Don’t Cry For Me Argentina (Feb 2024)

This commentary was initially penned in Buenos Aires, a beautiful city with wonderful people, food, sights, and a fascinating history. We had significant opportunities to do research, visited mines in the Puna, attended a large lithium conference in Salta, and met with leading agriculture, real estate, mining, and energy companies. Of course, we managed to save a little time to occasionally enjoy an excellent ribeye steak, accompanied by a nice glass of malbec, for less than $15. Even took a few tango lessons. It turned out to be a fascinating time to have been experiencing the rapid rate of inflation, the concomitant irrational pricing (cheap and dear), and the surprising election results as the people start to push back against the Peronist policies that have heavily contributed to current woes. In the contemporary world, with most of the world’s countries embarking on “Peronist” fiscal and monetary paths, Argentina – whose name, which translates to “made of silver,” literally means “money” – seems like an excellent vantage point from which to tackle the subject of investing during an era of monetary debasement. There are lessons to be learned.

“And as for fortune, and as for fame

I never invited them in

Though it seemed to the world they were all I desired

They are illusions

They’re not the solutions they promised to be

The answer was here all the time”

-Andrew Llyod Webber & Tim Rice

Before heading south, a group of us rewatched Evita, the 1996 film starring Madonna and Antonio Banderas, based on the play by Andrew Lloyd Webber and Tim Rice. This commentary takes its title from Evita’s hit song.

The movie focuses on an ambitious young “commoner” and her role in Juan Peron’s rise to – and use of – power. It is worth remembering the old axiom about history rhyming. If true, following the lyrics of the song may prove instructive in this world in which we all now find ourselves dancing. While our research finds that history may be too harsh on the Perons – it took a lot of people and a lot of years to erode Argentina’s stature from a top-10 world economy to its current circumstances – Juan and Eva certainly were an important catalyst. The juxtaposition between her messaging and her actions – between her fiery speeches in support of the common man and her passion for designer clothes and living large – brings to mind contemporary populists who preach equality and environmentalism as they travel on their private jets, rocket ships, and yachts.

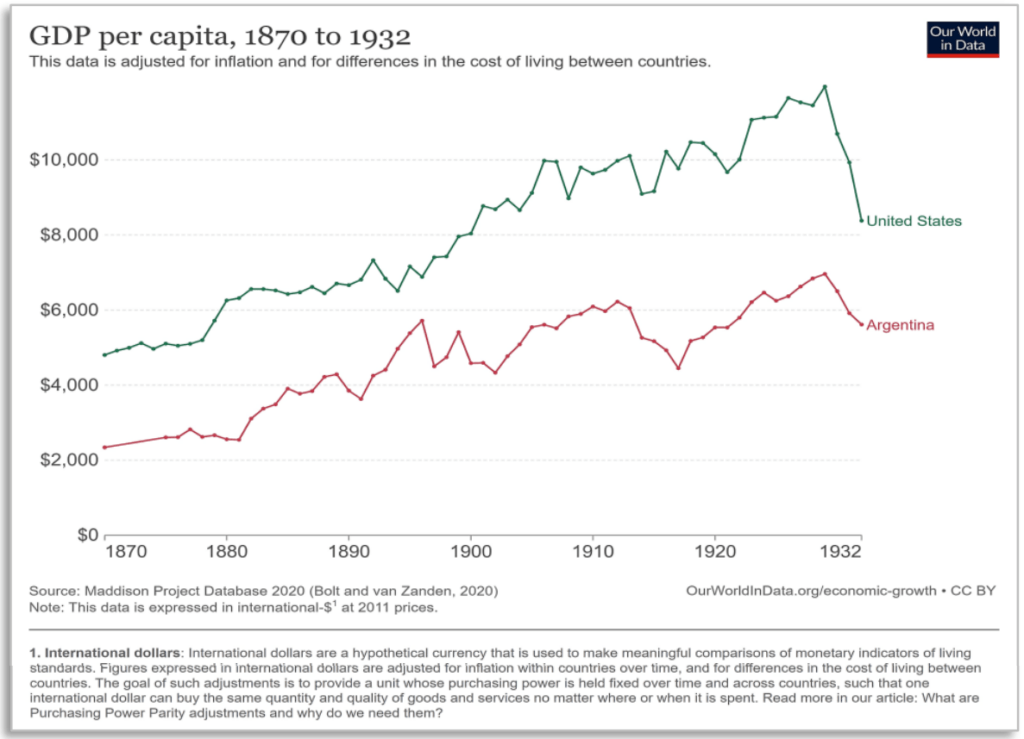

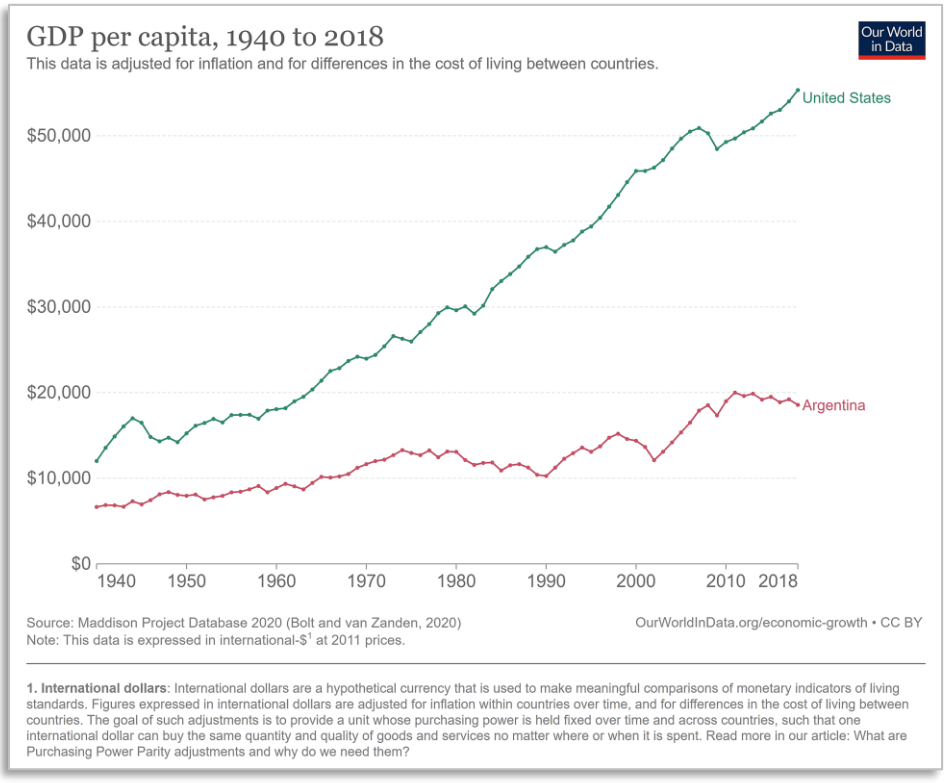

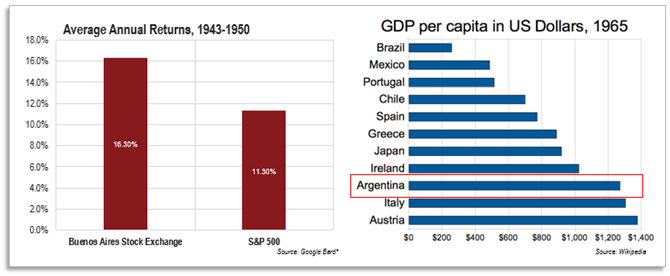

Argentina’s story was once not too different than that of the United States. It has fertile land, minerals, oil and gas, vast amounts of land, and a temperate climate. It also attracted many European immigrants who brought great skills and contributed to (and benefitted from) the country’s rising prosperity. A century ago, it is said to have been the seventh most prosperous country in the world (GDP/capita). They had a democracy and a constitution.

But alas, the fortunes of Argentina and the U.S. began to diverge.

What went wrong? It should be clear that life is complex and no one thing caused the downfall. Unlike the U.S., Argentina was not stronger than all its neighbors, nor was it protected from destructive wars. Like the U.S. the country had a civil war, but unlike the U.S. it endured the misfortune of decades of military coups and dictators. But many other countries have faced adversities similar to Argentina’s, without anywhere near the degree of damage. While many of the dictators and populists deserve discredit, Eva Peron serves as an excellent analog for the zeitgeist in Argentina.

Let’s start with Eva’s many positive attributes. What’s not to love – it’s a Latin American Horatio Alger story, a version of the American Dream set slightly further South. Poor girl makes good; she rises to fame and fortune and in the process, makes speeches, fires up the public, gets Juan sprung from political arrest, helps get him elected (perhaps saving democracy), and then institutes numerous programs and charities for the poor. She is beloved to this day. And her husband’s presidency initially did bring some prosperity, reindustrializing the country even as World War II’s aftermath left many other countries bereft of industrial infrastructure. The stock market initially performed better than the S&P 500 and the economy stayed strong for several decades afterwards.

