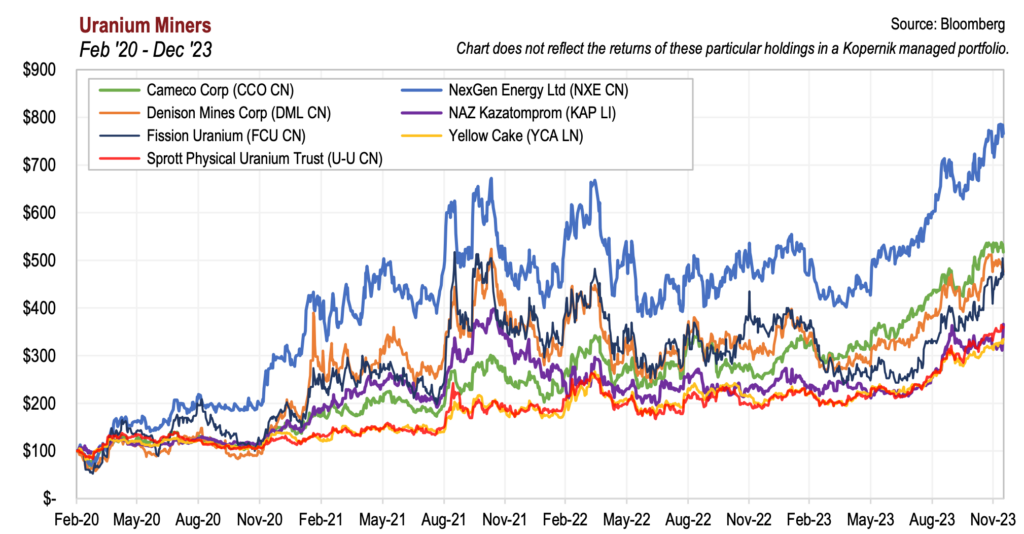

More recently, however, we have found ourselves in the unfamiliar position of asking ourselves whether we have finally earned a seat with the popular crowd. As the charts below show, both the uranium price and the stock prices of uranium companies have soared as investors have gone from fearing their radioactivity to basking in their warm glow. Uranium has more than doubled to over $80/lb. and uranium stock prices have increased significantly. The holding companies are up 3-4x, while the producing miners are up 3.5x-8x. Meanwhile, uranium exploration companies, which sit on massive reserves, are up an astounding 8-11x.

After years of sitting at the back of the cafeteria, it seems like nuclear energy has finally taken its coveted (and in our minds deserved) spot in the middle of the room. How cool has nuclear energy (and by extension uranium) become? Just look at some the examples below:

The current Miss America is a nuclear engineer. Are beauty contestants still cool in an era of influencers? We aren’t sure, but we’ll take it.

As a sidebar, this actually isn’t the first time that nuclear power has been featured in beauty pageants. In the 1950s, Las Vegas showgirls competed for the title of “Miss Atomic Bomb” as the city became an epicenter of nuclear testing. Certainly different than today’s nuclear power advocates, but interesting nonetheless:

Returning to the present, we also have a Brazilian model nuclear influencer. We’re still not sure what an influencer does, but Isabelle Boemeke has 25,000 followers on TikTok.

We have another influencer on TikTok called “Ms. Nuclear Energy” (this one with 118,900 followers!):

And we have “Atomic Eric” on X (the platform formerly known as Twitter) who, in addition to touting the benefits of nuclear energy, is a “fission musician” which seems destined to be the next “hot” musical genre.

While we are gratified that our investment thesis on uranium has finally started to play out, it leaves us wondering whether it has become too popular and maybe we need to move on to investments with more upside. Is it time for us to leave the cool kids’ table and return to our other, less popular pursuits?

