Queen Hatshepsut (Sep 2024)

Luxor is a fascinating place. So much history. And it has changed a lot since I last visited 35 years ago. It is interesting to listen to the tales from four millennia ago and realize how much has found its way into the messages in the religions of ancient Greece and Rome, and even in most present-day religions. Of all the fascinating characters, somehow Queen Hatshepsut had previously escaped my attention (our tour guide pronounced it ‘hat’ ‘ship’ ‘suit’).

Per History.com:

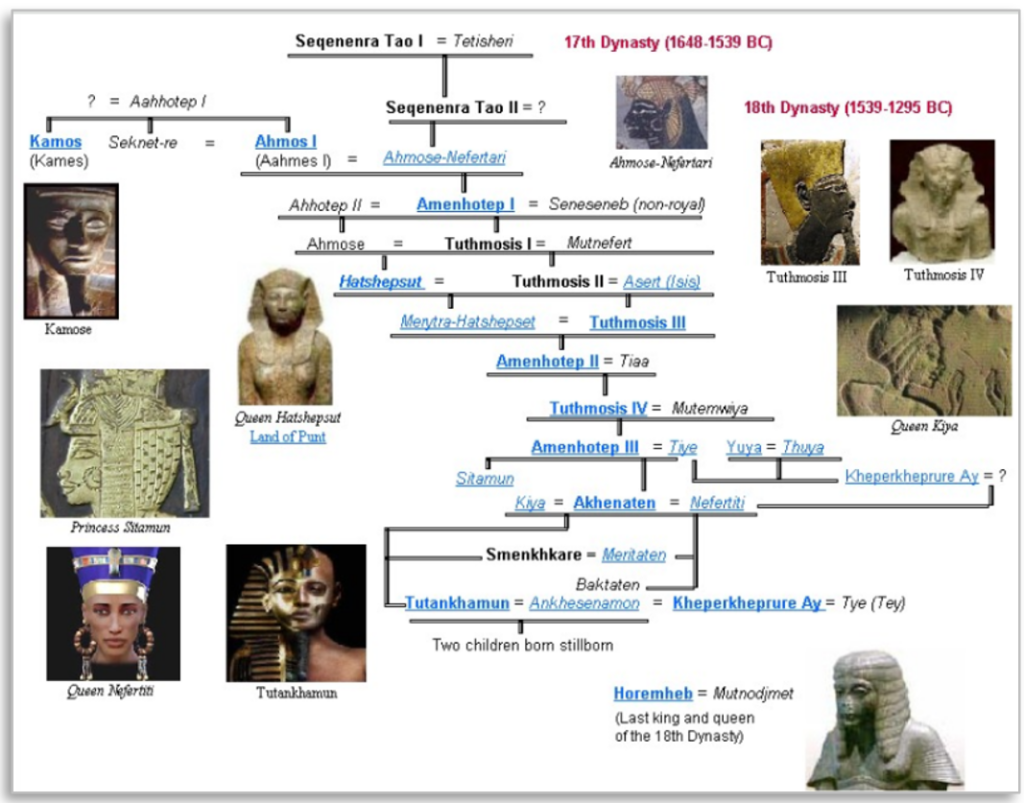

“Hatshepsut, daughter of King Thutmose I, became queen of Egypt when she married her half-brother, Thutmose II, around the age of 12. Upon his death, she began acting as regent for her stepson, the infant Thutmose III, but later took on the full powers of a pharaoh, becoming co-ruler of Egypt around 1473 B.C.”

While Cleopatra and Nefertiti are so prominently featured in modern retellings of ancient Egyptian history, Hatshepsut arguably is more impressive. Turning to Wikipedia:

“Hatshepsut is, according to Egyptologist James Henry Breasted, ‘the first great woman in history of whom we are informed.” In some ways, Hatshepsut’s reign was seen as going against the patriarchal system of her time. She managed to rule as regent for a son who was not her own, going against the system which had previously only allowed mothers to rule on behalf of their biological sons. She used this regency to create her female kingship, constructing extensive temples to celebrate her reign, which meant that the public became used to seeing a woman in such a powerful role. This ensured that when the oracle declared her king, the Egyptian public readily accepted her status.”