Early on, stimulative fiscal and monetary policy seemed a panacea. They won reelection. She was adored.

”Don’t look down, it’s a long, long way to fall

High flying, adored

What happens now, where do you go from here?

For someone on top of the world

The view is not exactly clear”

– High Flying Adored, Evita

Critics, however, will point out that much of the money her charities raised went unaccounted for, massive sums were spent on designer clothes, and promises went unkept. Juan’s policies, as is often the case with deficit spending, produced positive results – until they didn’t anymore. The Piper almost always eventually comes and demands payment. Problems were compounded by the lack of trust that follows nationalization.

Eva died while still popular. Juan was cast out, exiled, brought back into power, and, eventually, his next wife ended up as president. They say that truth is stranger than fiction. This may sound unreal, yet we in the U.S, Ukraine, Italy, and other parts of Europe have had an interesting parade of characters in leadership roles.

Okay, why should we care about Argentina? For starters, because we find ourselves once again living in a world where centralist providers of fiscal and monetary largesse are “high flying adored.”

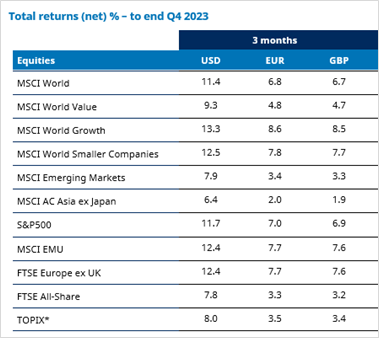

A world where the early effects of that largesse seem positive. Who doesn’t love a bull market? A bubble in everything?

Source: Schroders

“When the money keeps rolling in, you don’t ask how. Think of all the people guaranteed a good time now.”

(“And the money kept rolling in (and out),” Evita)

Will this bull market that is based upon fiscal profligacy and abetted by monetary debasement, really work out better for us than it did for the Perons? We suggest that, instead of “throwing stones from their glass palaces,” “first-world” investors should look toward Argentina for insights for investing in a world defined by government wastefulness.

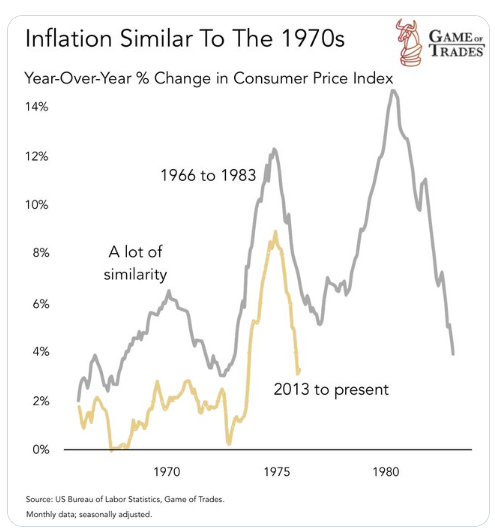

Now, it can be conceded that Argentines would, perhaps, call our level of inflation something akin to “stability,” but despite the lower decibel level the melody sounds awfully familiar.

While doing research there last summer, a season during which the Argentinian peso dropped from 484 to the dollar to over 1000 (at the blue market rate), we observed several things that might be helpful in a world where the U.S. money supply has increased tenfold (inclusive of the recent drawdown) and the annual fiscal deficit is running at $2 trillion, sans a recession. Does debasement matter any less north of the equator?

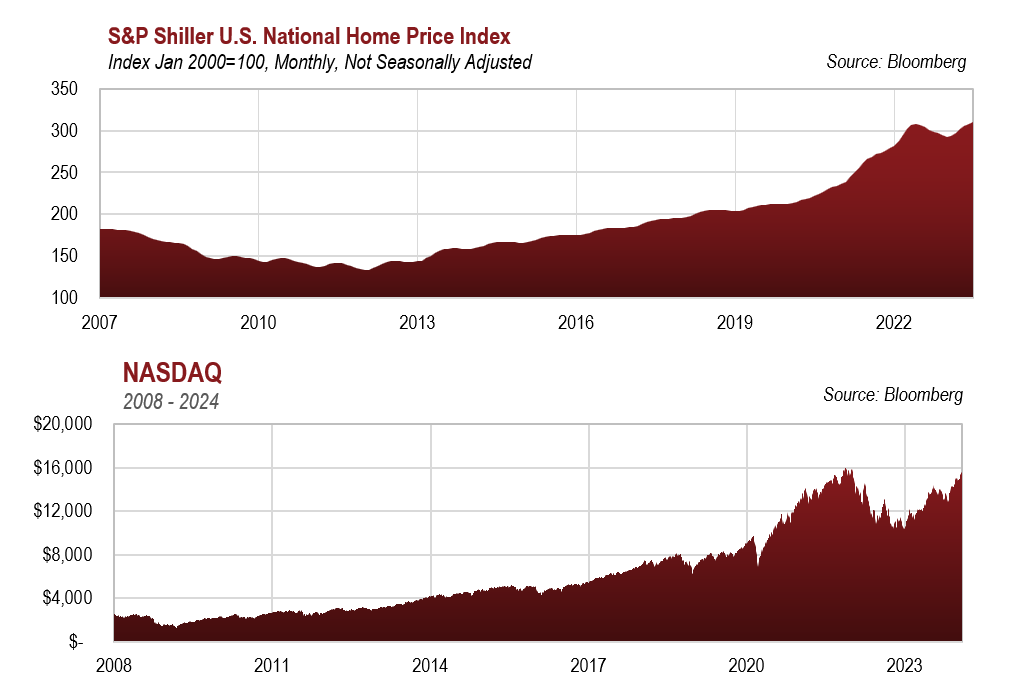

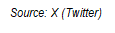

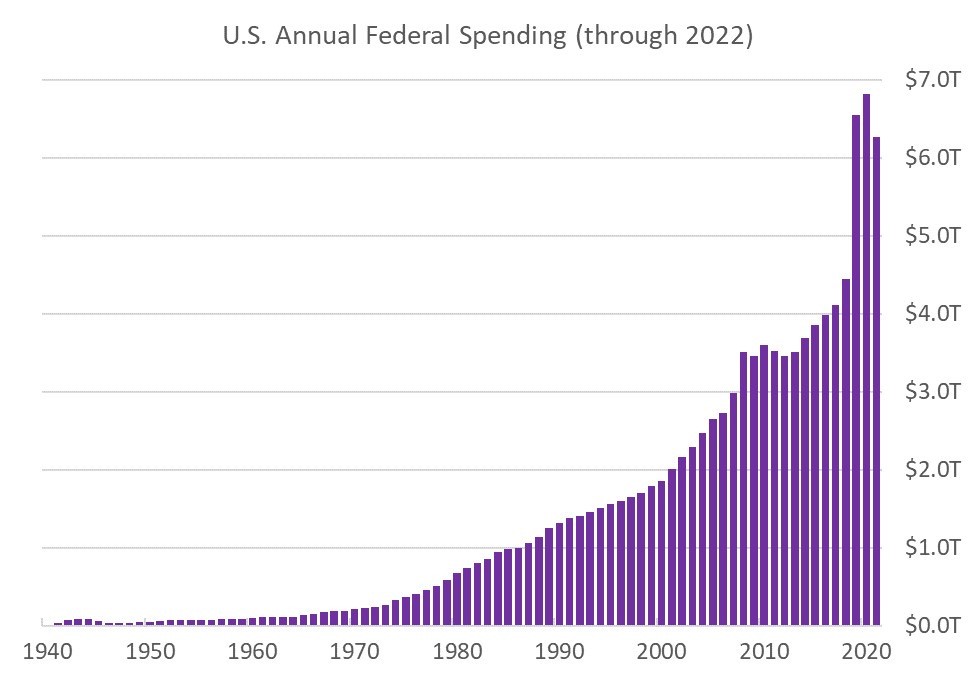

Let’s take a quick look at “modern” finance. The charts below give one a sense of just how much money had to be spent, and ultimately borrowed, to give voters the unaffordable.

This spending has led to a tremendous accumulation of debt, which is concerning since it is commonly understood that debt levels exceeding 100% of GDP are never made whole; defaults happen either outright or through inflation. If so, at 130% of GDP, we have a serious problem on our hands.

But might the government correct course and ameliorate the problem? This possibility is, unfortunately, extremely unlikely due to democracy’s tendency to eventually be undermined by peoples’ penchant to vote only for those politicians promising meaningful largesse from the public treasury. During the remainder of this missive, we will take it as a given that inflation is still worthy of investors’ attention. For those who are not yet convinced, you can find much more about monetary inflation and why the problems are here to stay, in our recent commentary, Money, and in our Deputy CIO Alissa Corcoran’s recently-released year-end review, The Nifty Seven.

“Would you like to try a college education?

Own your landlord’s house, take the family on vacation?