Just as we do when some of our investments move against us, when the stocks do well, we re-examine our investment theses and valuations to see what, if anything, has changed. With a stock that has gone down materially, we want to make sure we don’t panic out of it at the bottom if the value in the company is still there. With stocks that have performed well, we want to make sure we don’t “overstay our welcome” and hang on to them when they are fairly valued or overvalued, just because the momentum looks good at the moment. Kopernik’s investment thesis on commodities tends to be driven heavily by the incentive cost to bring the next mine into production, as over the long term the price tends to gravitate around that level. We estimate the incentive price for uranium to be between $60-$90/lb, unadjusted for the recent avalanche in money printing.

The portfolio’s exposure to uranium has gone from 10% to about 7% during a time when the stocks have doubled or tripled, so you can imagine which direction much of the trading has been in. Some of this is due to internal maximum position limits on companies, sectors, and industries. Ironically, the same people who thought we had too much uranium at 10% would probably be happy with us at 30% now that the charts look so good.

So what has changed in the last three years, besides the prices? Why has uranium become so popular? Why is nuclear energy enjoying a renaissance? Are the influencers on to something, after all?

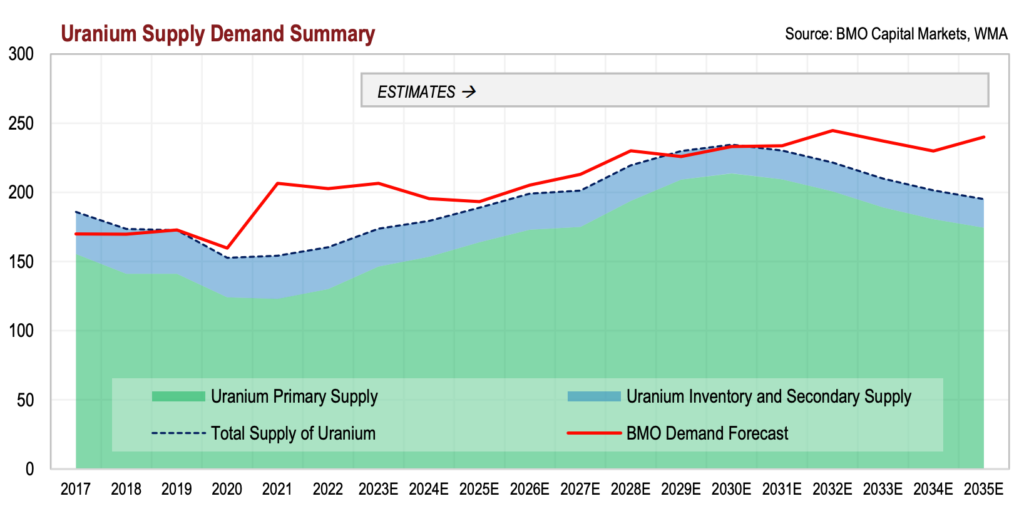

First, let’s talk about what hasn’t changed: the actual demand for uranium in reactors. The number of reactors commissioned, restarted, or decommissioned has been about in line with our expectations. Even though there are currently 57 new nuclear reactors under construction globally, our thesis was never dependent on great demand growth. It was more that supply would continue to decline at prices that were unsustainably low.

Sure enough, supply continued to come out of the market. It took longer than expected because many miners were protected by long-term contracts at higher prices. Once those started to roll off it was inevitable that mines would pause operations or shut down. The cycle was also elongated by secondary supplies such as enrichment underfeeding and inventory drawdowns, but these too eventually declined. Now with the restart of Cameco’s McArthur River mine and planned increases in Kazakh production, supply is starting to recover, as shown on the table below.

