Gold & Other Precious Metals (Oct 2024)

In a world of fiat currencies, where central banks can conjure trillions of dollars, yen, euros, or yuan out of thin air, it is more important than ever to recognize that precious metals provide important stores of value. Hence, this primer seems timely. Gold and silver have been money for thousands of years: important stores of value and mediums of exchange. The platinum group metals (PGMs) also have monetary characteristics and are stores of value; their industrial applications are an added benefit. Scarce, durable, ductile, malleable, and protection against a depreciating currency: gold and other precious metals are as important in 2024 as they have been throughout history.

What are Precious Metals?

“Precious metals are rare, naturally occurring metallic chemical elements of high economic value. Precious metals, particularly the noble metals, are more corrosion resistant and less chemically reactive than most elements. They are usually ductile and have a high luster. Historically, precious metals were important as currency but are now regarded mainly as investment and industrial raw materials.

The best known precious metals are the coinage metals, which are gold and silver. Although both have industrial uses, they are better known for their uses in art, jewelry, and coinage.

Other precious metals include the platinum group metals: ruthenium, rhodium, palladium, osmium, iridium, and platinum, of which platinum is the most widely traded. The demand for precious metals is driven not only by their practical use but also by their role as investments and a store of value. Historically, precious metals have commanded much higher prices than common industrial metals.” – Wikipedia

Gold

“The desire of gold is not for gold. It is for the means of freedom and benefit.”

-Ralph Waldo Emerson, 1803-1882

Gold is one of the most popular commodities in the world. According to 2023 estimates, 49% of the current demand in gold is in jewelry, 23% in investment, 21% in central banks, and 7% in industrial usage, especially technology.1 Industrially, gold is used primarily in electronics and computing, where it is utilized in circuit boards, connectors, and wiring. Thin layers of gold are used in the aerospace industry on space vehicle visors to reflect solar radiation and in climate control systems. Gold is also used in medicine as a component of treatments for rheumatoid arthritis and cancer.

Gold has been used extensively as a symbol of wealth and power in jewelry, religious objects, and architectural decorating. The ancient Egyptians attributed a divine status to the metal, believing it to be the skin of their gods (especially Ra, the sun god), and used it extensively in burial masks and tombs. In ancient China, gold was thought to have healing properties. Roman emperors built very sophisticated tunnels with metallurgical processing capabilities. Indigenous populations in the Americas used gold as a symbol of power; the Incan king Atahualpa was rumored to possess a portable, 15-carat gold throne weighing 183 pounds! European colonizers conquered the Americas largely in search of riches; between 1500-1800, over 1,700 metric tonnes of gold were shipped from the Americas to Europe.2 In 1848, the discovery of gold in California marked the beginning of the California gold rush and the rapid settlement of the American West; in the 1890s, the process repeated itself in Alaska.

Silver

While well known for its use in jewelry, high-value tableware and utensils (hence the term “silverware”), and ornaments, silver also has a wide variety of industrial uses. Silver conducts heat and electricity very well, and it is flexible and corrosion resistant, making it ideal for electronic applications. Almost every computer, phone, car, or electrical appliance uses silver as it is a very good coating for electrical contacts. It is also used in solar panel cells and modules. Other uses include specialized mirror and window coatings and as a colorant in stained glass; a catalyst for chemical reactions, and in baking, where edible silver decorations can be used in specialized confectionary. Silver compounds are used in photographic and x-ray film, and dilute solutions of silver nitrate and other silver compounds are used as disinfectants and microbiocides, added to bandages, wound-dressings, catheters, and other medical instruments.

Silver is one of the “seven metals of antiquity,” (those that were identified and used by humans in pre-historic times), and has had an enduring role throughout history. Silver, along with gold, was used as a currency (see more on that below). Silver’s low structural strength meant that it was rarely used in metallurgy, but rather ornamentally. Archaeological evidence suggests that silver was being separated from lead as early as the 4th millennium BCE; the origins of silver production in India, China, and Japan are equally ancient, although poorly documented.

