Changes in Latitude (Feb 2022)

“Visions of good times that brought so much pleasure

Makes me want to go back again

If it suddenly ended tomorrow

I could somehow adjust to the fall

Good times and riches and son of a bitches

I’ve seen more than I can recall

It’s these changes in latitudes, changes in attitudes

Nothing remains quite the same”

-Jimmy Buffett

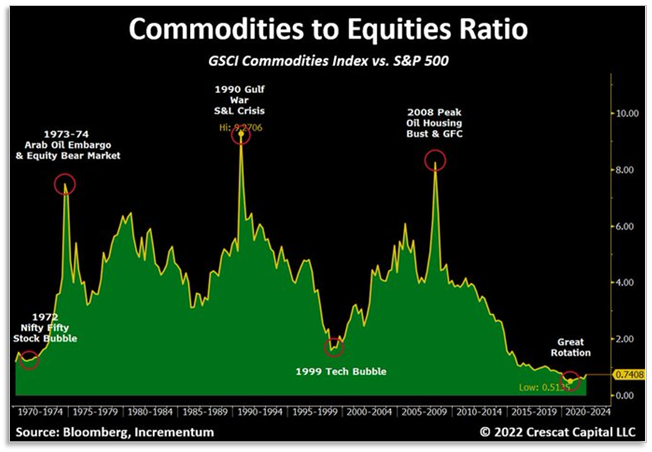

I’ve now been lucky enough to have spent four full decades in the investment business. I look forward to the next two decades. As the song says, it’s been good times and riches, and all kinds of characters (mostly wonderful), and I’ve seen more than I can recall. I’ve also witnessed a hundred- and eighty-degree change in investor attitudes towards stocks, bonds, gold, inflation, the role of government, and more. Some of the most frequent questions lately have been regarding whether the growth/value cycle is turning, ending a phenomenal fifteen-year run for growth stocks, in absolute terms and relative to value. The evidence that this may be occurring is growing stronger. Whether or not this is the real deal, or just another head fake, remains to be seen. But from current valuations, a pivot from growth to value seems inevitable. It is only a question of when. Therefore, a much more important discussion revolves around attitudes towards value investing. A conversation with many “value” investors could leave potential investors dazed and confused as to what “value” is. Even more so than in 1999, we’ve noticed many value managers proclaiming their move to a more exciting and less painful definition of value.

For those who believe that growth is the place to be forever, no need to read on. For those who are considering moving a portion of their portfolio into value, what follows is a short discussion of our thoughts on value. You undoubtedly won’t be surprised to find that they differ from the norm.

Jimmy Buffett seems, in ways, like the ultimate value investor. Behind that laid back persona is a guy who, through hard work, patience, and good decisions, has reportedly accumulated a net worth just short of $1 billion. Changes in latitude, changes in attitude seemed the perfect song to discuss society’s rapidly changing attitudes toward markets in general, stocks more specifically, and value investing most explicitly. Don’t worry, this will not be a discussion about Fed policy; we would have found some of Buffett’s other, more apropos, songs if that were the case (“The Great Filling Station Holdup” or “Why Don’t We Get Drunk…..” for example). What we do want to discuss is the concept of “Buffett stocks.” What?! Wrong Buffett?! Pardon the confusion, but that is exactly the point that we’d like to make. We are suggesting that people are confused as to what a Buffett stock really is. Admittedly, there’s already a large oversupply of people writing about Warren Buffett, but we promise to come from a unique angle.

Endeavoring to discuss our take on Warren Buffett’s view of stocks may be foolhardy as it brings to mind a great scene from the movie Annie Hall. Distressed with the opinions of a boisterous pseudo-intellectual in front of him in a movie queue, Woody Allen’s character turns toward the audience complaining that the guy’s opinions on Marshall McLuhan’s philosophy are all wrong. He then materializes Mr. McLuhan out of nowhere, who proceeds to tell the man, “I heard what you were saying. You know nothing of my theories.” Understanding the perils, let’s move on. I am doubtful that any of you will materialize Mr. Buffett to rebut this. We doubt that he will see this or that he would take exception to any of it. If I’m wrong, his feedback would be extremely welcome.