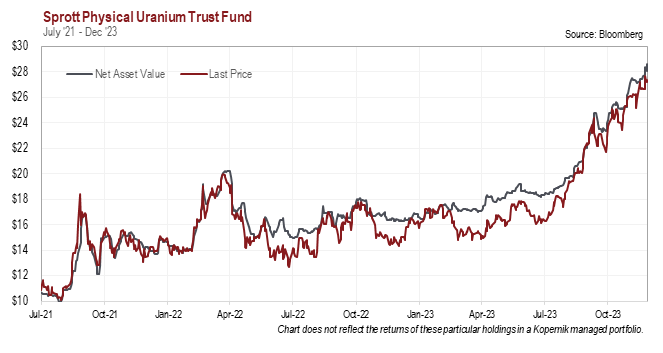

One area that absorbed a lot of uranium were the holding companies like Sprott Uranium Trust and Yellowcake PLC (full disclosure: we own both). In 2021 the Sprott trust absorbed quite a bit of uranium as it traded at a premium to NAV, allowing it to sell shares and buy spot uranium in the market. Yellowcake was less active but also bought quite a bit. These two have now accumulated over 80 million pounds of U3O8 in a market that is producing under 140 million pounds a year.

Once these companies started trading at discounts to NAV in early 2022, they stopped buying, which sent the price of uranium back down from $63 to the high $40s. The current run-up in uranium, however, has happened without much, if any, buying from these players, reflecting a more fundamental tightening of supply/demand. We have been somewhat frustrated with these stocks’ consistent discounts to NAV, although maybe we should expect it since the arbitrage opportunities in them only work one way. When trading at a premium Sprott and Yellowcake can sell shares and buy uranium. When they are at a discount, they can do nothing (and collect the management fees) since there is no redemption ability.

Even though current demand remains stable, longer-term demand could rise more than we would have anticipated a few years ago due to two things: the development of Small Modular Reactors (SMRs) and, more importantly, a near complete turnaround in popular opinion on nuclear power’s safety and environmental benefits.

SMRs are basically (to oversimplify it) small nuclear power units that can be built in modular fashion and transported to their final locations, rather than having everything built on site. The idea is that these reactors would be much cheaper and faster to build, especially after the first one. They could also be deployed to areas that do not necessarily have enough demand for a full-scale reactor. There are currently about 80 SMRs in various stages of research, design, licensing, or construction. The technologies behind these vary between smaller light water reactors, molten salt reactors, and high temperature gas-cooled reactors. While the final fuel assemblies and required enrichment levels can vary, all of them will require uranium.

With this many planned projects it seems likely that a few of them will eventually become commercially viable. The question is, when? We have seen a few of these that claim they could be in operation by 2030, but we think this is quite optimistic. Licensing alone of these reactors will likely take at least 5-6 years and stated construction times of 2-3 years are probably low until the companies can establish supply chains and develop scale to have efficient manufacturing. In the longer term SMRs will likely cut down permitting and construction times materially, greatly reducing costs. However, as with any large energy or infrastructure deployment, it is always a good bet to take the “over” on permitting and construction times as well as on costs, especially with new technologies or where governments are involved.

We doubt these will be deployed in great numbers before the late 2030s. In fact, one of the most promising projects, Nuscale’s Utah project, was recently cancelled due to rising costs. Over the longer term, SMRs will likely be the source of much uranium demand growth and could even replace existing reactors at the end of their lives as they could even be cheaper than life extensions on older plants.

The most impressive change we have seen over the last few years vis-à-vis nuclear energy has been the dramatic and rapid reversal in popular attitudes towards it. It is not just the young influencers mentioned above (who might just be rebelling against their boomer and Gen-X parents’ environmental mores).

- France has gone from targeting reducing nuclear power from 70% to 50% of electricity to now wanting to grow it once again.

- The EU has included nuclear power in its Green Taxonomy giving it some tax benefits as green energy.

- Japan has gone from slow walking the restarts of its nuclear plants to trying to accelerate them and even plan to build more as public opinion has reversed markedly since Fukushima.

- South Korea has gone from trying to scrap reactors under construction to planning to extend existing reactors’ licenses and building more.

- Support for nuclear power in the US has increased from 43% to 57% since 2020.