Platinum

Platinum is a non-reactive metal and has significant resistance to corrosion, even at high temperatures, making it a noble metal. This makes it useful in a variety of settings. It is used in catalytic converters, laboratory equipment, electrical contacts and electrodes, thermometers, dentistry equipment, and jewelry. It is also used in the glass industry to manipulate molten glass. Compounds containing platinum are applied in chemotherapy treatments.

Platinum is naturally occurring in the alluvial sands of various rivers, as such, it was used by ancient civilizations in Egypt and South America to make ceremonial items and jewelry. In the 1500s, the Spanish nicknamed it platina, meaning “little silver.” The metal did not melt and was difficult to work with, and so the Spanish considered it inferior. It wasn’t until the 1800s that processes and technology for making platinum malleable became available.

Palladium

Palladium is a similar metal to platinum; in fact, the two are often used as substitutes for each other. Palladium’s largest use is in catalytic converters, but it is also used in jewelry, dentistry, watch making, blood sugar test strips, aircraft spark plugs, surgical instruments, and electrical contacts. It is also used to make classical flutes.

Palladium was discovered by chemist William Hyde Wollaston in 1802. Wollaston was experimenting with how to purify platinum ore, and when he dissolved the ore in a mixture of nitric acid and hydrochloric acid, the residue was not platinum—it was palladium. Palladium became a popular treatment for tuberculosis in the late 1800s, but the side effects were significant, and it faded into obscurity until the 1980s when it became part of the controversial “cold fusion” experiments due to its ability to absorb hydrogen.

Precious Metals as Money

“Gold is money. Everything else is credit.”

-J.P. Morgan, 1837-1913

Prior to 9000 BCE, there was no such thing as money. Everything was on a barter system: “I will trade my corn for your cow.” However, there are many problems that arise with the barter system. What if I only had half a cow’s worth of corn to sell? How many ears of corn should a healthy cow fetch vs. a skinny, sickly cow? What if the person who needs the corn is halfway around the world from me?

In his book Dave Berry’s Money Secrets, comedian Dave Berry describes an ancient Chinese solution to the problem: seashells. Seashells had a lot of advantages over cows—they were small, non-perishable, easy to transport. There was a problem, however: they were seashells. All you had to do was go to a beach, get your fill, and you were rich! Over time, societies progressed to forms of money that were better than seashells due to better durability or more scarcity. Metals such as copper and bronze became popular for this purpose. Eventually societies migrated to even scarcer and more valuable metals like silver and gold.

To this day, there is no better form of money than gold. Gold is homogenous, easy to transport, inert, divisible, attractive, and rare. Gold is difficult to get out of the ground and has minimal industrial use, thereby reducing the risk of wild swings in money supply. As such, it has been used as money for millennia. Admittedly, it is commonly used in jewelry, but much of that is held as an investment or for barter.

Gold coins are said to have first been struck in Lydia in 550 BCE by King Croesus, and the practice continued throughout the ancient and medieval periods. During the Colonial era, the huge inflow of gold from the New World (in addition to improvements in technology) meant that gold use became even more common. European countries adopted gold standards in the 1600s; the U.S. adopted a bi-metallic (silver and gold) standard in 1792 and went to a solely gold standard in 1900.

One problem with gold as money is that it is bulky and heavy. Paper IOUs made their way into the system in China around the 6th century and in the West in 1661. Goldsmiths kept gold safe and issued paper receipts to be redeemed at a later point. These goldsmiths eventually evolved into bankers and started lending the gold out at interest. The trustworthiness and reputation of a bank would largely determine whether the gold would be there when you came to redeem it. Over time, governments took over for banks as the primary issuers of these receipts/currency.

