A Value Investor’s Reflections on a Unique Decade (Jan 2023)

Dear Kopernik Friends and Partners,

While last year seemed like one for the record books in many ways, think about how unimaginable and intriguing the last decade has been. As we head towards our 10th anniversary as a firm, it’s important for us to look back and take stock of how far we’ve come, the lessons learned, and where we go from here. In sum, the last decade has been fulfilling—not because it has been kind to value investors (au contraire)—but because we’ve gained strength and wisdom, experienced fascinating times, and found ourselves in a place where we believe the portfolios we manage are uniquely positioned to add significant value over the coming decade.

Of equally critical importance, we’ve formed relationships with incredible clients who share our patience and conviction that valuation matters, as does scarcity. We also have a tremendously talented and dedicated team, most of whom are owners of Kopernik, and an extremely strong collaborative culture that has kept us nimble and together despite a global pandemic that upended the cultures of larger organizations. Who could ask for more than to be where we find ourselves in now?

When we launched Kopernik in 2013, I don’t think anyone imagined the wild market environment we were entering. Negative interest rates, real, and then even nominal rates! Quantitative Easing (“QE”) versions 1, 2, and 3 seemed insane at the time, but who could have envisioned the sheer foppery of QE-infinity? To fully comprehend the enormity of the additional $5 trillion that the Federal Reserve conjured out of thin air between 2020 and 2022, it is helpful to recall that from the years 1913 through 2008, the Federal Reserve materialized only $800 billion. If one thinks about the difficulty of introducing that amount into the system, it is clear that, at best, it was placed inefficiently, and at worst—extremely fraudulently. Certainly, the media is rife with stories demonstrating a plethora of both inefficiency and fraud.

A Decade of Economic Craziness and Delusion

Any familiarity with economic theory would lead one to the understanding that the suppression of interest rates would, as it always had in the past, lead to an abundance of malinvestments, some dangerous and some outright foolish. Speaking of outright foolish, over the past ten years we have seen:

- Banks accept negative interest rates when loaning money to homebuyers

- Investors pay for the “privilege” of loaning money to distressed countries (including those that they had recently derided as the “PIGS”)

- Junk bonds begin to trade at sub-inflation rate yields

- An index of money-losing tech stocks going parabolic

- Money-losing “venture” companies start to go public—a vast majority completely unprofitable Meme stocks (including bankruptcies) become all the rage

- Non-Fungible Tokens (NFTs), second-tier crypto currencies, Special Purpose Acquisition Companies (SPACs), and other “assets” of dubious value become de rigueur

In summary, mainstream thought began to accept that debt, profit, accounting, valuation, and even research had all stopped being worthy of thought or consideration.

This was not a welcome environment for an “old school” firm that still believes that the wisdom of ages continues to hold meaning. Yet here we are—stronger, wiser, and full of optimism for the future. Granted, we were full of optimism a decade ago, believing that history and logic dictated that several years of underperformance by the value indices couldn’t last much longer. But Keynes had a point when he declared that the markets could stay irrational longer than many can stay solvent.