She was a fascinating character, well worth doing some research on. The royal lineage, family intrigue, the politics, the myths as to whether she was a wife of God, or conceived by God, her relationship with her advisor, etc. are all things that could lead to a successful miniseries.

Female pharaohs were quite rare. Successful ones, well—she may have been the only one. Returning to Wikipedia:

“Hatshepsut’s reign was a period of great prosperity and general peace. One of the most prolific builders in Ancient Egypt, she oversaw large-scale construction projects such as the Karnak Temple Complex, the Red Chapel, the Speos Artemidos and most famously, the Mortuary Temple of Hatshepsut at Deir el-Bahari.”

But alas, not everyone appreciates a successful female leader. The next several pharaohs apparently did not (Wikipedia):

“Toward the end of the reign of Thutmose III and into the reign of his son, an attempt was made to remove Hatshepsut from certain historical and pharaonic records. Her cartouches and images were chiseled off stone walls. Erasure methods ranged from full destruction of any instance of her name or image to replacement, inserting Thutmose I or II where Hatshepsut once stood. There were also instances of smoothing, patchwork jobs that covered Hatshepsut’s cartouche; examples of this can be seen on the walls of the Deir el-Bahari temple. Simpler methods also included covering, where new stone was added to fully cover reliefs or sacred stonework. At the Deir el-Bahari temple, Hatshepsut’s many statues were torn down and, in many cases, smashed or disfigured before being buried in a pit. At Karnak, an attempt was made to wall up her monuments.”

Furthermore:

“He (Amenhotep II) is documented, further, as having usurped many of Hatshepsut’s accomplishments during his own reign. His reign is marked with attempts to break the royal lineage as well, not recording the names of his queens and eliminating the powerful titles and official roles of royal women, such as God’s Wife of Amun. Some of these titles would be restored in the reign of his son Thutmose IV.”

There are so many directions that we can go from here. History; parables; diversity, equity, and inclusion; how times have or have not changed; how civilizations have migrated as modes of transportation have changed (the Nile was effectively the center of the world); and much more. All are worthy of discussion. But this missive draws on the censorship of Queen Hatshepsut to discuss “story telling” and the important implications for present-day investors.

One of the most thought-provoking books I’ve ever read was Sapiens, by Yuval Noah Harari. At first, I found his provocative and differentiated interpretation of history intriguing. A central message of the book seemed to be that what separates mankind from other animals isn’t so much opposable thumbs but our ability to tell stories. A good storyteller can fire up the mobs to conquer the next village and often get the conquered village to cooperate, even assimilate. Ultimately, I believe he is saying that mankind is easily manipulated and, looking at the contemporary world, perhaps he’s even suggesting that clever men should manage the world narrative.

History, it is said, is written by the winners, incorporating their biases. Certainly, the world is derived from “his-story.” Societies’ attitudes change over time, and this is reflected in their stories, in their history books. And as was the case with this commentary’s title character, the stories can change from a celebration of success to complete censorship, to slowly being restored to being viewed from a positive vantagepoint. Let’s briefly touch on a few examples of how views can change.

Several centuries ago, carrying extra body weight was viewed favorably. Being “Rubenesque” was a sign of wealth and prosperity. Poor people were thin, struggling to get enough food to survive. Nowadays, people have come to realize that obesity is unhealthy. Being fit is often a sign of prosperity. Less affluent people tend to have less access to healthy foods. They also generally have less time and money for fitness equipment, private trainers, and education on such matters.

Similarly, many years ago, tanned skin was a sign of being in the working class, stuck laboring outdoors while the rich worked from a cush office, if they needed to work at all. Later, at least in the western world, tans became desirable, as the working class was stuck indoors, in factories or offices, while the rich could afford to hang out by the pool, the beach, or on a yacht. More recently, tans have gone back out of favor since too much exposure to sunlight ages one’s skin and increases chances for developing skin cancer. Very recently, some articles suggest that all the sunblock and sun avoidance may have gone too far, causing a deficiency of vitamin D, which in turn causes health problems. Lack of sun may affect moods as well. What will views be in twenty-five years?