- Even California, where energy from solar farms is abundant, has extended the life of its lone nuclear plant, Diablo Canyon. However, there still seems to be a pitched battle there between “Mothers for Peace” and “Mothers for Nuclear” over whether or not this is a good thing.

- The UK and the Netherlands have proposed building new nuclear plants. Although these are currently only in the planning/discussion phase, this would be a huge change. Currently, the Netherlands only has one nuclear reactor, and the UK hasn’t opened a new nuclear power plant since 1995.

- Switzerland has gone from passing a referendum in 2017 to phase out nuclear energy (almost 40% of their electricity generation) to looking to extend the lives of their plants to 60 and possibly 80 years.

- Attitudes are changing elsewhere in Europe as well. After Fukushima, Germany, Spain and Belgium vowed to shut down their nuclear reactors. Belgium has since tried to reverse course by extending the lives of two plants. Spain is trying to reverse or extend their shut down dates. Germany on the other hand, has shut down all of its nukes and will replace them with Lignite and Liquified Natural Gas. The irony, of course, is that this policy has forced the ultra-green-leaning Germans to rely on fossil fuels.

So what led to this change in heart towards the nuclear power industry? We had always thought that nuclear simply made sense as it is safe, relatively cheap, reliable, and carbon free. But none of those positive attributes have changed over the last three years. Did the world suddenly wake up and say, “Hey, those guys at Kopernik might be on to something?” As much as our egos would prefer the latter, we think two things had the biggest effect: the war in Ukraine and the growing realization that current renewables technologies cannot power the world in a cost-effective way.

Russia’s invasion of Ukraine did not actually have much direct effect on the uranium market. While the west gets a great deal of its enriched uranium from Russia, the amount of U3O8 coming from there is fairly small. Despite aggressive sanctions against many Russia businesses, there have been no sanctions so far against Russian enrichment, probably because of the recognition that such sanctions would harm Western nations much more than Russia.

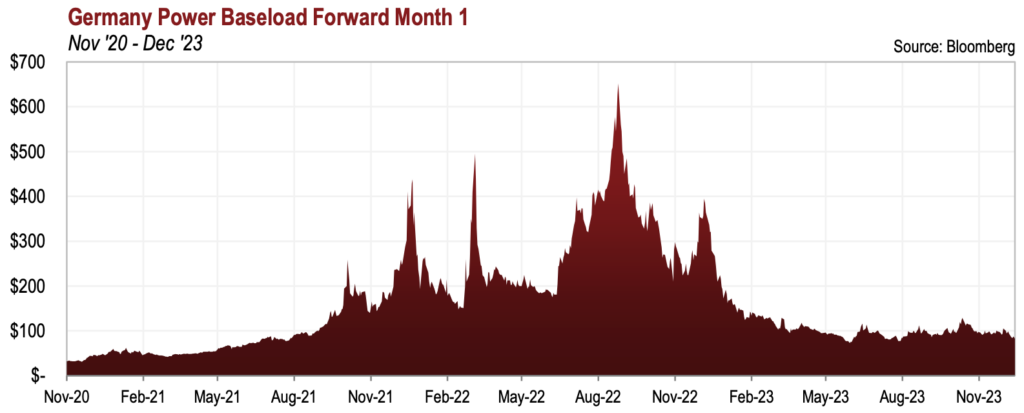

What the war has done is create an energy crisis in Europe due to the cutoff of Russian natural gas. In addition to the high costs of gas and electricity post-invasion, energy security has become a major issue for businesses and governments everywhere. The rapidity and scale of energy cost changes in Europe have been unprecedented. For example, electricity costs in Germany (the worst hit) rose over 12 times during the peak of the crisis. They have since fallen dramatically but are still twice where they were before the war.