Eva and her blessed fund can make your dreams come true”

(“And the Money Kept Rolling In (And Out),” Evita)

Investment Strategy in a World Lacking Fiscal Discipline

Using logic and history as our guides, let’s assume that fiat money will prove, yet again, to be a woeful store of value.

Starting with the obvious:

- It is important to own stores of value.

And the less obvious:

- It is quite worthwhile to comparison shop. In other words, this is an excellent time for active management.

To the perhaps non-obvious:

- The inherent volatile nature of fiscal imprudence doesn’t get priced into the marketplace quickly. This has resulted in option-laden investments becoming very attractive.

The main point of this letter is that times of fiscal and monetary profligacy create a fertile environment for active management. Currently, the markets are loaded with peril and with tremendous opportunity. This is a time when it really pays to comparison shop. Talking with individuals in Buenos Aires, they suggested going from store to store. They understood firsthand that a currency debased by 50% will not affect all prices equally nor promptly. One store quickly doubles prices, another by only half as much. Some won’t get around to raising prices for some time. This message is just as apropos to those of us who do our shopping at the stock exchanges. What should we be shopping for? Things of value.

Of course, all investors presumably want to hold valuable companies and assets. Different people may have different viewpoints concerning value. It’s well known that, in our opinion, the attributes of good stores of value include necessity and scarcity. While some may rightly point out that this definition applies to many of the products/services of the vaulted “Magnificent Seven” stocks, we agree, but must point out that these stocks are arguably not undiscovered, are highly esteemed, over-owned, and have already risen in price by more than the tenfold increase in the money stock. We calculate they are up 70 times (dividends reinvested) since March of 2007.

While a moonshot of this magnitude ought to grab one’s attention, as “bottom-up,” fundamentals-based investors, we at Kopernik find it more meaningful to look at specific businesses and sectors. Here the message is even more striking. Since “the Magnificent Seven” are top of mind for contemporary investors, they represent a reasonable starting point for this analysis. Rather than debate whether these “Magnificent” U.S.-based companies are better than everyone else, perhaps it makes more sense to question, how much better?

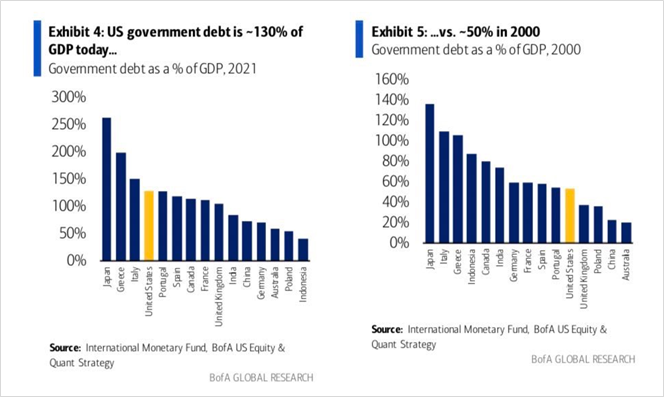

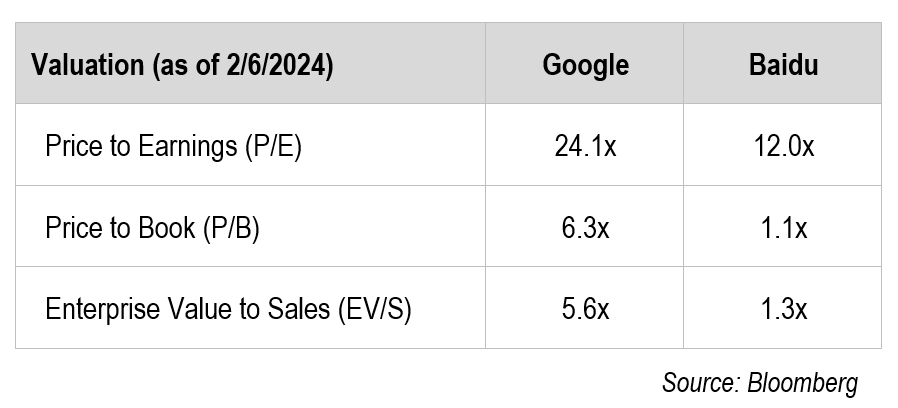

Google is a great company. They add value to their clients, have large barriers to competition, and seem well-positioned to pass cost inflation through. We are fans, but unfortunately its attributes are known to all, and the market has already marked up the price to a more than adequate level. It is more than 60% above the yearend 2022 price and is now 25x earnings, 6x book value, and 5x sales.

Chart reflects the stock prices of comparable companies and does NOT reflect the returns of any particular stock within any Kopernik portfolio.

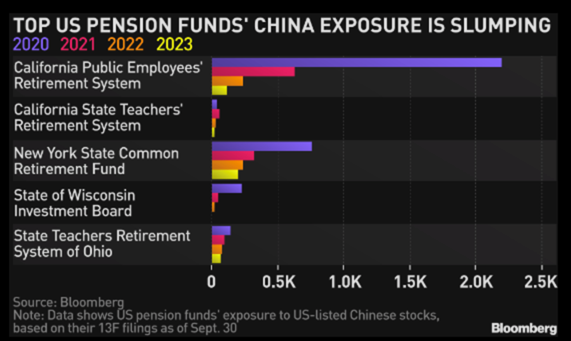

For comparison shoppers, the Chinese equivalent of Google may be of interest. It may not be as good or even an exact comparison, but the valuation difference is so dramatic that the message can’t be missed.

Asia should have more growth to boot. Sticking with the Mag 7, let’s turn to Apple.

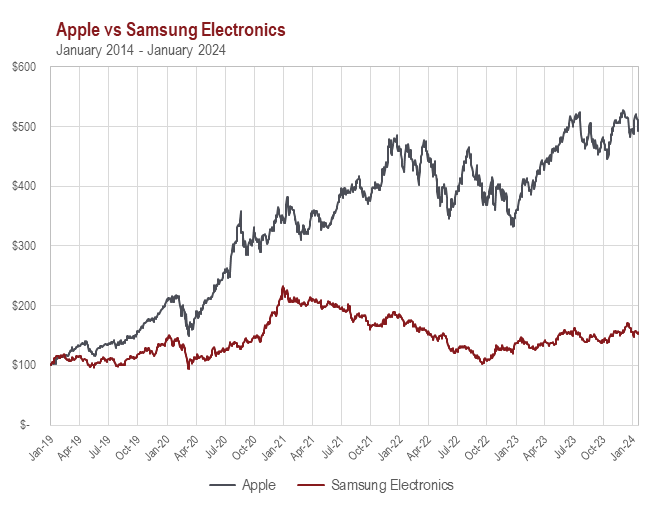

Admittedly, individuals will give up most anything before their cellphone, and Apple has an unparalleled ecosystem. But, yet again, its stock has been discovered; the quintupling of investors’ money over the past five years is now firmly in the rear-view mirror. Once again, astute investors may prefer to look for alternatives that are not priced at 30x earnings and 5.5x sales. That is nobody’s bargain. Samsung’s phones have similar market share and quality, and the company also sells industrial electronics, household appliances, air conditioners, internet access, and much more.

Chart reflects the stock prices of comparable companies and does NOT reflect the returns of any particular stock within any Kopernik portfolio.