Years ago, it was thought that childhood was, among other things, a time to build one’s immunity to pathogens. People would even have “pox parties” so that a whole group of kids could get exposure to the flu, chicken pox, the measles, etc. immediately so as not to have to worry about getting it later, perhaps at a less opportune time. Measles, for example, is much more dangerous for adults than for children over 5. Nowadays, people use massive amounts of disinfectant, “social distancing,” and vaccinations in an effort to prevent catching anything. Many believe that we now live in a much safer society while others believe that we’ve become “fragile,” more vulnerable to epidemics in the future. Here the story is not universal and bears watching.

“Too many people going underground

Too many reaching for a piece of cake

Too many people pulled and pushed around

Too many waiting for that lucky break”

-Paul McCartney

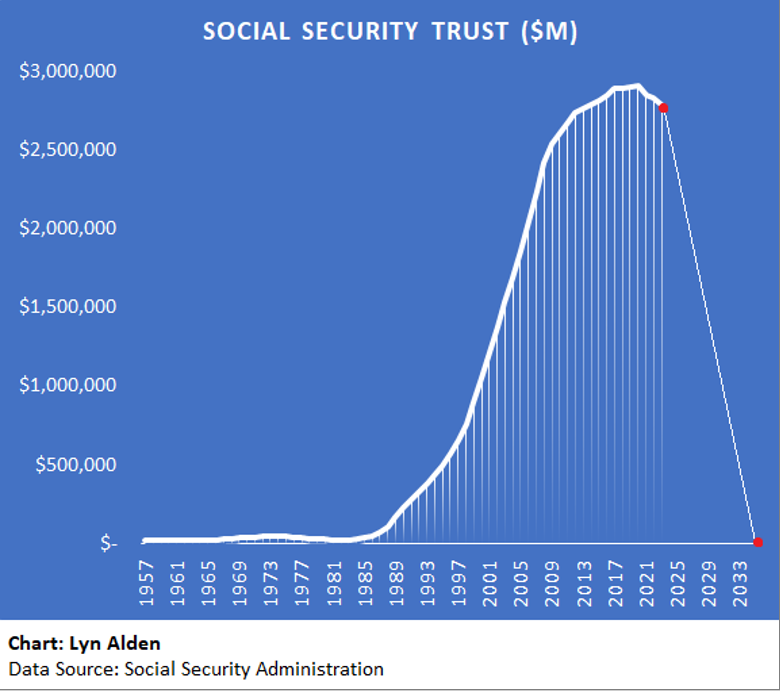

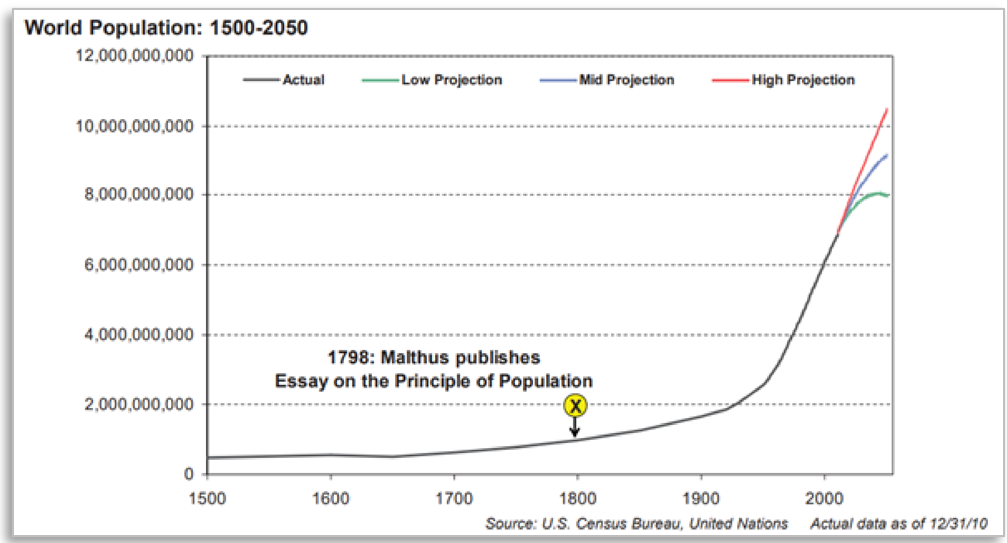

Views on population growth have changed immensely. Two-and-a-quarter centuries ago, when the earth’s population was less than one billion people, Thomas Malthus famously proposed that population growth had gone too far, and direly predicted that “populations had a tendency to grow until the lower class suffers hardship, want and greater susceptibility to war famine and disease.” His timing was notoriously off-base. However, his thesis that “humans have a propensity to use abundance for population growth rather than maintaining a high standard of living,” seems as true now as ever. The current plight of the less fortunate perhaps lends further credence to his ideas. Be that as it may, nowadays, with a population of 8 billion, investors and politicians are constantly warning us of the perils of depopulation. Investors are avoiding investing in Europe, Korea, Japan (although not so much anymore), and other areas that may have shrinking populations. Here, we’ll weigh in with a view: population growth is not desirable. The reason politicians desire it is, in our humble opinion, because most countries have pension schemes that are effectively mere Ponzi-schemes, requiring an increasing number of people to fund the “empty” promises that were made to previous generations.