Famously, Mr. Buffett, a big fan of his mentor Ben Graham, realized that a lot of potential returns were being left on the table by confining his investment purview to Mr. Graham’s ”cigar butt” stocks. In conjunction with Charlie Munger, Warren broadened his horizon, cognizant of the fact that there is tremendous value in intangibles, to businesses with a “moat,” that the market was failing to recognize. Additionally, the miracle of compounding was also clearly underpriced. He legendarily spent the 1980s and early 1990s building a portfolio of these compounding, quality franchises. His success was unparalleled, and these stocks have come to be known by the honorific “Buffett stocks.”

We don’t mean to take any of this away from him. We have long been fans of his logic, wit, analogies, and pearls of wisdom, and feel that he deserves all the kudos he’s received for steering value investing toward a better, more thoughtful place. However, to paint him into a box, to categorize him or make his stocks a cliché is to do him a great disservice. He has proven to be a great and versatile investor. And true investors can’t be neatly tucked into a category; one time period’s sucker bet becomes the bargain of a latter period. Investors should take advantage of the bargains that the market gives them. This is something that Mr. Buffett has always done extremely well. As such, we opine that people are making a mistake when they carry an adage of his into a different environment, believing it to still hold water.

Think about it. In Berkshire Hathaway’s 2002 annual report, Buffett called derivatives ”financial weapons of mass destruction” yet in a later time he made $4.9 billion by selling put options on the S&P 500, FTSE 100, Euro Stoxx 50, and the Nikkei 225. He sold puts on Coca Cola in 1993 as well. There are many other examples of where Warren has cautioned against a class of investment only to reverse course when compelling values later emerged. This action virtually always served him well. Investors were well-suited to follow his actions rather than adhere to his prior words from a no longer relevant period. These include junk bonds, highly levered companies, airlines, technology stocks, gold miners, poorly managed companies, and international/emerging market stocks. John Maynard Keynes famously answered a question by stating…

It seems to us as though Buffett has taken a page out of the economist’s book in his stock picking.

All the above is meant to lay the foundation for one of the two major points we hope to make in this missive, that stereotypical “Buffett stocks” are not necessarily “Buffett stocks!” In the current market, it is clear that they are not. Like everything else, the high quality, wide-moat franchise companies represent investments that Buffett likes to make when the time is right. Perhaps history will help illuminate the point. In the late 1960s and very early 1970s, quality franchise stocks were becoming all the rage, culminating in an infamous stock market peak. The market leaders were widely known as “one-decision stocks” (only need to decide when to buy, selling was foolish) and later as the “Nifty Fifty.” Did Warren get killed in the subsequent massacre of these sacred stocks? He did not, for several reasons. One, he sold all of his stocks several years earlier. Furthermore, he never owned these quality franchise stocks during the 1960s. In that decade, his investment partnership owned the likes of Associated Cotton Shops, Hochschild & Kohn department stores, Mid-Continent Tab Card, Dempster Mill Manufacturing, Sanborn Map, and Commonwealth Trust of Union City. Traditional value all the way, no household names amongst them. When he sold all of these in 1969, he kept only one stock – a struggling textile mill named Berkshire Hathaway. Deep value.

In late 1973, when the stock market had fallen sharply, Warren was back in, buying stocks hand over fist. He famously likened himself to “an oversexed guy in a whorehouse” (later toned down to “a kid in a candy store.”) Importantly, amongst his orgy of investments were none of the “Nifty Fifty” quality franchise stocks. The time was still not right.

The 1970s were arguably a precursor to our current decade. They also followed a time of euphoria and ushered in a time when the piper figuratively needed to be paid for prior monetary and fiscal malfeasance. Buffett bought GEICO, down from $61 to $2, which was teetering on bankruptcy and likely would not have survived without Mr. Buffett’s assistance. He bought Blue Chip Stamps, a franchise on a rapid course of decline. Other companies were early on in their ascension toward becoming stronger franchises: the Washington Post and See’s Candy. The stocks of quality franchises would need to languish for another decade before they hit Warren’s radar screen. Coca-Cola, Gillette, etc. were all priced at unbelievable discounts in the 1980s; this is when I came into the business and I, too, felt like “a kid in a candy store.” He succeeded because he bought when good companies were valued to be good investments, not merely because they were such good companies.