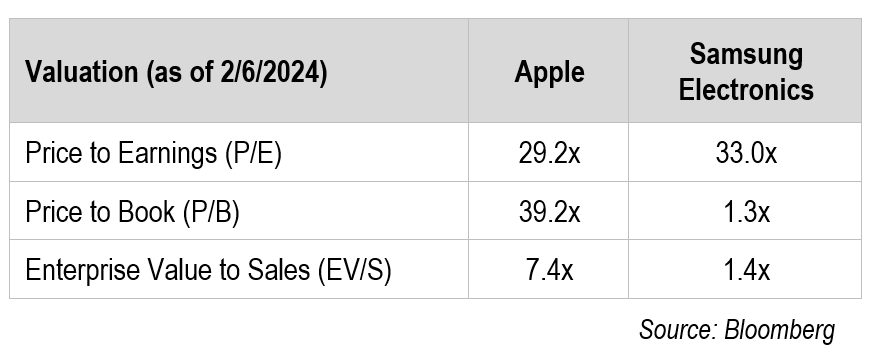

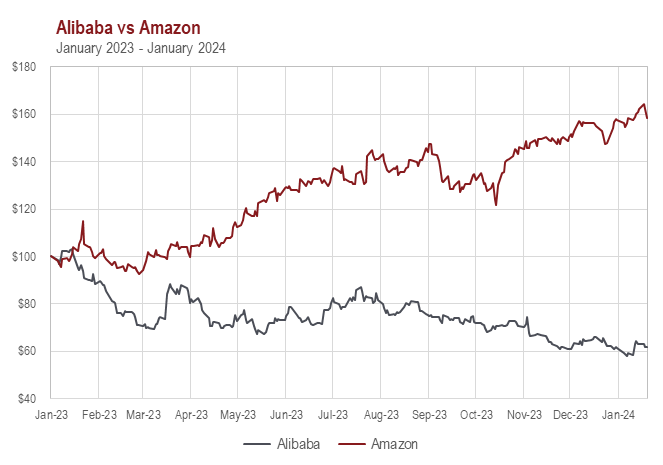

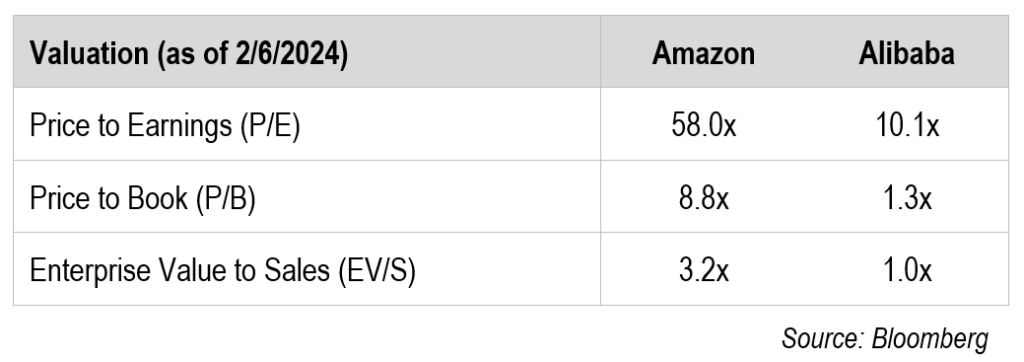

Next up – Amazon, another deified stock. What’s not to like – they mint money from Amazon Web Services (AWS), notably from the U.S. Department of Defense and elsewhere, and have adeptly used that to fund predatory pricing in a successful effort to put most retail competitors in a compromised position, or worse. They are now probably in an unassailable position. But, once again, none of this is lost on anyone and the price reflects such. In has doubled over the past year. Admittedly its price is still down slightly from the levels of late 2021 but is up 280x over the past 22 years. That is 280 times, not percent. Some of that increase was deserved, but it has seemingly well-overshot reality, leaving it at 68x earnings. Bargain shoppers might remember all the hoopla when their Asian competitor, Alibaba, went public in 2014. Proponents weren’t wrong – since then EPS is up 5.5x, revenues 10x and tangible book value 28x. The stock launched upward fourfold but has since fallen all the way back to its starting point. It’s worth repeating, fundamentals are up many times and the stock is flat. Arguably, enthusiastic punters overpaid in 2014 while overly dour investors are shunning an attractive stock today. Relative to Amazon, it’s a bargain.

Chart reflects the stock prices of comparable companies and does NOT reflect the returns of any particular stock within any Kopernik portfolio.

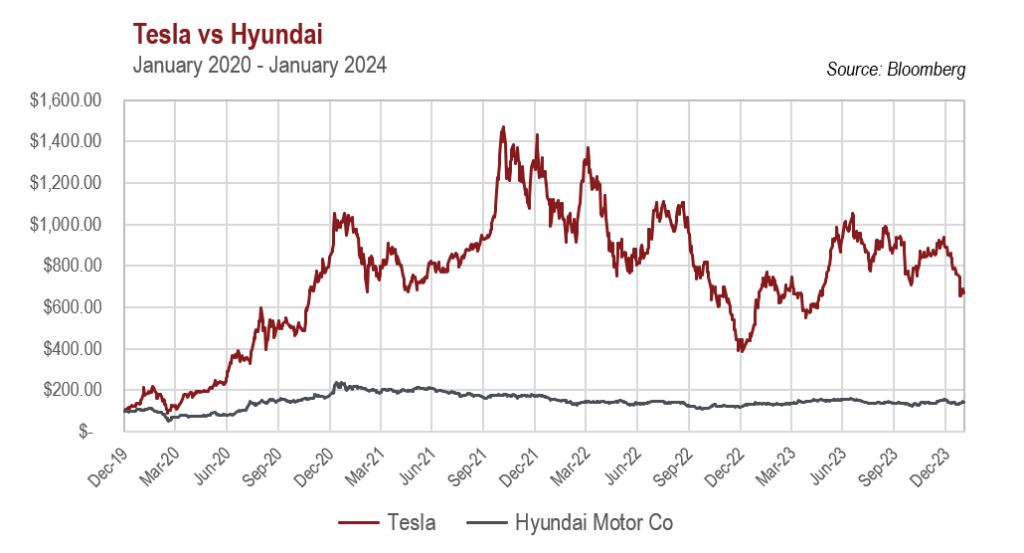

No analysis of the Mag 7 is complete without Tesla. On the surface, it is the epitome of a successful disruptor. Sporty, fast acceleration, no stops at the gas station, no exhaust coming out the tailpipe, and an important market share lead in the EV space. They’ve been innovative, with overnight software downloads, a charger network, and automation software augmented by a large database. Getting the government to mandate that their competitors pay them hundreds of millions of dollars for carbon credits, despite no real evidence that they have a smaller carbon footprint, was genius. I’m not an EV hater; my wife has one and I think it is great. For commuting they seem far superior to ICE cars. It’s a great feeling to drive past gas stations without ever having to pull in. But the negatives can’t be ignored. They aren’t ideal for long drives, and between the need to mine beaucoup amounts of nickel, copper, and cobalt, plus build windmills and solar farms, and the fact that most electricity used by EVs still comes from carbon-based fuels, it is far from clear that the carbon credits were deserved. The carbon footprint for windmills is astonishingly high, not to mention the cluttering of the environment with miles of unsightly infrastructure. I believe that the future for EVs is still quite promising, but the bloom currently is off the rose.

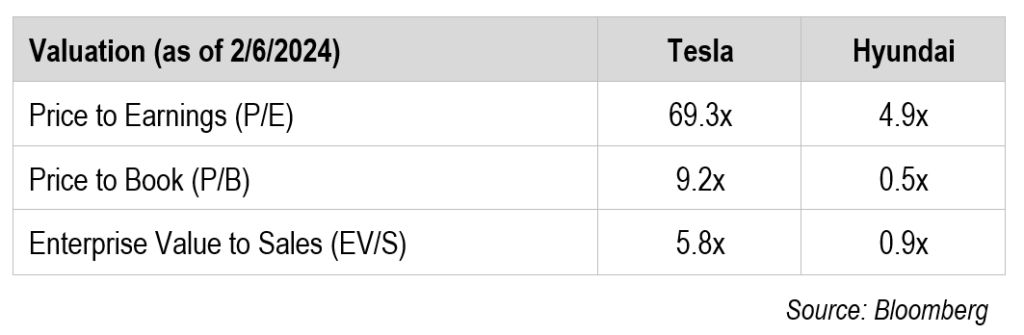

Nonetheless, there is Tesla stock, and there is every other auto company. Fans suggest that Tesla isn’t an auto company – it’s a tech company. They had better be correct. We’ll use Hyundai in this illustration since it’s in the portfolios, but many other auto stocks would suffice. Compare:

Before you attribute the difference to growth, keep in mind that Hyundai’s earnings were up nicely in 2023 while Tesla’s are down. Owners of Hyundai preferred stock get an even better bargain.

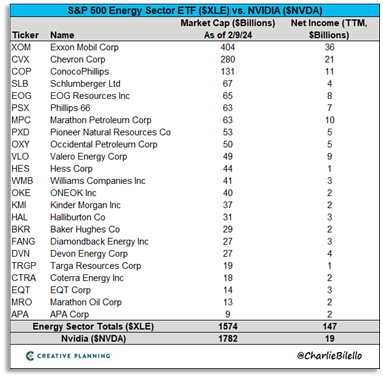

Before moving on to the things that we are most excited about, we’ll finish off the Mag 7 review with the piece de resistance – Nvidia. Like everyone else, we are admirers of the company. In a tough business, fraught with disruption and obsolescence, they have consistently demonstrated the ability to be in the right position with the right products. They were in the right place at the right time when crypto mining was all the rage several years ago and that is true again now, in spades, for the current infatuation with AI. Is AI real? Of course. Will Nvidia maintain their importance? History says we shouldn’t dismiss the company’s ability to find themselves well positioned for the future. Like the other Mag 7s, this stock is anything but overlooked. Unlike the other six, which are merely aggressively valued, this one smacks of mania. Its market cap is $1.65 trillion (trillion with a T) – 36 times larger than their trailing twelve-month sales. It is always good to reference back to Scott McNeally’s admonishment of investors who had paid 10 times revenues for Sun Microsystems at the top of the previous tech bubble. And it should be clear that this is not a small cap company that can easily grow into its valuation. It is 49x book value and 85x earnings. If analysts’ wildly bullish guesses come true, it will still be 32x earnings two years out.