Outside of that, why would people desire a more crowded world? More people, more traffic jams, more carbon, more global warming (perhaps), more wars as people fight over scarce resources and food, faster spreading of disease as people live in tighter corridors, beaucoup pollution, and a continuing trend of less flora and fauna, less arable land/food, less resources as they are consumed. A dozen or so years ago, Jeremy Grantham, following in Malthus’ footsteps, wrote that:

Returning to our point, while the population has gone up eightfold since Malthus’ time, the planet has not grown. The Earth’s resources have not increased (they’ve shrunk/been consumed). Available fresh water has not increased. Might the earth be analogous to a petri dish? One can hope that mankind stops expanding. And it is interesting that, in general, the countries that have rapidly expanding populations are the poorest ones. China, as a prime example, was very poor until they implemented their one-child policy. Since then, they’ve produced an economic miracle. Investors should take note. Centuries ago, people needed kids to work the farm. In the modern world, kids are a major cost, requiring food, housing, childcare and education, while there is little need, or desirability, to send them to work. And, fortunately, most children now are healthy, making it to adulthood. Therefore, it is logical that most families now choose to remain smaller in size. Are the economics different for countries? For the world? Outgrowing one’s resources is a problem at any level. (For a depressing history of this subject, there is Collapse, by Jared Diamond.) We have no plans to be prescriptive and we offer no answers to the problem of overpopulation. We are saying that views change over time. We’ll further go on record with the prediction that over the next decade, given current valuations, investors will do better in Korea and Southeast Asia than they will in India, a prominently fast growing and well-loved market.

Briefly returning to Sapiens, early in the read, I was annoyed that he kept referring to countries, money, God, companies, etc. as myths. I protested that the USA was certainly real, as are England, Germany, Japan, and most every other country. But later it became clear that Harari defines myths as something that may or may not be true, but which depend upon peoples’ beliefs. Unlike gravity (which would still make things fall even if we all stopped believing it would) if the concept of the USA was erased from the collective memory of all people, the USA would no longer exist.