If the prudent strategy is to follow Warren’s actions rather than his ruminations from eras past, it behooves one to look at his current actions. Admittedly, this is much harder to do now than in the past since it’s not easy to distinguish Buffett’s actions from those of Ted Weschler and Todd Combs. In recent years, Berkshire has admittedly bought into great, yet far from cheap franchises such as Visa and Amazon. The drug companies are arguably good franchises but there are so many of them around the globe that the size of their ‘moats’ is worthy of debate. Berkshire has made recent entries into technology such as Snowflake and the well-timed purchase of Activision Blizzard. There are a host of very expensive stocks, so maybe he’s evolving into an aggressive growth investor (or, more likely, his colleagues are leading the efforts in that direction). But the main interests for this discussion are two items of note: 1) Berkshire’s recent tendency to sell rather than buy more of the classic “Buffett stocks” of old; and 2) indications of an important key change of direction.

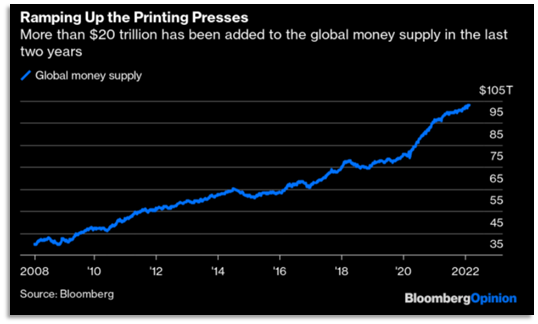

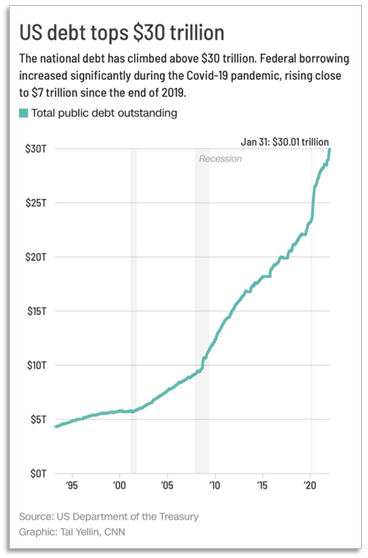

Importantly, four decades ago, when interest rates were in the mid-teens, Warren eschewed taking on financial debt, famously touting the “free float” on offer to insurance companies. In the year 2022, when the rates on 30-year treasury bonds are a full 500 basis points below the rate of inflation (the abridged number as actually acknowledged by the government) he seems to have once again adapted to the times. A quick look at the Bloomberg shows that Berkshire Hathaway has 36 bonds outstanding. Seems like an intelligent move on its part. (And, not to mislead, the company is not highly leveraged, net of cash balances). Another change is a willingness to sell, not just dollar-based debt but, foreign currency bonds as well. Even more importantly, Buffett is using the money to purchase stocks that are a far cry from the stereotypical “Buffett stock.” A year and a half ago, he purchased $6 billion of Japanese trading companies. In addition to not being U.S. based, a quick perusal of the financials will show that “trading” is a name from the distant past; Mitsubishi, Mitsui, Sumitomo, Marubeni, and even Itochu are, in large part, natural resource companies. If that seems a strange move, we’d suggest otherwise. He bought at a time when people’s fear of depression (remember 2020? So recent and yet so long ago) led to bargain basement prices: commodity prices were below 2007 levels; and many of his comments from recent years have made it clear that he believes that contemporary fiscal and monetary policy will rapidly erode the purchasing power of the dollar. Those looking for more specific evidence of change need look no further than Barrick Gold. Warren had been well-known for his animosity toward gold. He’s spun many a disparaging remark in an auric direction. But again, we emphasize that his opinions migrate with the opportunity set. It appears that he now finds gold mining to be a worthwhile investment. It is worth pointing out that he has also bought several oil companies in recent years.

Segueing from Warren back to Jimmy, what should investors do in the current environment?

“I don’t know where I’m a gonna go

When the volcano blow”

-Jimmy Buffett, Volcano

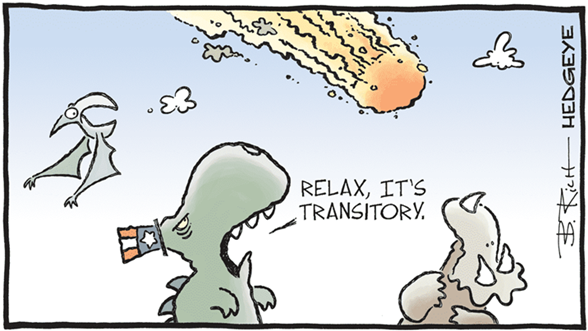

As mentioned early on, if you believe that the past thirteen years of growth-led, debt-powered, wild bull markets served as a precursor to a long future of more growth-led, debt-powered, bull markets, then you needn’t have read this far. For those who believe that the world is complex and cyclical, and that at least a portion of your investment portfolio needs to migrate away from the expensive winner of the past decade, let’s discuss other alternatives.