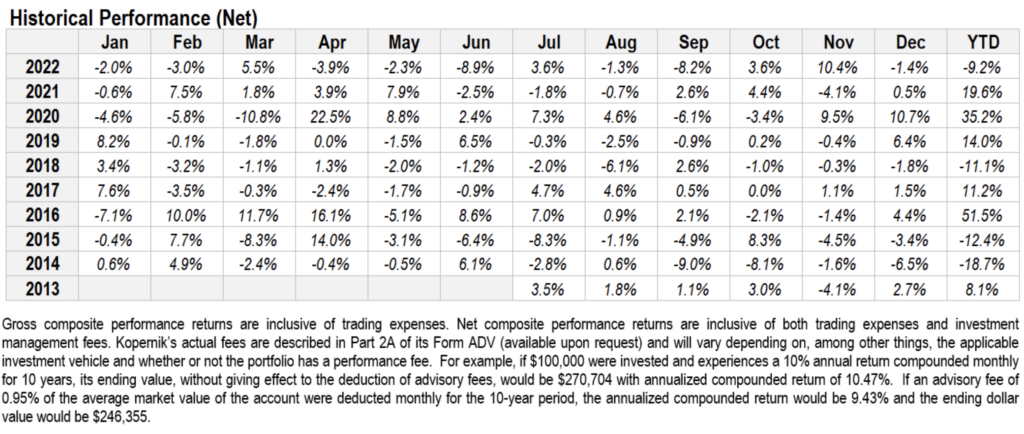

We and our clients embraced the idea that Kopernik was “an old wine in a new skin,” suggesting that the extremely fortunate returns we’d generated at Tradewinds Global Investors (our predecessor firm) over the previous dozen years would continue without skipping a beat. I, for one, believe it to be an apt analogy: same wine, but better, having aged and matured. What was missed, and let’s give due credit/blame to the central banks of the world, was that the past decade turned out to be an environment in which investors, figuratively, vastly preferred the excitement of “narcotics to fine wines.” While Kopernik started out on a decent note, the 19 months from mid-2014 through January of 2016 dealt the worst relative portfolio returns of the 41 years I’ve been managing money. Our Global All-Cap portfolio dropped by 38% as investors stampeded out of stocks that had low valuations. In most cases, there was no bad news to justify their actions. Rubbing serious salt into the wound, expensive stocks soared; during this time period the SPX increased 2.3% while the NASDAQ rose 6.7%. I had thought that 1999 was as bad as things could get. Fortunately, a mere 5 months later the tables had turned, with a powerful value rally that neutralized much of what had been the worst relative performance of my entire career. This led to three-year (from inception) returns of 20% for Global All-Cap (“GAC”) vs a strong 50% for the SPX and 29% for ACWI.

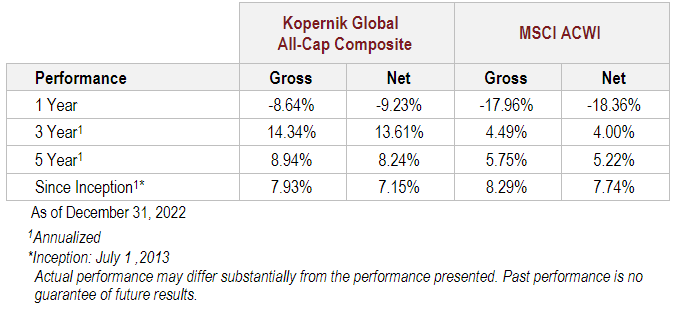

Kopernik Global All-Cap Composite Preliminary Performance

2022: Value Withstands the Storm

The storm resumed during a déjà vu moment in the summer of 2018 when expensive stocks staged a strong rally, while value stocks tanked. Fortunately, things were somewhat rectified in the fourth quarter. Since then, value seems to be outperforming, excepting the surreal blast off in the aforementioned bubble assets during the summer of 2021.

What about 2022, you may ask? Value has also borne the burden of the hit to emerging markets in 2022, accentuated by events in Ukraine, Russia, China and the broader resumption of the Cold War. Indeed, 2022 turned out to be a challenging year for everyone. It was tough on value investors, but strikingly it was tougher on “growth” investors. In many cases, it was tougher on bond investors. We’re told that it was the worst year ever for 60/40 portfolios. And it was a disaster for those playing the wild things.

So, all in all, it is looking like value is returning to the forefront this decade. We endeavor to tread water during the tough periods and excel during the good ones. Arguably, we’ve done better than tread water, as returns since inception have exceeded 60%, despite tough times for the key constituents of the portfolio: value stocks, real assets, non-dollar investments, emerging markets, frontier markets, precious metals stocks, and small caps. Through the first 9 ½ years of investing in all the “wrong” areas, GAC returns are in line with the ACWI returns (net of dividend withholdings), nicely ahead of the ACWI-value index, and substantially ahead of the ACWI-ex-US index. We thank you all for your partnership and patience during this distinctly “non-value” era. As your investment partner, we believe that we are well positioned for what comes next.

The Kopernik Philosophy: Well-positioned for a decade of success

Well-positioned, but since recent financial and geopolitical events have people reeling and wondering what to believe, I thought it worthwhile to plainly state our beliefs—which have not changed since our inception—and to let you know what you can expect from Kopernik during the coming decade.

We believe that:

- Markets are demonstrably inefficient. People are not always rational. Crowds can become shockingly irrational. These periodic bouts of extreme irrationality can often lead to bargains in the marketplace.

- Independent thought is a distinct advantage for investors. Due to the madness of crowds, extreme value usually requires investing in very unpopular securities and asset classes. We chose our eponym, Copernicus, in large part due to his willingness to trust his own analysis when it was dangerously unpopular with contemporary society during his time.