Valued more dearly than the entire U.S. energy sector? For those who believe that energy no longer matters, a comparison to other tech giants may resonate better. Taiwan Semiconductor absolutely dominates semiconductor manufacturing. Intel is still a powerhouse. Samsung, mentioned above, is dominant in many areas within semis. All three cumulatively are valued at a $300 billion discount to Nvidia’s price.

Granted, being no tech genius, I could easily be wrong, but this seems to be much more about market psychology than science. Caveat Emptor!

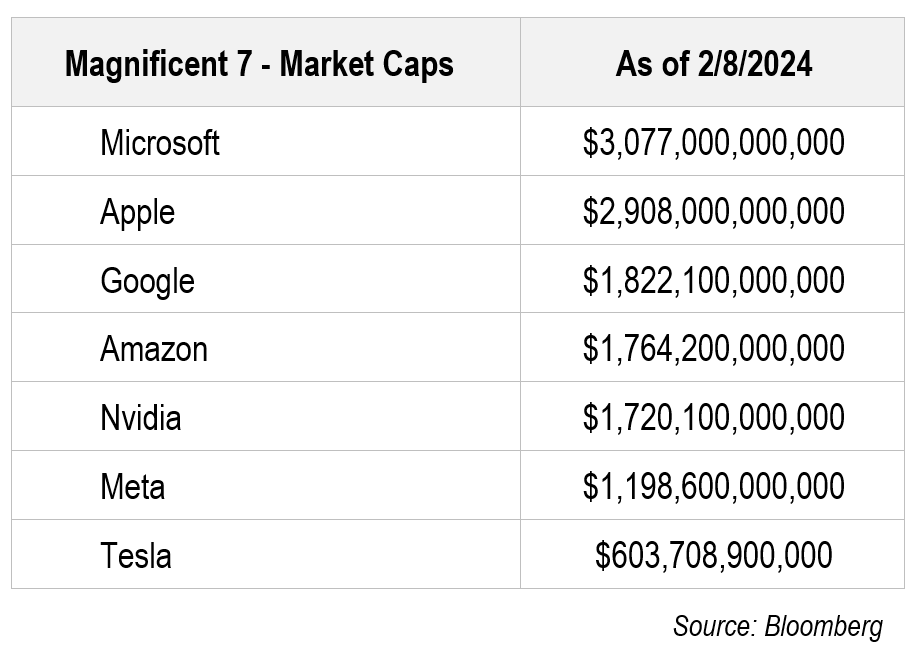

One last table before moving on. Look at the size of the market capitalizations that the market has accorded these darlings.

Moving on to the important part of this message, let’s start by repeating – The main point of this letter is that times of fiscal and monetary profligacy create a fertile environment for active management. And, as “bottom-up,” fundamentals-based investors, we at Kopernik find it more meaningful to look at specific businesses and sectors.

In the stock market, those stocks that the crowd has not yet marked up in price are exactly the ones that we are looking for; the ones where the nominal fundamental value has increased markedly but the market hasn’t gotten around to figuring that out. That seems clearly the case in many sectors today. Investors worry about being early, sitting on “dead money” as they like to call it. Given the tenfold increase in the money stock, their bigger concern ought to be of missing the resultant, potentially massive, upswing in prices, not of the stocks that have already rallied in lockstep, but of exciting, option-laden stocks like the ones discussed below. It would be a pity to miss the move because they dithered or tried to time the market. The effects of monetary inflation seldom reverse. The resultant nominal price increases of well-positioned stocks shouldn’t be missed.

(The McDonalds ad is, of course, just satire.

But it captures the times)

Where are these pockets of value that shouldn’t be missed? Let’s start with Emerging Markets.

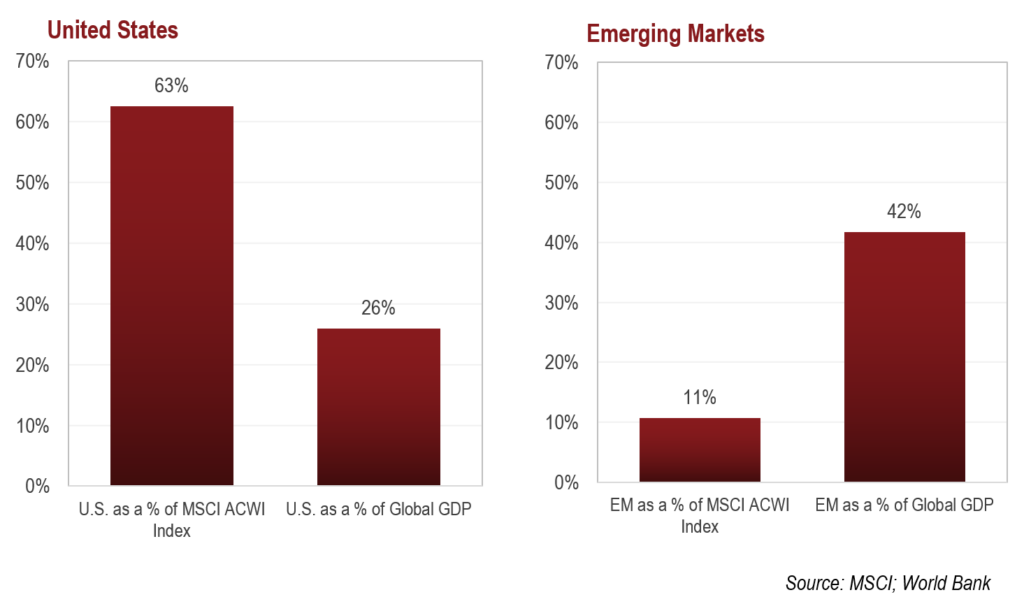

As the map should make clear, it is a mistake for investors to view EM as a small market niche. Countries labeled as emerging, or frontier, make up most of the world: land, people, resources, potential growth, and opportunities. Yet, as the chart below shows, the markets still do view EM as a small niche. Maybe this should be viewed as the stock market equivalent of a “Black Friday/Cyber Monday” sale for the markets.

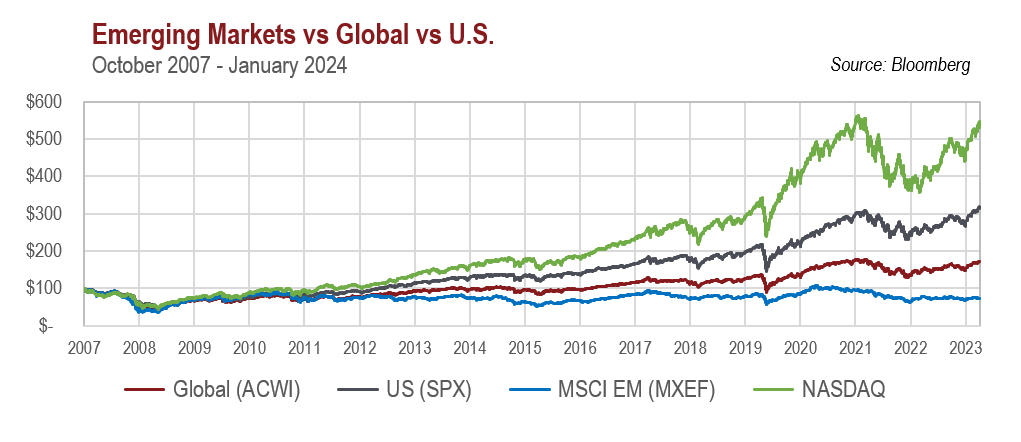

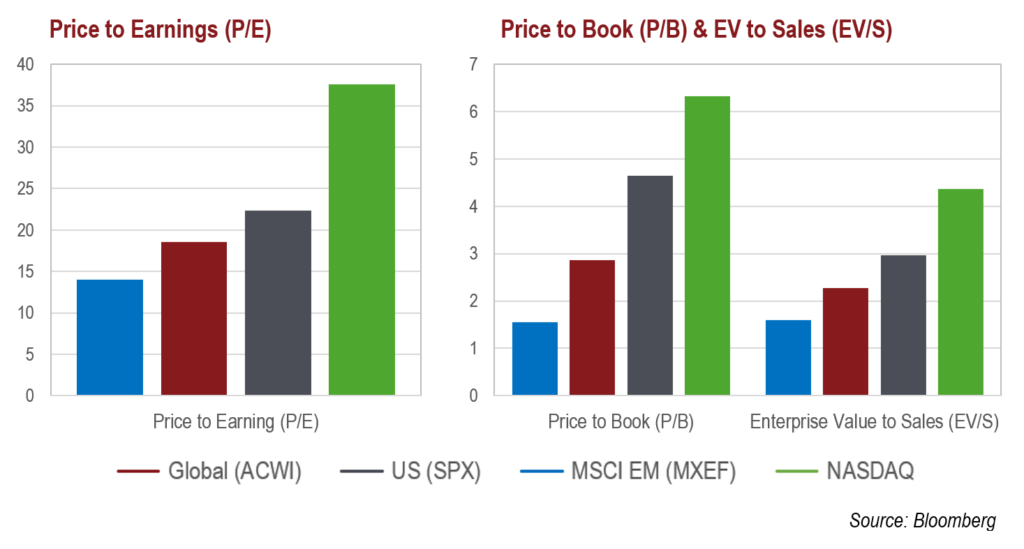

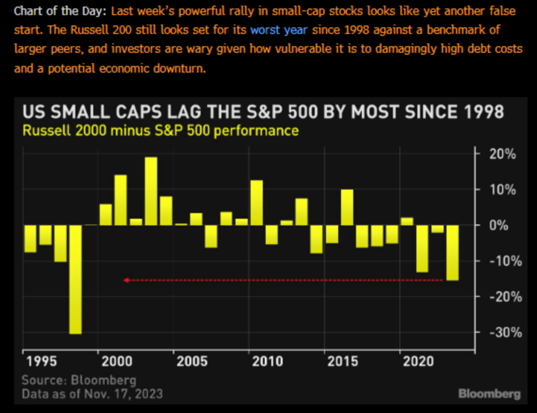

As shown above, this bargain basement sale has been over 16 years in the making. The U.S. market index has tripled while the rest of the world has risen less than half that amount. The Emerging Markets’ stocks are actually down 40% (as represented by the MXEF). Illustrated below, the price differentials are amazing, well worth the international shopping excursion. A decade and a half ago, investors often paid premia for the superior growth offered by developing countries.