European governments have thrown €800 billion at the problem, but, many industries there, including chemicals, cement, fertilizer, and aluminum producers have been badly hurt by the increase in one of their main costs. As a result, governments in countries without domestic sources of energy are looking for ways to avoid such a risk to their economies. This explains why Japan, Korea, and the European countries mentioned above have changed their attitudes so quickly (except for Germany, which is another story and very confusing to us). Nuclear power has shown itself to be a good stabilizer in the energy supply picture with its ability to provide consistent baseload power and its need to hold significant uranium inventory to avoid short term disruptions (nuclear utilities typically hold 3-4 years’ worth of uranium in their pipelines).

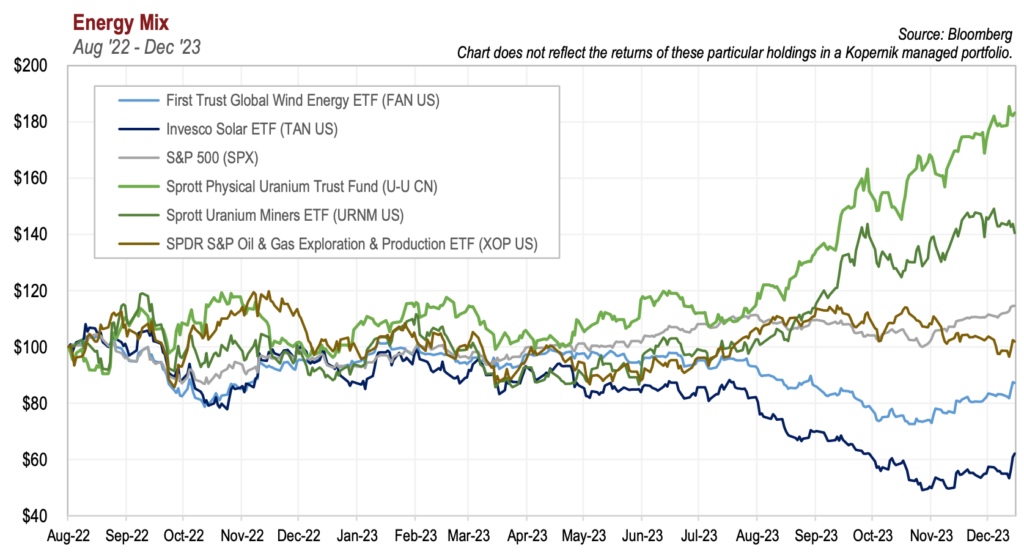

There are still a few people out there who still believe the world can go completely renewable (wind and solar power) cheaply and quickly. However, it is becoming more and more apparent that this is going to be difficult. The Inflation Reduction Act signed into law in the US a little over a year ago created huge subsidies for all sorts of renewables (and a few minor ones for nuclear power). Clearly, the market is not buying it: since then, stock prices of solar and wind companies have fallen 25%-50%, while the uranium price has risen 70%.

The recent increases in interest rates around the world have rapidly disrupted the renewables industry, which tends to finance projects with 75-80% debt (and earns single digit returns on equity even with that). These projects were marginal when rates were at zero, and now, with rates over 5%, they need major increases in prices to get built. Many of these will continue to get built but their growth will slow due to the higher costs which are unpalatable in an environment of higher inflation. With the focus shifting away from climate change and towards the reliability and security of the energy supply, nuclear power seems to be the winner here.

Back to our original question. Is it time to leave the cool kids table and seek more familiar dining options? The bull thesis for nuclear power and uranium stocks is fairly clear. Demand is growing, albeit slowly. The current supply still does not meet consumption by a decent margin, requiring secondary supplies and, eventually, increased mine production. Mine restarts are happening but are unlikely to fill the supply/demand gap in the near term. What’s not to like?