We’ll skip over the obvious – that with interest rates still miniscule and the possibility that the monetary inflation of the past 13 years will continue to migrate through the environment looks to be increasingly evident, owning bonds should be avoided whenever possible. The same goes for de facto bond proxies within the higher echelons of the equity and real estate spheres. More positively and concretely positioned, investors ought to invest part of their portfolio in sectors that offer significant upside potential and, even more importantly, provide shelter from the impending storm.

But there’s this one particular harbor

Sheltered from the wind

Where the children play on the shore each day

And all are safe within

-Jimmy Buffett, One Particular Harbor

Top-down/macro investors should be seeking investments that perform well during troubled times and offer significant protection from inflation. Gold is an obvious choice. Other commodities are perhaps equally of interest. Other owners of hard assets such as hydroelectric dams, nuclear electricity generators, broad-based resource properties (the aforementioned “trading” companies), cellular networks and others should pique their interest, as well.

Ua pau te maitai no te fenua

Re zai noa ra te ora o te mitie

This is translated as:

“Bounty of the land is exhausted

But there’s still abundance on the sea.”

-Jimmy Buffett, One Particular Harbor

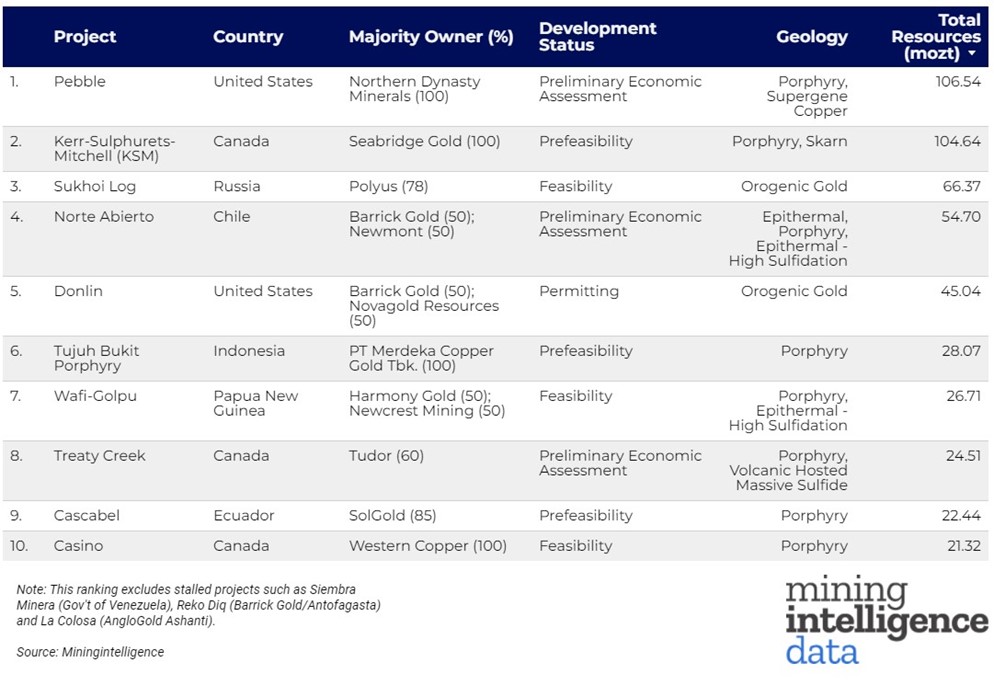

For firms like Kopernik that employ a 100% bottom-up approach to investing, we are thrilled to own these very same macro validated assets for less than book value and in many cases for less than ten times earnings. And these values are not pertaining to down and out turnaround situations; they are world class businesses. We are pleased to own the two world leading companies in important arenas: nuclear power franchises, hydroelectric power franchises, owners of uranium reserves, undeveloped gold reserves (see below), and trading companies. We are invested in the world’s largest telecom franchise and also in the largest, lowest cost natural gas company. The portfolios hold strong oligopoly businesses around the globe including: a stock exchange, dominant banks, railroads, electricity distribution, housing, shipping and agriculture. Seven and a half billion people require commodities. Reducing carbon generally means replacing one commodity with another. Scarcity matters. Demand will remain strong but supply is limited, as Jimmy points out – the “bounty of the land is exhausted.”