Relative to history, EM valuations are attractive while the global ex-US markets are less so.

What we find especially interesting are the stocks of companies that provide much needed and scarce goods and services like cell phone service, electricity, fuel, food, industrial metals (including battery metals for green products like EVs and windmills), and precious metals that have been reliable stores of value for several millennia. Within these areas it is clearly worth shopping around. Since food is the most needed, and the least disruptable area, agriculture is a nice place to start.

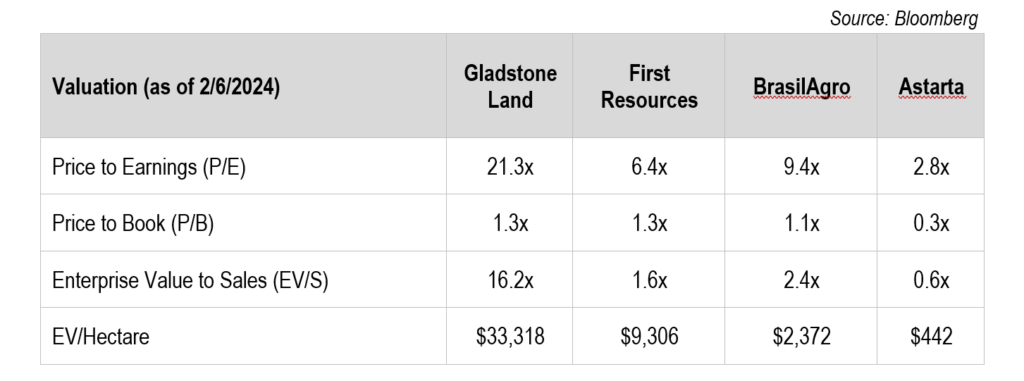

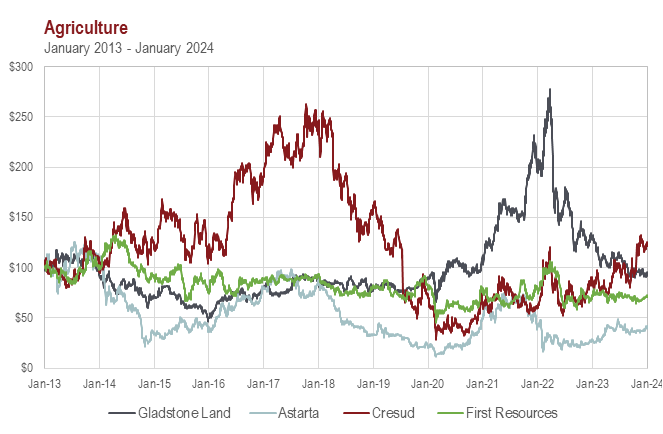

Agriculture

The U.S. is renowned for premier farmland, and it seems like a good place to invest. Notice how much less expensive farming company stocks are in Asia and Latin America. BrasilAgro can be bought directly on the Brazilian market or through partial owner Cresud, which also owns a lot of premier Argentine farmland. And for those willing to venture into the Ukraine, companies there are extremely inexpensive and are very profitable even amongst the current turmoil. Ukraine and Argentina are, like the U.S., famed for the quality of their topsoil.

Chart reflects the stock prices of comparable companies and does NOT reflect the returns of any particular stock within any Kopernik portfolio.

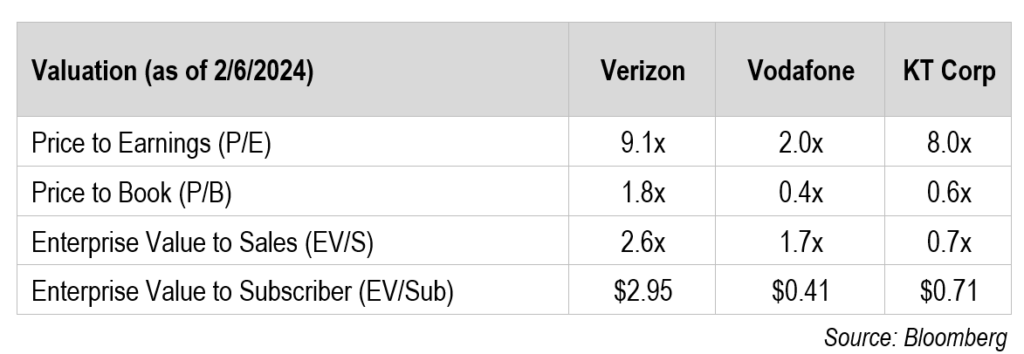

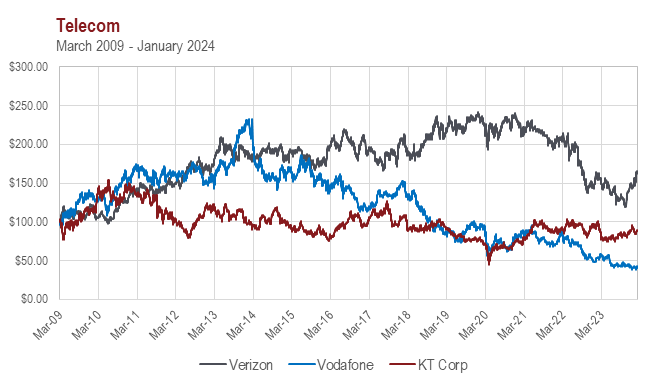

Telecom

Other than food, perhaps the last thing that the average person would part with is their cellphone. The common stocks of the U.S. service providers have fallen in half in recent years and are now at attractive levels for those who are comfortable with their high debt levels and the questionable sustainability of their profit margins. Globally, Vodaphone also has challenging levels of debt but is priced much more attractively. Trading 77% below its peak, it’s currently valued at only 2x earnings (which are expected to fall, making it more comparable to Verizon and AT&T’s 9x multiple). It is still much cheaper on other metrics. In Korea, arguably a developed market that is still categorized as EM by MSCI, phone companies are very inexpensive despite excellent technology and a triopoly structure.

Cellular stocks in frontier markets are also quite attractive. It is currently fascinating to reflect on the fact that telecom stocks once represented the third letter of the absurdly expensive TMT mania of the late 1990s.

Chart reflects the stock prices of comparable companies and does NOT reflect the returns of any particular stock within any Kopernik portfolio.

Of course, cellphones don’t work too well sans electricity, which leads us to another much-needed industry.