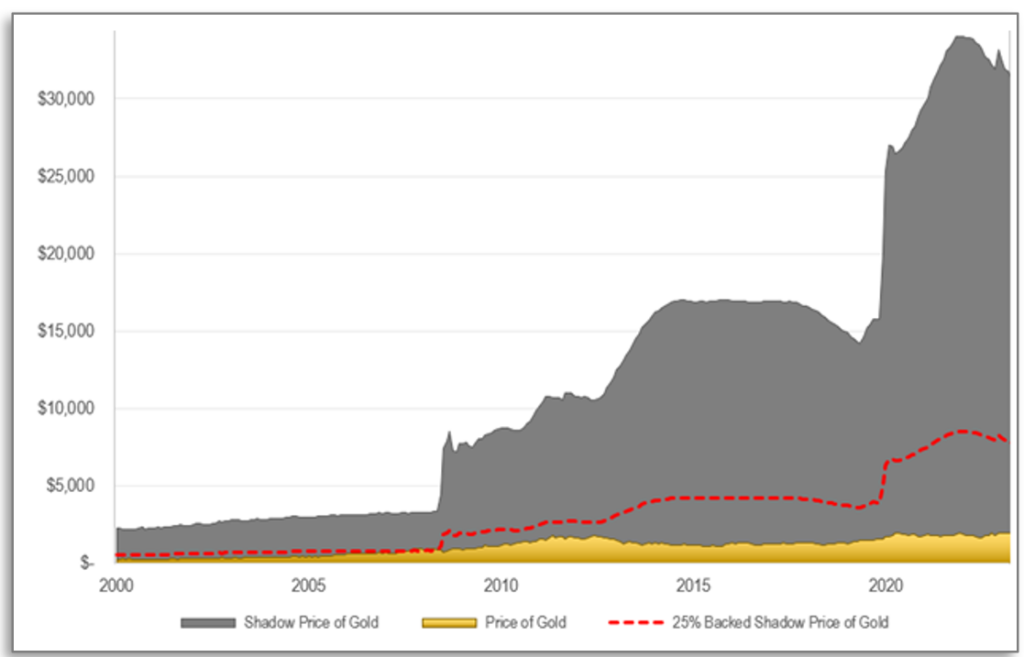

The same is true for money. Bears on gold often proclaim that gold is valuable only because people believe that it is. They are, of course, correct. People have ascribed value to bark, seashells, coins made from nickel, copper, silver, and of course bills made from cotton paper or digits 1s and 0s. Why should society continue to view any of these as money?

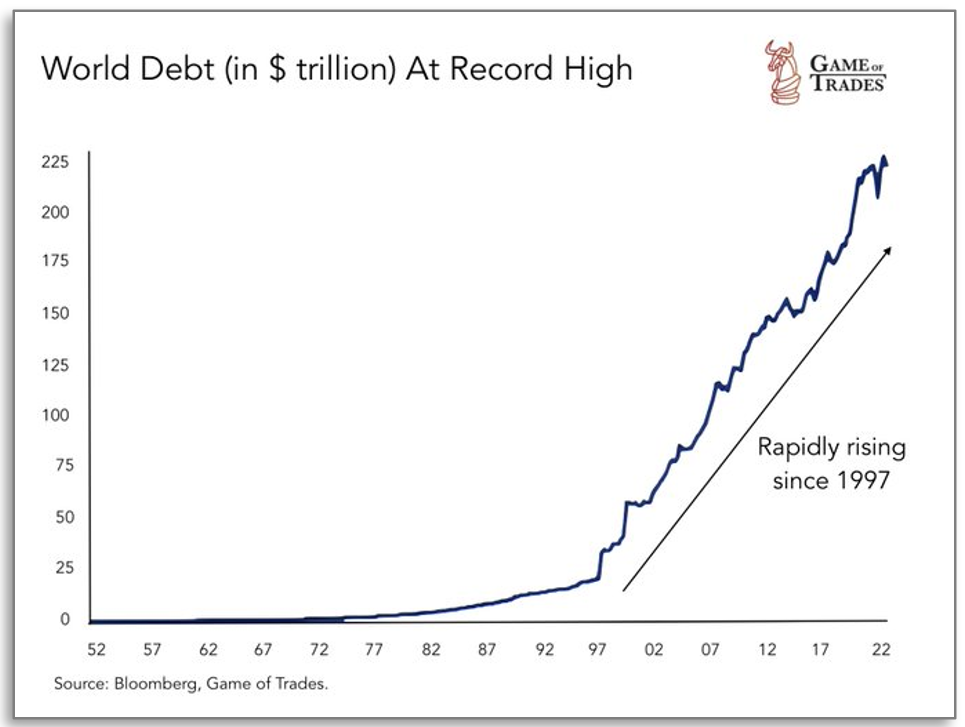

Perhaps they shouldn’t. And, in fact, they haven’t. These have all fallen by the wayside. What?! You may protest that society continues to strongly believe that fiat currencies constitute money. Maybe. But this view begs for examination. Fiat money was introduced by the Chinese in the 7th century. Later experiments include Assignats, Greenbacks, Continentals, Weimar marks, Zimbabwe Dollars, and hundreds of other infamous currencies of failing states. A recent FT article talked about 176 currencies that are currently being used while 600 have failed and disappeared. But the Pound Sterling and the U.S. Dollar have served the test of time, haven’t they? The answer is – No! Over the past half century, peoples’ appraisal of their monetary worth has fallen by 99%. They now require 50 to 100 times more of them to compensate for a good or service than they did in the early 1970s.