Conclusion

“Oh, yesterday’s over my shoulder

So I can’t look back for too long

There’s just too much to see waiting in front of me

And I know that I just can’t go wrong

With these changes in latitudes, changes in attitudes

Nothing remains quite the same

With all of my running and all of my cunning

If I couldn’t laugh I just would go insane

If we couldn’t laugh we just would go insane”

-Jimmy Buffett

“A great many people think they are thinking when they are merely rearranging their prejudices.”

”Common sense and a sense of humor are the same thing, moving at different speeds. A sense of humor is just common sense, dancing.”

-William James

Many of us probably wish that the world was a little less insane at the moment. We could cry but laughing is a better way to stay happy and sane. Perhaps equally important, the insanity of the crowds usually provides extremely attractive money-making opportunities to those who can keep their wits about them. If everything turns out well, owning good assets at depressed prices should prove to be a successful strategy. However, should the apparent complete breakdown of fiscal and monetary discipline (and common sense) turn out once again to be highly inflationary, the ownership of scarce, useful resources could be highly rewarding, even requisite to the preservation of one’s purchasing power.

To paraphrase Mr. Buffett (Jimmy, but perhaps Warren too), value investors “shouldn’t look back for too long at yesterday, there’s just too much to see waiting in front of them.” For non-value investors, perhaps it’s time for “changes in attitude. Nothing remains quite the same.”

We deeply appreciate your partnership and support during these fascinating times. We wish you a happy healthy 2022.

Cheers,

David B. Iben

Chief Investment Officer

February 2022

Kopernik’s portfolio holds four of the top five and six of the top ten.

TOP 10 – World Gold Projects

As of January 2022.

Important Information and Disclosures

The information presented herein is confidential and proprietary to Kopernik Global Investors, LLC. This material is not to be reproduced in whole or in part or used for any purpose except as authorized by Kopernik Global Investors, LLC. This material is for informational purposes only and should not be regarded as a recommendation or an offer to buy or sell any product or service to which this information may relate.

This letter may contain forward-looking statements. Use of words such was “believe”, “intend”, “expect”, anticipate”, “project”, “estimate”, “predict”, “is confident”, “has confidence” and similar expressions are intended to identify forward-looking statements. Forward-looking statements are not historical facts and are based on current observations, beliefs, assumptions, expectations, estimates, and projections. Forward-looking statements are not guarantees of future performance and are subject to risks, uncertainties and other factors, some of which are beyond our control and are difficult to predict. As a result, actual results could differ materially from those expressed, implied or forecasted in the forward-looking statements.

Please consider all risks carefully before investing. Investments in a Kopernik strategy are subject to certain risks such as market, investment style, interest rate, deflation, and illiquidity risk. Investments in small and mid-capitalization companies also involve greater risk and portfolio price volatility than investments in larger capitalization stocks. Investing in non-U.S. markets, including emerging and frontier markets, involves certain additional risks, including potential currency fluctuations and controls, restrictions on foreign investments, less governmental supervision and regulation, less liquidity, less disclosure, and the potential for market volatility, expropriation, confiscatory taxation, and social, economic and political instability. Investments in energy and natural resources companies are especially affected by developments in the commodities markets, the supply of and demand for specific resources, raw materials, products and services, the price of oil and gas, exploration and production spending, government regulation, economic conditions, international political developments, energy conservation efforts and the success of exploration projects.

Investing involves risk, including possible loss of principal. There can be no assurance that a fund will achieve its stated objectives. Equity funds are subject generally to market, market sector, market liquidity, issuer, and investment style risks, among other factors, to varying degrees, all of which are more fully described in the fund’s prospectus. Investments in foreign securities may underperform and may be more volatile than comparable U.S. securities because of the risks involving foreign economies and markets, foreign political systems, foreign regulatory standards, foreign currencies and taxes. Investments in foreign and emerging markets present additional risks, such as increased volatility and lower trading volume.

The holdings discussed in this piece should not be considered recommendations to purchase or sell a particular security. It should not be assumed that securities bought or sold in the future will be profitable or will equal the performance of the securities in this portfolio. Current and future portfolio holdings are subject to risk.