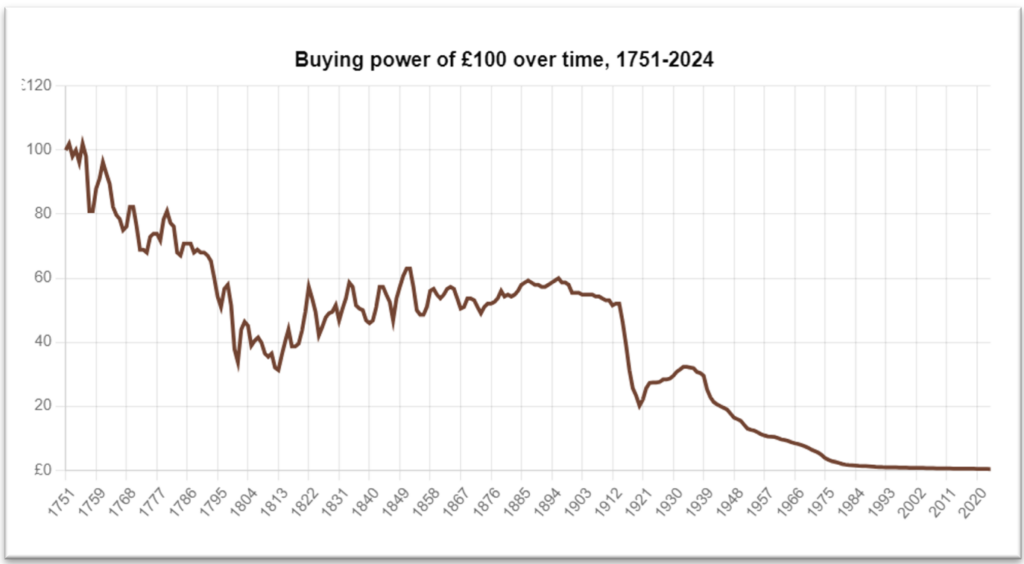

Early on, these paper receipts were backed by physical gold – something that made sense, since paper currencies are a much more convenient medium of exchange, while the underlying gold collateral provided a store of value. It’s a great system—if governments could be trusted to adhere to it. But, alas, countries proved to be untrustworthy, issuing more currency than they could back. When called to task, they began to abandon the practice of backing their currencies with collateral. In 1914, the British went off a gold standard to print money to pay for World War I. The purchasing power of the British pound declined drastically relative to precious metals when this happened. However, the value of the pound rose dramatically during the 1920s when Winston Churchill put Great Britain back on the gold standard; unfortunately, this was short-lived as the Brits went off again in the early 1930s. Ever since then, the pound has continued to fall.

In the U.S., the financial system has broken down twice in the last 100 years. It broke down in 1933 when President Franklin Roosevelt forced every American to hand in their gold for $20.67/ounce and then revalued the price to $35/ounce, in the equivalent to a 41% hit to a saver’s wealth (and effectively a theft of gold by the government.). A second, more impactful default occurred on August 15, 1971, when President Richard Nixon announced his New Economic Policy and effectively killed the Bretton Woods version of a gold standard, and with it, the obligation for the U.S. to purchase gold at $35/ounce.

Under the 1944 Bretton Woods system, foreign currencies were pegged to the U.S. dollar, whose value was backed by gold at the set price of $35/ounce. Countries held dollar reserves instead of truing up deficits every year through gold. The rules of the game allowed countries to convert their dollar reserves into gold at any time. During the 1960s, foreign nations had begun to catch on to the fact that the U.S. hadn’t been living up to its side of the bargain, that is, keeping a stable money supply that justified $35/ounce. Instead, the U.S. had been inflating its money supply (to pay for things like President Johnson’s “Guns and Butter” policy) and paying for imported goods with an overvalued dollar.

The French were among the first to call the U.S. out on this. French President Charles De Gaulle referred to the U.S. buying European companies with overvalued dollars as “expropriation.” In 1965, De Gaulle converted $150 million (today’s value = $1.5 billion) of their dollar reserves into gold and said they planned to convert another $150 million.3 The French government even offered to send the French navy to help ferry the gold back to France. Spain followed France, and other European nations followed Spain. By March 1968, the outflow from the gold pool was running at a peak rate of 30 metric tons per hour.4

Realizing that the amount of foreign dollar reserves overwhelmed the amount of gold held by the U.S. Mint (at the $35/ounce price), President Nixon closed the gold window on August 15, 1971, and announced that the dollar would no longer be convertible into gold. The last semblance of a gold standard was dead.