Gold, and other precious metals, also depend upon peoples’ willingness to believe that they are money. Currently, most nations and people don’t view it as money (though they now ascribe more value to gold than at any other time in history). We cannot say with certainty that it will be viewed as money well into the future. But, if one had to choose one thing to act as money and a store of wealth, it would be hard to come up with anything better, or nearly as good. (Crypto is an interesting story and has many great attributes but is lacking in several areas, including the test of time.) Precious metals are rare, inert, divisible, attractive, are nobody’s liability, and have a long history of being money.

Future Increases to the shadow Gold Price?

“King Tut (King Tut)

Now when he was a young man

He never thought he’d see (King Tut)

People stand in line to see the boy king. (King Tut)

How’d you get so funky? (Funky Tut)

Did you do the monkey?

Born in Arizona

Moved to Babylonia (King Tut)”

-Steve Martin and the Toot Uncommons

As we work toward a conclusion, let’s turn our attention from Queen Hatshepsut to King Tut. He ascended to the throne at 9 years of age. For those interested in the story of Howard Carter’s quest to find the tomb of King Tutankhamun, there is an interesting four-part mini-series, The Mummy of Tutankhamun, released in 2016. The tomb was discovered with great fanfare in 1922 with all the riches still intact. In the 1970s, the treasures went on tour in the U.S., attracting 8 million visitors and a lot of press. Steve Martin wrote a parody of the hoopla which I thoroughly enjoyed watching him perform live at Lake Tahoe, back in 1979. I had the pleasure of visiting Tutankhamun’s tomb 35 years ago and again this month. With that out of the way, let’s turn our focus to his father, Akhenaten, formerly known as Amenhotep IV. (See sculpture below from the Luxor museum.)

“As a pharaoh, Akhenaten is noted for abandoning traditional ancient Egyptian religion of polytheism and introducing Atenism, or worship centered around Aten.” – (Wikipedia). Though he ruled during very prosperous times and completely changed Egypt, he is relatively unknown, certainly far less famous than his wife, Queen Nefertiti.