- Value and scarcity matter. What something is worth is admittedly debatable but paying more than intrinsic value seems to us to be more akin to speculation than investment. Value comes from usefulness/need combined with scarcity. Things that can be easily conjured into being in infinite quantity are of limited value.

- Risk means different things to different people. Volatility is not risk, but often presents opportunities. We believe that investors should be concerned about the prospect of permanent loss of capital and purchasing power. Volatility is an inappropriate measure of risk since it is usually a temporary loss of capital and is backward looking. The very act of selling volatile stocks, down to bargain basement valuations, creates a situation where volatile stocks become less risky and more lucrative. Apparent risk effectively becomes the opposite of real risk to a portfolio. Similarly, tracking error erroneously assumes that the index being tracked is risk free. Misperceptions create opportunity.

- Firm size matters. While in many industries scale brings advantages, we believe it is a disadvantage for asset managers to be too large (as opposed to assets gatherers). It becomes harder to build positions in anything but mega-cap securities, and because the best bargains often are not large caps, Kopernik has, from the beginning, pledged not to become large.

- “There is no such thing as a free lunch.” This saying is perhaps more important to heed now than ever before. Every action has consequences, often painful ones. Intelligent people can debate levels, but there are always consequences to excess. Debt, government, money supply, and price represent some important areas of current excess. It is important to build in a large margin of safety when investing in anything that could be adversely affected by these areas.

- Accounting, though flawed, is still indispensable. It must be used, thoroughly digested, and adjusted.

- We employ rigorous, bottom-up, fundamental analysis on every security before it is admitted to a portfolio; we apply a margin of safety to our estimate of intrinsic value for every security. The margin is larger for securities that have more risks, and investment is only made at prices below the RAIV (risk-adjusted intrinsic value); and purchases are never made based on forecasts.

- Employee-owned, always. Kopernik is employee-owned, alleviating pressure from outsiders to stray from our style/mission. It is an honor to be a steward of your capital, and we believe we should treat it with at least as much care as we would our own. Therefore, we require our professionals to co-invest with our clients, and many of us have the bulk of our net worth invested in our strategies.

Investing in a world that looks much different than the past four decades

Following these tenets has helped us to build a portfolio that we believe is well-suited to the times. It consists, generally, of the stocks of high-quality companies, selling well below their intrinsic value, after adjusting for large margins of safety. The rapid, tenfold expansion of the money supply over the past decade and a half may, or may not, continue to migrate through the system. If it does, the preponderance of inflation beneficiaries in the portfolio will serve investors well. Whether or not the large cohort of individuals likening today to the “Fourth Turning” are correct, it is clear that the investment winds have changed direction. Falling interest rates, belief in capitalism and laissez faire economics, support for free trade, improving rule of law, stable cost of living, attitudes toward free speech and unbiased data, belief that hydrocarbons and other commodities have a positive effect on the quality of life, and the idea that having core values is a positive attribute are all places we’ve seen a shift in direction. To the extent that these trend-reversals continue, investors will come to appreciate the importance of large margins of safety. Large margins of safety, of course, mean that less money is lost when difficulties arise, and more money is made when things go smoothly.

At Kopernik, the portfolios have a large margin of safety. The weighted average COV (minimum required margin of safety or what we refer to as our Certainty of Value) is a conservative 5, meaning that, on average, our theoretical value is double our adjusted estimate of intrinsic value. Furthermore, in our opinion the expected upside to our risk-adjusted estimates across all portfolios is more than three times current market prices. We’ll let others opt for 5% bond yields amidst this volatile, inflation-prone environment.