The gold standard was scrapped in favor of what Jim Grant (of Grant’s Interest Rate Observer) refers to as “the PhD Standard.” He continues, “One can think of the original Federal Reserve note as a kind of derivative. It derived its value chiefly from gold, into which it was lawfully exchangeable. Now that the Federal Reserve note is exchangeable into nothing except small change, it is a derivative without an underlier. Or, at a stretch, one might say it is a derivative that secures its value from the wisdom of Congress and the foresight and judgment of the monetary scholars at the Federal Reserve. Either way, we would seem to be in dangerous, uncharted waters.”5 Since 1971, the value that society has attributed to gold has waxed and waned. With the new U.S. government policy of unlimited quantitative easing and the seemingly unfettered printing of fiat currency, this is a perfect time to analyze gold’s role. Today’s government’s printing presses are the equivalent to yesterday’s Chinese beaches.

Under a true gold standard, the number of paper receipts can only be as big as the amount of gold backing it, which creates a problem for governments with unlimited budgets. James Grant states, “An unanchored currency presents a temptation that mortal man finds irresistible.” Unrestrained governments throughout history have an impeccable track record of succumbing to the “irresistible” temptation to fund all the spending desires of their citizens by diluting their purchasing power.

Other precious metals, including silver, platinum, and palladium, also have monetary characteristics: they are scarce, recognizable, durable, uniform, divisible, portable, and fungible. Like gold, these metals hold their value over the long term. Unlike gold, they also have substantial industrial use cases, an added benefit on top of their monetary characteristics. While we don’t eat gold or put it in our gas tanks, we do put silver in our electronics and platinum/palladium in our catalytic converters. We discuss these metals in more detail below.

Silver

Historically, silver has been used as a monetary metal more frequently and for a longer duration than gold: from 3000 BCE-1873 CE, the silver standard was prevalent. More common than gold, silver has been perceived as currency of the common man, while gold was associated with displays of wealth and power.

The U.S. first established a bimetallic standard with the Coinage Act of 1792—the law that set up the country’s monetary system stated that both silver and gold could be used as legal tender, setting the ratio of silver to gold at 15:1. This lasted until the Coinage Act of 1873 effectively demonetized silver by omitting the silver dollar from the list of authorized coins in the United States.

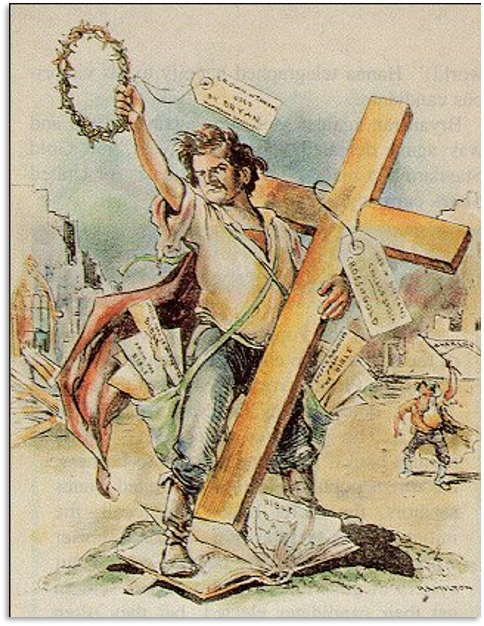

This so-called “Crime of ‘73” spurred a social and political movement known as “Free Silver.” The Free Silver movement brought together groups that advocated for the unlimited coinage of silver: owners of silver mines in the West (whose livelihoods depended on it), farmers (who hoped that more money in the system would drive up the price of their crops), and debtors (who thought it would help them pay their debts more easily). Even though it essentially advocated for inflation, Free Silver became a symbol of economic justice, and politicians took up the cause. In 1896, the Democrats made unlimited silver coinage a key plank of their platform and nominated William Jennings Bryan, one of its most impassioned defenders, for president. At the Democratic National Convention, Bryan gave a defense of silver coinage that still echoes through the history books:

“If they dare to come out in the open field and defend the gold standard as a good thing, we shall fight them to the uttermost, having behind us the producing masses of the nation and the world….we shall answer their demands for a gold standard by saying to them, you shall not press down upon the brow of labor this crown of thorns. You shall not crucify mankind upon a cross of gold.”

Bryan lost the 1896 election, and in 1900, Congress passed the Gold Standard Act, which codified a gold standard in the U.S. that lasted until President Nixon abandoned it, as discussed above. Today, approximately 70% of silver production is used industrially, with only 30% used for jewelry and investment. Silver is one of the best conductors of electricity; as such it is used extensively in solar panels and electronics. It is also used as a catalyst in chemical reactions, as a component in brazing and soldering, and in the medical field, where its antimicrobial properties make it useful for coating medical devices, such as breathing tubes and catheters, to prevent infection. Projections from the Silver Institute and Oxford Economics indicate that, through 2033, industrial demand for silver will increase by 42%.6 We have little conviction in these projections, but believe that directionally, they are correct: demand for silver will continue to increase.

Platinum and Palladium

Unlike gold and silver, platinum and palladium do not have long histories as monetary metals. Platinum was first discovered by pre-Columbian American civilizations; during the colonial period, the Spanish nicknamed it “platina,” meaning “little silver,” due to its initial confusion with silver. The Spanish first minted platinum coins in the 1700s, but those coins were not circulated widely, since platinum was difficult to process and easily confused with silver. Platinum coins were struck as national currency in Russia between 1828-1845, and there have been many commemorative platinum issues across the world, including in the U.S., Britain, China, Canada, and Australia. Palladium was discovered by English chemist William Hyde Wollaston in 1802; it has even less of a history as money. Palladium coins have been issued in Sierra Leone, Tonga, the U.S., Canada, France, Russia, China, and Australia, but only as commemorative issues.

While platinum and palladium may not have long histories as money, they do have the same monetary properties: like gold and silver, platinum and palladium are scarce, durable, ductile, and good stores of value. As of this writing, spot prices for platinum and palladium are roughly $1000/oz and $1030/oz, respectively. A collection of eight commemorative 1 oz. palladium coins minted in the U.S. between 2017-2023 will run a collector nearly $46,000—far above the $8,240 implied by the spot price. After seeing success selling gold bars in recent years, U.S. wholesale retailer Costco has added platinum bars to its inventory. At least some policymakers acknowledge that platinum holds its value: the Russian central bank recently announced it would be buying platinum to augment its precious metals holdings; in the U.S., the minting of a trillion-dollar platinum coin has been proposed as a solution to various debt-ceiling crises since 2011.

Fiat Currencies

“Paper money eventually returns to its intrinsic value—zero.”

-Voltaire, 1694-1778

The lives of fiat currencies are short ones, with an average lifespan of roughly 35 years.7 Many of these fail through hyperinflation, but some are destroyed by war (frequently after also experiencing hyperinflation), some fail through acts of independence, and others through voluntary monetary reforms, such as the creation of the Euro in 1999, which eliminated 12 separate fiat currencies, including the German Mark, Dutch Guilder, French Franc, and Greek Drachma.

The British pound was one European currency not to get subsumed by the introduction of the Euro. In fact, it is one of the longest-living fiat currencies, having been around since 1694. What a success! Does this buck the trend that fiat currencies have a short lifespan? Technically yes, economically no. When the Bank of England was established and paper notes were issued in 1694, the British pound represented one troy pound of sterling silver, of 12 silver ounces. In 2023, it would have taken 183.6 pounds to buy those same 12 ounces. This is equivalent to a 99.4% loss in purchasing power.