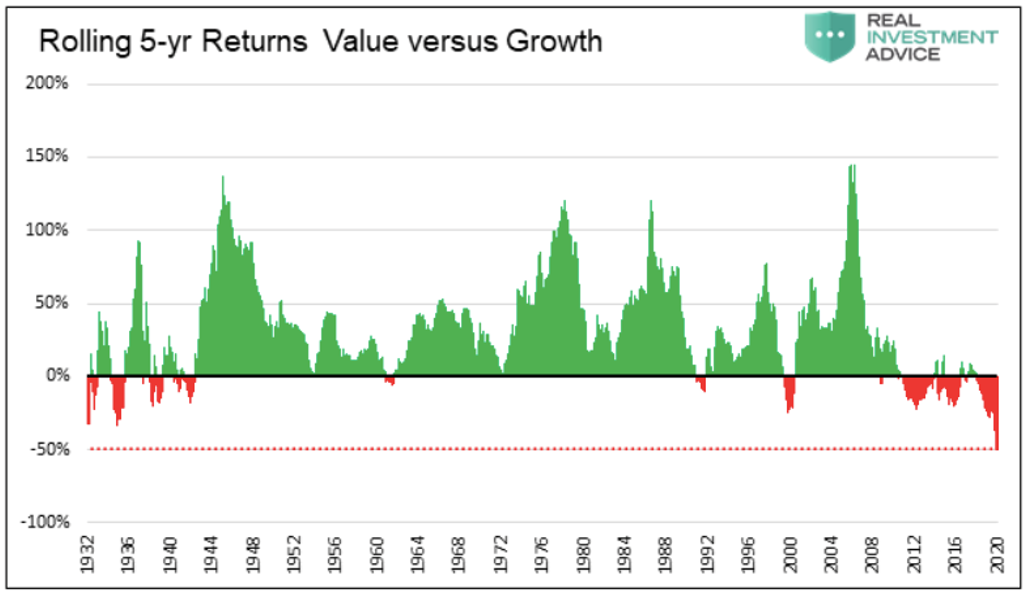

I view the story of this Egyptian royal family, admittedly like too many other things, as an investment analogy. Value investing has been the staple of investors for centuries. It merely means that one strives to buy things for less than they are worth. How can that ever be a bad strategy? It never is. But periodically, society searches for a new “God,” a new sense of values, and sets forth in search of more exciting stories. “Growth” rules the day. But growth only makes sense when it is undervalued. When it gets crazy, bad things eventually follow. That is when the crowds stampede back toward more traditional values. During his reign, Tut restored the traditional polytheistic form of ancient Egyptian religion, undoing the religious shift known as Atenism. His endowments and restorations of cults were recorded on the Restoration Stela. The cult of the god Amun at Thebes was restored to prominence and the royal couple changed their names to “Tutankhamun” and “Ankhesenamun”, replacing the -aten suffix. Additionally, he moved the royal court away from Akhenaten’s capital, Amarna, and back to Memphis.

“Now it’s a mighty long way down the dusty trail

And the sun burns hot on the cold steel rails

And I look like a bum and I crawl like a snail

(All the way from Memphis)”

-Mott the Hoople

The idea of various pharaohs dragging all the people, treasure in tow, across a dusty desert trail from Thebes to Memphis to Amarna and back brought the above Mott the Hoople song back to mind. At any rate, the point of this commentary is that songs change, stories are rewritten, the world is cyclical, and the death of value investing is temporary. Akhenaten’s reign was 17 years, coincidentally about equal to the period during which momentum has now reigned over value. “Aten”-like, the mob chased new stories in 1929, 1972, 1999, 2007, and dare we say, 2024 (as Harari might say, story stocks require continued belief in the stories). Values exist without regard to peoples’ beliefs. While others focus on what the crowds want, we’ll stick with more traditional values such as needs and scarcity and cash on cash returns. When will the “Momentum God” figuratively pass the torch back to “King Tut?” There are certainly many omens that the time is nigh.

Cheers,

David B. Iben, CFA

Chief Investment Officer

Kopernik Global Investors

September 2024

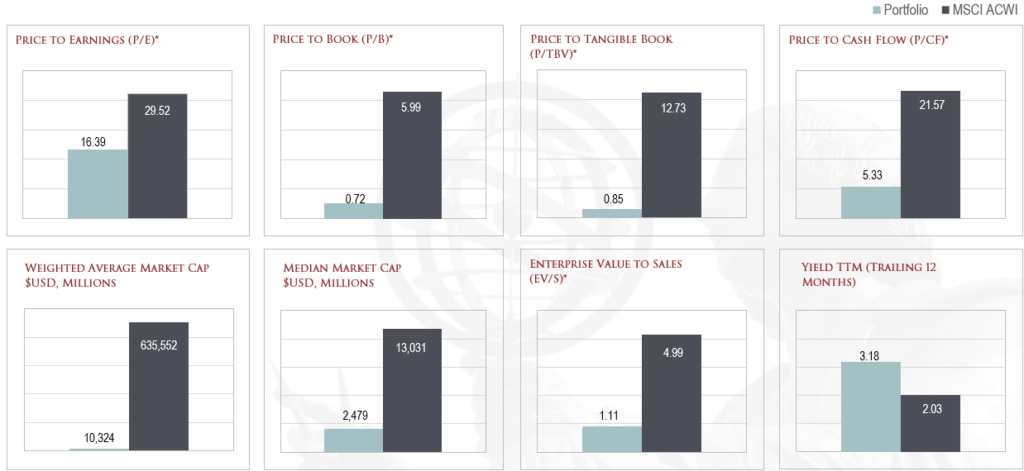

Kopernik Global All-Cap Model Portfolio Characteristics

Characteristics above are based on the holdings of a model portfolio as of August 31, 2024, and are calculated using data from Bloomberg. Calculation method is a weighted average using GAAP/IFRS financials and including companies with negative metrics.

The value of local Russian security holdings and Russian GDR/ADR holdings as of July 31, 2024, reflect fair value pricing.