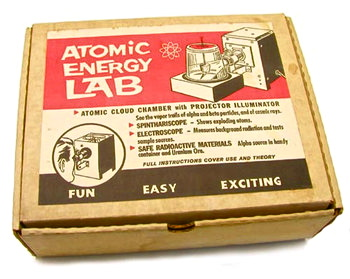

We are of the opinion that we are clearly closer to the top than the bottom. With uranium having gone from $18 to $82/pound, this falls into the “duh” category. If animal spirits take over this market (á la Keynes) as more kids crowd the “cool table,” the stocks could certainly go much higher, and we have seen some forecasts of exactly that. As of this writing, the market cap of the entire uranium mining industry is about $42 billion after the recent huge run in the stocks. That number is dwarfed by the fossil fuel companies, EV manufacturers, and the utilities that use enriched uranium. If public opinion were to shift even further in favor of nuclear power, who knows how high prices could go? Over the years, nuclear fission has been suggested as the key to a golden age. Everything from automobiles to children’s toys was poised to benefit from atomic power. Popular opinion has shifted, but things that are out of favor tend to come into favor again. If the masses decided once again that nuclear power was the key to a green future with a clean energy supply, what would the result be? We would suggest it would be beneficial to the miners.

Kopernik’s disciplined investment process is price dependent. We only initiate or add to a position when a stock is trading at a discount to what we estimate is its risk-adjusted intrinsic value. As that discount shrinks, we trim the position opportunistically, eliminating it when prices appreciate far enough. We have substantially trimmed most of the uranium positions, but still see upside in some of the companies. We are getting close and could well get crowded out soon. When we are, we will happily leave the cool kids’ table and head back to our little corner of the investing cafeteria

Steve Rosenthal, CFA

Kopernik Global Investors, LLC

December 2023

Original: February 2017, Updated: August 2020

Important Information and Disclosures

The information presented herein is proprietary to Kopernik Global Investors, LLC. This material is not to be reproduced in whole or in part or used for any purpose except as authorized by Kopernik Global Investors, LLC. This material is for informational purposes only and should not be regarded as a recommendation or an offer to buy or sell any product or service to which this information may relate.

This letter may contain forward-looking statements. Use of words such was “believe”, “intend”, “expect”, anticipate”, “project”, “estimate”, “predict”, “is confident”, “has confidence” and similar expressions are intended to identify forward-looking statements. Forward-looking statements are not historical facts and are based on current observations, beliefs, assumptions, expectations, estimates, and projections. Forward-looking statements are not guarantees of future performance and are subject to risks, uncertainties and other factors, some of which are beyond our control and are difficult to predict. As a result, actual results could differ materially from those expressed, implied or forecasted in the forward-looking statements.

Please consider all risks carefully before investing. Investments in a Kopernik strategy are subject to certain risks such as market, investment style, interest rate, deflation, and illiquidity risk. Investments in small and mid-capitalization companies also involve greater risk and portfolio price volatility than investments in larger capitalization stocks. Investing in non-U.S. markets, including emerging and frontier markets, involves certain additional risks, including potential currency fluctuations and controls, restrictions on foreign investments, less governmental supervision and regulation, less liquidity, less disclosure, and the potential for market volatility, expropriation, confiscatory taxation, and social, economic and political instability. Investments in energy and natural resources companies are especially affected by developments in the commodities markets, the supply of and demand for specific resources, raw materials, products and services, the price of oil and gas, exploration and production spending, government regulation, economic conditions, international political developments, energy conservation efforts and the success of exploration projects.

Investing involves risk, including possible loss of principal. There can be no assurance that a strategy will achieve its stated objectives. Equity funds are subject generally to market, market sector, market liquidity, issuer, and investment style risks, among other factors, to varying degrees, all of which are more fully described in the fund’s prospectus. Investments in foreign securities may underperform and may be more volatile than comparable U.S. securities because of the risks involving foreign economies and markets, foreign political systems, foreign regulatory standards, foreign currencies and taxes. Investments in foreign and emerging markets present additional risks, such as increased volatility and lower trading volume.

The holdings discussed in this piece should not be considered recommendations to purchase or sell a particular security. It should not be assumed that securities bought or sold in the future will be profitable or will equal the performance of the securities in this portfolio. Current and future portfolio holdings are subject to risk.