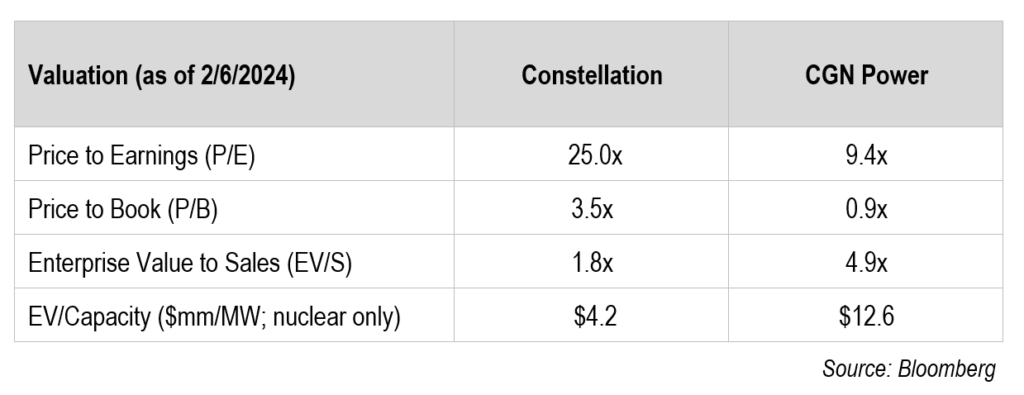

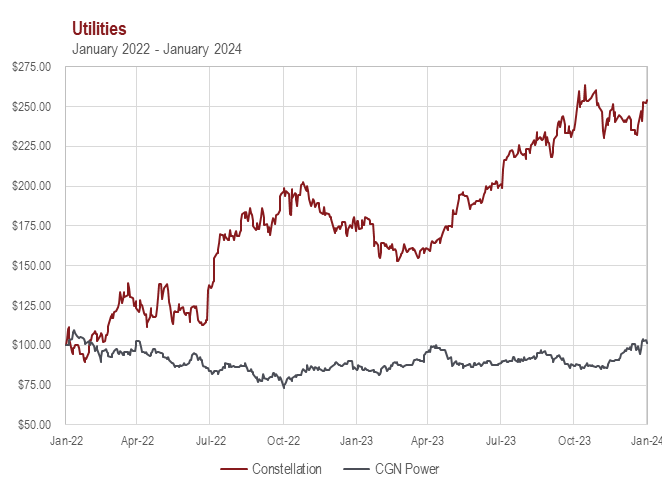

Utilities

Within electric utilities, due to society’s preference for greenhouse gas free electricity, nuclear power has found itself back in good graces. Constellation Energy is positioned to benefit from this trend and is priced accordingly. Interestingly, CGN Power is priced much more attractively despite modern plants and prospective Chinese growth. We’ve written a lot about nuclear and hydro power in the past, so we’ll move on.

Chart reflects the stock prices of comparable companies and does NOT reflect the returns of any particular stock within any Kopernik portfolio.

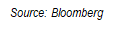

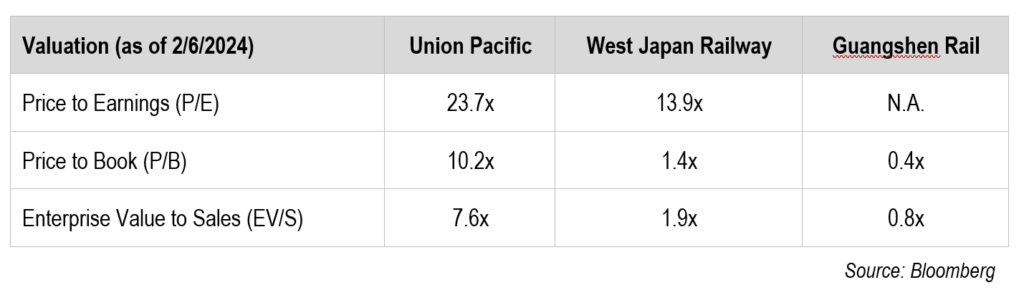

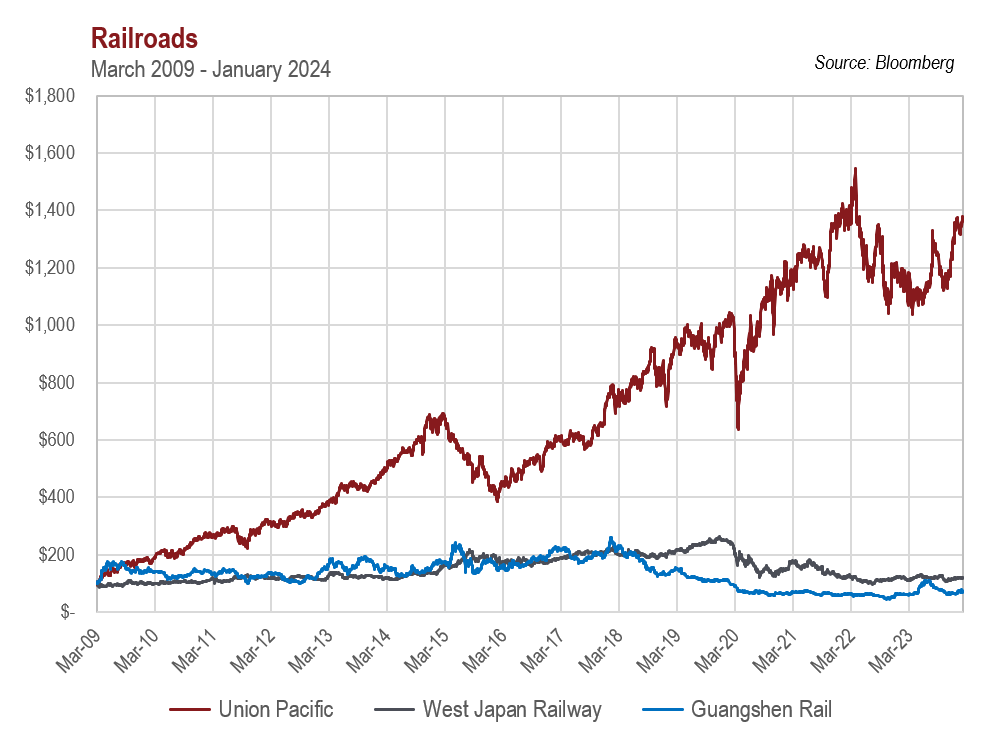

Railroads

Moving from utilities to quasi-utilities, railroads have generally had an important place in our portfolios for the past several decades due to their strong and improving fundamentals combined with bouts of extreme undervaluation. We’ve owned most of the U.S. railroads in the past. They performed very well over the past two decades and therefore haven’t been of interest recently. Fortunately, it’s a big world. Rails in Asia remain compelling. The following chart and table highlight the contrast between quality rails in the U.S., Japan, and Hong Kong/China.

Chart reflects the stock prices of comparable companies and does NOT reflect the returns of any particular stock within any Kopernik portfolio.

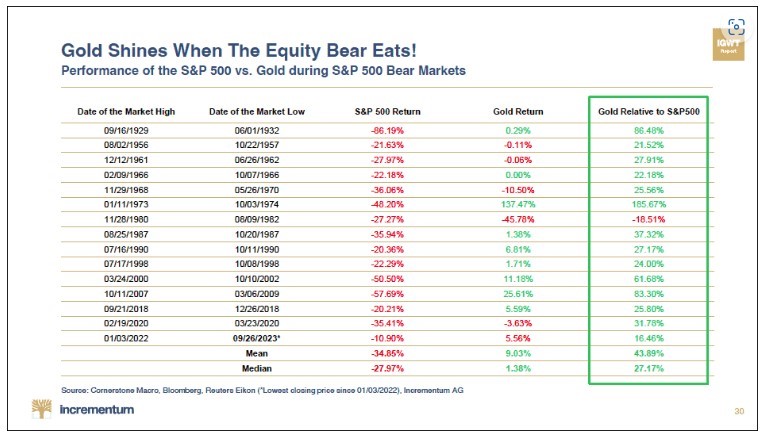

Other Real Assets

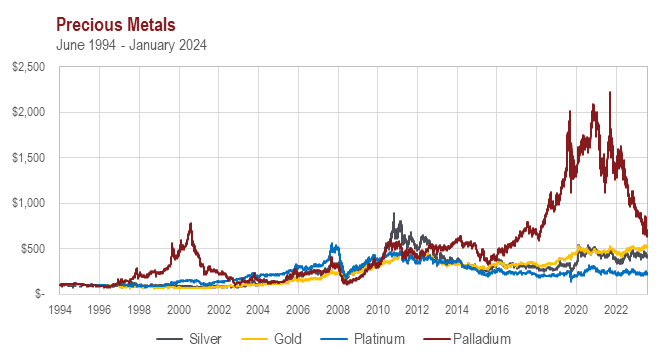

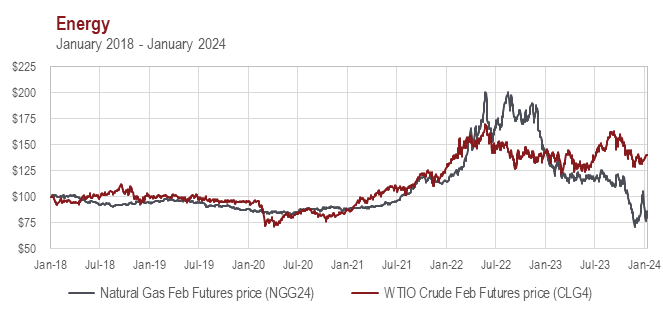

Moving the discussion from shopping for franchises across the globe, let’s quickly touch on the even more alluring opportunities to comparison shop for much needed commodities. We’ll be quick, in consideration of the fact that we’ve tackled this subject in depth in recent years. But it is worth noting that changes in money stock have sloshed from commodity to commodity, and done so unequally, with a lot of volatility and little discernment. Three quick points: correlation has not been high between commodities; it has not been that high between commodities and the stocks of companies which own those commodities; and long-lived commodity reserves are being discounted heavily relative to their value.