*Using an industry standard reporting, which utilizes harmonic average (a method of calculating an average value that lessens the impact of large outliers) as of August 31, 2024, characteristics are as follows: P/E: 12.03 (GAC), 22.55 (MSCI ACWI) | P/B: 0.61 (GAC), 3.20 (MSCI ACWI) | P/TBV: 0.72 (GAC), 3.61 (MSCI ACWI) | P/CF: 3.58 (GAC), 15.25 (MSCI ACWI) | EV/S: 0.96 (GAC), 2.52 (MSCI ACWI).

The MSCI All Country World Index is a broad-based securities market index that captures over two thousand primarily large- and mid-cap companies across 23 developed and 24 emerging market countries. The MSCI All Country World Index is different from the strategy in a number of material respects, including being much more diversified among companies and countries, having less exposure to emerging market and small- cap companies, having no exposure to frontier markets and having no ability to invest in fixed income or derivative securities.

PS: In the very cyclical world in which we live, it is noteworthy that this culture shift away from traditional religion was reversed after Akhenaten’s death. His monuments were dismantled and hidden, his statues were destroyed, and his name excluded from lists of rulers compiled by later pharaohs. Traditional religious practice was gradually restored, notably under his close successor Tutankhamun, who changed his name from Tutankhaten early in his reign. When some dozen years later, rulers without clear rights of succession from the Eighteenth Dynasty founded a new dynasty, they discredited Akhenaten and his immediate successors and referred to Akhenaten as “the enemy” or “that criminal” in archival records. Akhenaten was all but lost to history until the late-19th-century discovery of Amarna, or Akhetaten, the new capital city he built for the worship of Aten (Wikipedia). Yet another example of a story being rewritten and perhaps rewritten again.

Important Information and Disclosures

The information presented herein is proprietary to Kopernik Global Investors, LLC. This material is not to be reproduced in whole or in part or used for any purpose except as authorized by Kopernik Global Investors, LLC. This material is for informational purposes only and should not be regarded as a recommendation or an offer to buy or sell any product or service to which this information may relate.

This letter may contain forward-looking statements. Use of words such was “believe”, “intend”, “expect”, anticipate”, “project”, “estimate”, “predict”, “is confident”, “has confidence” and similar expressions are intended to identify forward-looking statements. Forward-looking statements are not historical facts and are based on current observations, beliefs, assumptions, expectations, estimates, and projections. Forward-looking statements are not guarantees of future performance and are subject to risks, uncertainties and other factors, some of which are beyond our control and are difficult to predict. As a result, actual results could differ materially from those expressed, implied or forecasted in the forward-looking statements.

Please consider all risks carefully before investing. Investments in a Kopernik strategy are subject to certain risks such as market, investment style, interest rate, deflation, and illiquidity risk. Investments in small and mid-capitalization companies also involve greater risk and portfolio price volatility than investments in larger capitalization stocks. Investing in non-U.S. markets, including emerging and frontier markets, involves certain additional risks, including potential currency fluctuations and controls, restrictions on foreign investments, less governmental supervision and regulation, less liquidity, less disclosure, and the potential for market volatility, expropriation, confiscatory taxation, and social, economic and political instability. Investments in energy and natural resources companies are especially affected by developments in the commodities markets, the supply of and demand for specific resources, raw materials, products and services, the price of oil and gas, exploration and production spending, government regulation, economic conditions, international political developments, energy conservation efforts and the success of exploration projects.

Investing involves risk, including possible loss of principal. There can be no assurance that a strategy will achieve its stated objectives. Equity funds are subject generally to market, market sector, market liquidity, issuer, and investment style risks, among other factors, to varying degrees, all of which are more fully described in the fund’s prospectus. Investments in foreign securities may underperform and may be more volatile than comparable U.S. securities because of the risks involving foreign economies and markets, foreign political systems, foreign regulatory standards, foreign currencies and taxes. Investments in foreign and emerging markets present additional risks, such as increased volatility and lower trading volume.

The holdings discussed in this piece should not be considered recommendations to purchase or sell a particular security. It should not be assumed that securities bought or sold in the future will be profitable or will equal the performance of the securities in this portfolio. Current and future portfolio holdings are subject to risk.