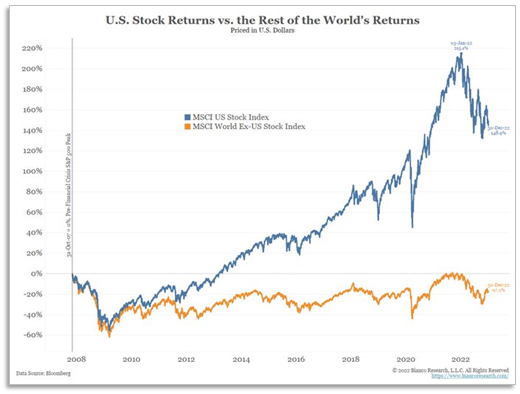

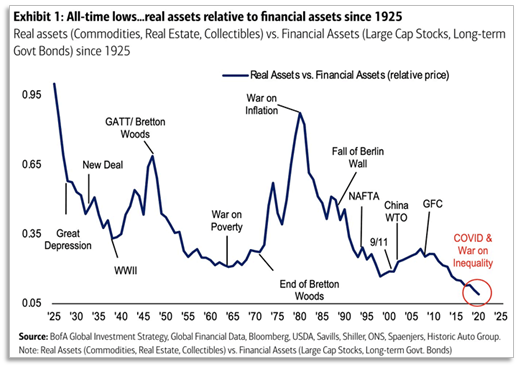

Thus, due to the strong fundamentals underpinning our portfolios, it is with great optimism that we embark on our second decade. It bodes well that a half-dozen different cycles are currently at extremes. Value, despite recent improvement, is quite underpriced relative to “growth” stocks. Real assets are the cheapest they have been in a century and a half, relative to financial assets. International stocks are outrageously cheap relative to U.S. stocks; emerging markets are especially so. The U.S. dollar is expensive. And small stocks have a way to go to catch up to the over-esteemed mega-caps. We manage portfolios consisting of globally leading companies and selling for two-thirds of book value, 10.4 times earnings, and only 1.15 times sales.

And, importantly, we are extremely grateful to our smart, knowledgeable, and patient clients who have chosen us to be stewards of their capital, and their partners, during these exciting but peculiar times. Thank you all very much.

Wishing you all a happy, healthy, prosperous 2023.

David B. Iben, CFA

Chief Investment Officer

January 2023

Appendix: Opportunities in Emerging Markets, Real Assets, and Small Cap Companies

Important Information and Disclosures

The information presented herein is confidential and proprietary to Kopernik Global Investors, LLC. This material is not to be reproduced in whole or in part or used for any purpose except as authorized by Kopernik Global Investors, LLC. This material is for informational purposes only and should not be regarded as a recommendation or an offer to buy or sell any product or service to which this information may relate.

This letter may contain forward-looking statements. Use of words such was “believe”, “intend”, “expect”, anticipate”, “project”, “estimate”, “predict”, “is confident”, “has confidence” and similar expressions are intended to identify forward-looking statements. Forward-looking statements are not historical facts and are based on current observations, beliefs, assumptions, expectations, estimates, and projections. Forward-looking statements are not guarantees of future performance and are subject to risks, uncertainties and other factors, some of which are beyond our control and are difficult to predict. As a result, actual results could differ materially from those expressed, implied or forecasted in the forward-looking statements.

Please consider all risks carefully before investing. Investments in a Kopernik strategy are subject to certain risks such as market, investment style, interest rate, deflation, and illiquidity risk. Investments in small and mid-capitalization companies also involve greater risk and portfolio price volatility than investments in larger capitalization stocks. Investing in non-U.S. markets, including emerging and frontier markets, involves certain additional risks, including potential currency fluctuations and controls, restrictions on foreign investments, less governmental supervision and regulation, less liquidity, less disclosure, and the potential for market volatility, expropriation, confiscatory taxation, and social, economic and political instability. Investments in energy and natural resources companies are especially affected by developments in the commodities markets, the supply of and demand for specific resources, raw materials, products and services, the price of oil and gas, exploration and production spending, government regulation, economic conditions, international political developments, energy conservation efforts and the success of exploration projects.

Investing involves risk, including possible loss of principal. There can be no assurance that a fund will achieve its stated objectives. Equity funds are subject generally to market, market sector, market liquidity, issuer, and investment style risks, among other factors, to varying degrees, all of which are more fully described in the fund’s prospectus. Investments in foreign securities may underperform and may be more volatile than comparable U.S. securities because of the risks involving foreign economies and markets, foreign political systems, foreign regulatory standards, foreign currencies and taxes. Investments in foreign and emerging markets present additional risks, such as increased volatility and lower trading volume.

The holdings discussed in this piece should not be considered recommendations to purchase or sell a particular security. It should not be assumed that securities bought or sold in the future will be profitable or will equal the performance of the securities in this portfolio. Current and future portfolio holdings are subject to risk.

To determine if a Fund is an appropriate investment for you, carefully consider the Fund’s investment objectives, risk factors, charges and expenses before investing. This and other information can be found in the Fund offering materials, which may be obtained by contacting your investment professional or calling Kopernik Fund at 1-855-887-4KGI (4544). Read the offering materials carefully before investing or sending money. Check with your investment professional to determine if a Fund is available for sale within their firm. Not all funds are available for sale at all firms.