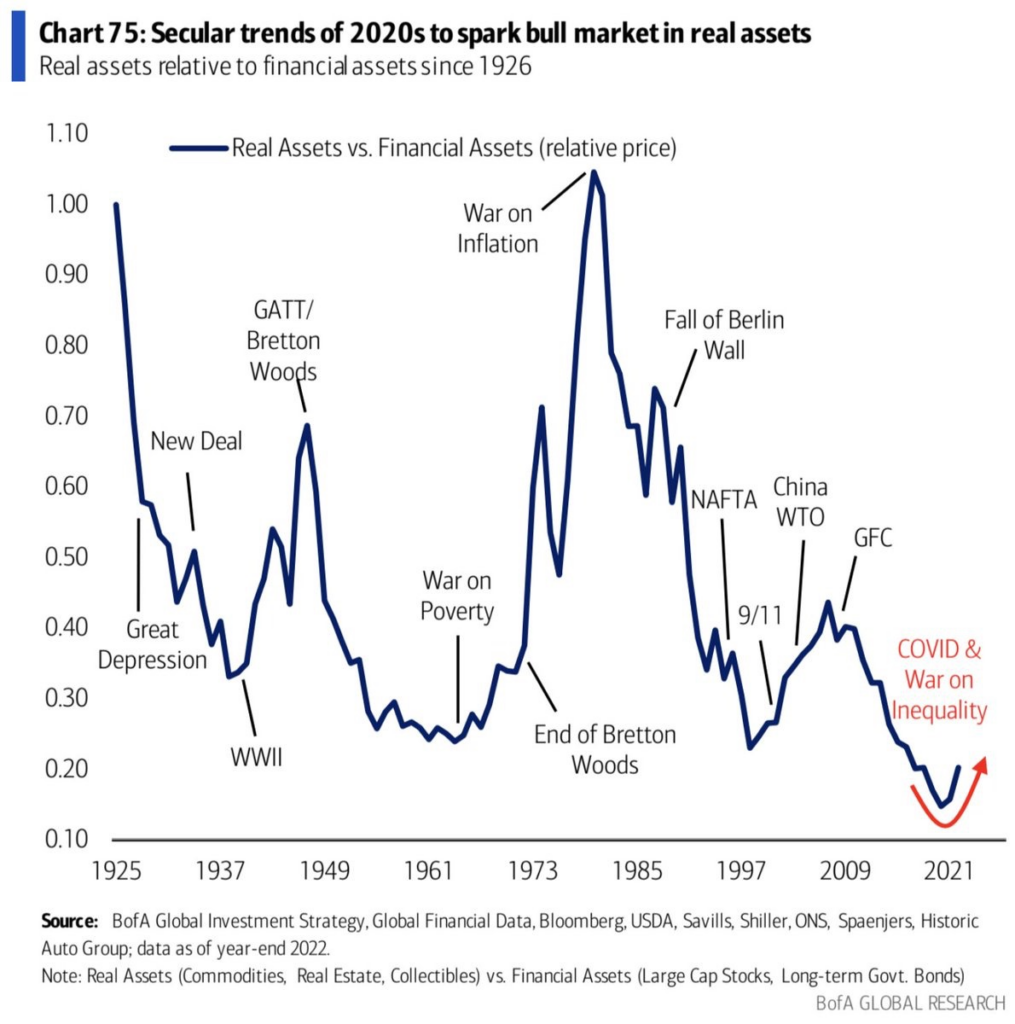

They say a picture paints a thousand words.

Gold prices are up while platinum, palladium, and lithium prices have fallen a lot. Gold prices are near all-time highs while the prices of stocks of the companies that own gold are down a lot. The GDXJ is down 75% from its high of 13 years ago. Oil is selling at around half of its all-time high while many major oil stocks are near all-time highs. Cameco is back near its all-time high from 2007 even though the price of uranium is 30% lower. Natural gas in the U.S. is a third lower than it was two years ago. Clearly this indiscriminate volatility gives savvy shoppers ample opportunity for enrichment.

And minerals that likely won’t be extracted for many years sell at obscene discounts to comparable minerals that will be converted into cash shortly. This is odd considering that fundamentals and government fiscal malfeasance both portend higher prices for the sales in the future. We are excited about this mispricing, but, as we have written extensively about it in the past, will move on.

Concluding Thoughts

The stocks of providers of these needed goods and services clearly haven’t yet caught up with the escalating quantity of money. When will they? Importantly, many of the stocks and industries highlighted above appear way too cheap even if our premises are misguided. Fiscal recklessness is inflationary. The tenfold increase of the past couple decades is still working its way through the system. Higher volatility and higher nominal prices are the reasonable expectation. The randomness of future price increases will serve active managers well.

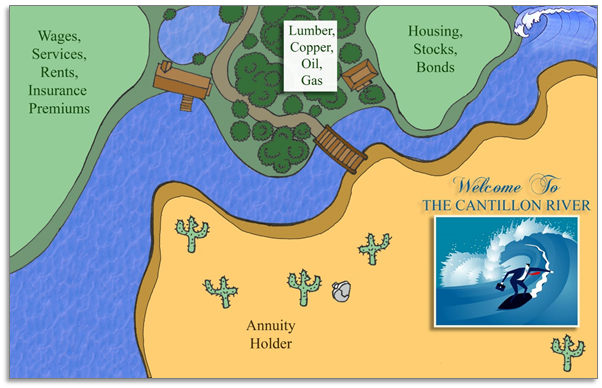

We’ll refer to you our recent commentaries about the Cantillon Effect. In a nutshell, Richard Cantillon pointed out that money is non-neutral. It surges downstream like a torrent of water in a river. It benefits financial assets first and real assets down the road.

“Time brings all things to pass”

-Aeschylus

As the $7 trillion wave of money figuratively descends the “Cantillon River,” it is wise to analyze where the water is headed. Look downstream. Get ahead of the wave. The potential likely upside is multiples of today’s prices. Look for where the riverbanks are high and where they are low and thus vulnerable to a flood of money.

As demonstrated above, the deluge of money, much of it emanating from the U.S., has buoyed domestic stocks first. This is not surprising. As the wave of greenbacks cascades downstream, history and logic suggest that investors should be lining up in domiciles further down river, in other nations. We believe that the companies highlighted above fit the bill.

Wishing All a Happy, Healthy, Prosperous 2024!

David B. Iben, CFA

Chief Investment Officer

Kopernik Global Investors

February 2024

After U.S. debt crossed $33 trillion in mid-September, the U.S. added another $500 billion in debt in just 15 days. That’s an average of $1.4 billion per hour.

Important Information and Disclosures

The information presented herein is proprietary to Kopernik Global Investors, LLC. This material is not to be reproduced in whole or in part or used for any purpose except as authorized by Kopernik Global Investors, LLC. This material is for informational purposes only and should not be regarded as a recommendation or an offer to buy or sell any product or service to which this information may relate.

This letter may contain forward-looking statements. Use of words such was “believe”, “intend”, “expect”, anticipate”, “project”, “estimate”, “predict”, “is confident”, “has confidence” and similar expressions are intended to identify forward-looking statements. Forward-looking statements are not historical facts and are based on current observations, beliefs, assumptions, expectations, estimates, and projections. Forward-looking statements are not guarantees of future performance and are subject to risks, uncertainties and other factors, some of which are beyond our control and are difficult to predict. As a result, actual results could differ materially from those expressed, implied or forecasted in the forward-looking statements.

Please consider all risks carefully before investing. Investments in a Kopernik strategy are subject to certain risks such as market, investment style, interest rate, deflation, and illiquidity risk. Investments in small and mid-capitalization companies also involve greater risk and portfolio price volatility than investments in larger capitalization stocks. Investing in non-U.S. markets, including emerging and frontier markets, involves certain additional risks, including potential currency fluctuations and controls, restrictions on foreign investments, less governmental supervision and regulation, less liquidity, less disclosure, and the potential for market volatility, expropriation, confiscatory taxation, and social, economic and political instability. Investments in energy and natural resources companies are especially affected by developments in the commodities markets, the supply of and demand for specific resources, raw materials, products and services, the price of oil and gas, exploration and production spending, government regulation, economic conditions, international political developments, energy conservation efforts and the success of exploration projects.

Investing involves risk, including possible loss of principal. There can be no assurance that a strategy will achieve its stated objectives. Equity funds are subject generally to market, market sector, market liquidity, issuer, and investment style risks, among other factors, to varying degrees, all of which are more fully described in the fund’s prospectus. Investments in foreign securities may underperform and may be more volatile than comparable U.S. securities because of the risks involving foreign economies and markets, foreign political systems, foreign regulatory standards, foreign currencies and taxes. Investments in foreign and emerging markets present additional risks, such as increased volatility and lower trading volume.

The holdings discussed in this piece should not be considered recommendations to purchase or sell a particular security. It should not be assumed that securities bought or sold in the future will be profitable or will equal the performance of the securities in this portfolio. Current and future portfolio holdings are subject to risk.