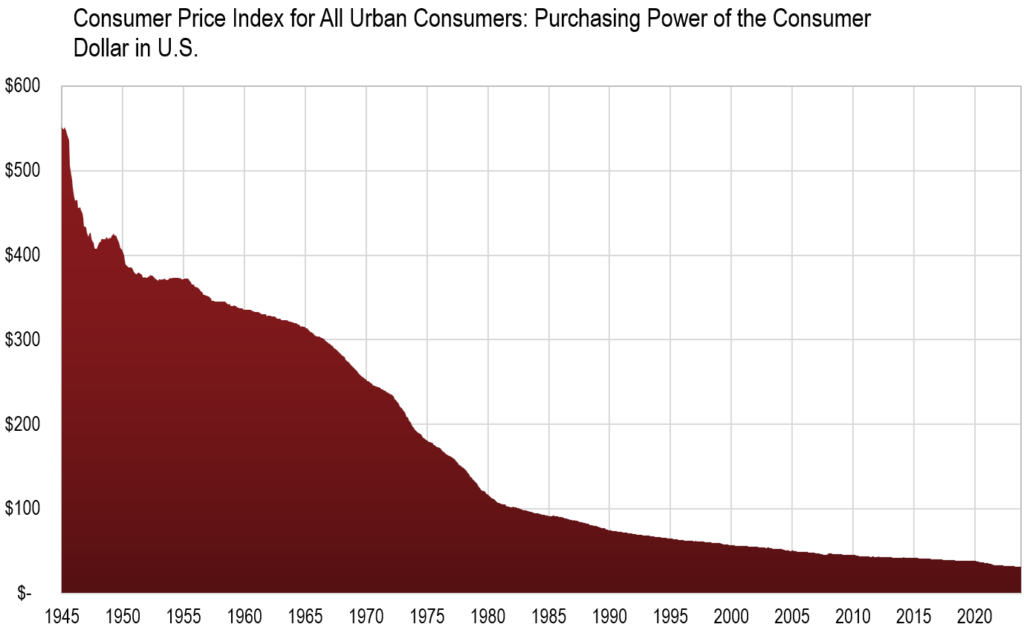

A similar thing has happened in the United States. David Stockman (once the budget director for the Reagan administration) said, “The gold standard wouldn’t have allowed forty years of deficits…Nations were compelled to live within their means…The gold standard was an honest regulator of Wall Street greed…nor did we [in upholding a gold standard] punish people who invested in savings accounts.”8 An untethered currency has allowed the U.S. to compromise its balance sheet, and, as a result, the dollar has lost 98% of its purchasing power since 1971. For those who prefer to measure the dollar’s purchasing power in terms of the Consumer Price Index (CPI), the story is the same:

Since 1947, the dollar has lost 93% of its purchasing power measured against the CPI. Using 1971 as our base, the dollar has lost 87%.

Why Precious Metals are a Better Alternative to Fiat Currencies

“The gold standard did not collapse. Governments abolished it in order to pave the way for inflation.”

-Ludwig von Mises, 1881-1973

America had used gold to value the U.S. dollar successfully for roughly 150 years before first devaluing and then eliminating its use in the twentieth century. The last 50 years of a fiat money system in America is actually a departure from the norm, and it is becoming more evident that this fiat money experiment has been a failure for everyone except the top few percent (who have benefited from inflating asset prices) and the U.S. government (who can pay back debt with a devalued dollar). Countries worldwide are in a solvency crisis and have currency devaluation as the only option.

As currencies continue to devalue, savers must look elsewhere. As mentioned previously, it is important to remember that gold possesses the qualities inherent in a reliable monetary medium. As a result, people have chosen to use gold as money for thousands of years. Thus, it is important to think about a different supply/demand dynamic: that of gold relative to fiat currency. To value gold as money, we compare the supply of fiat dollars to the gold stock.

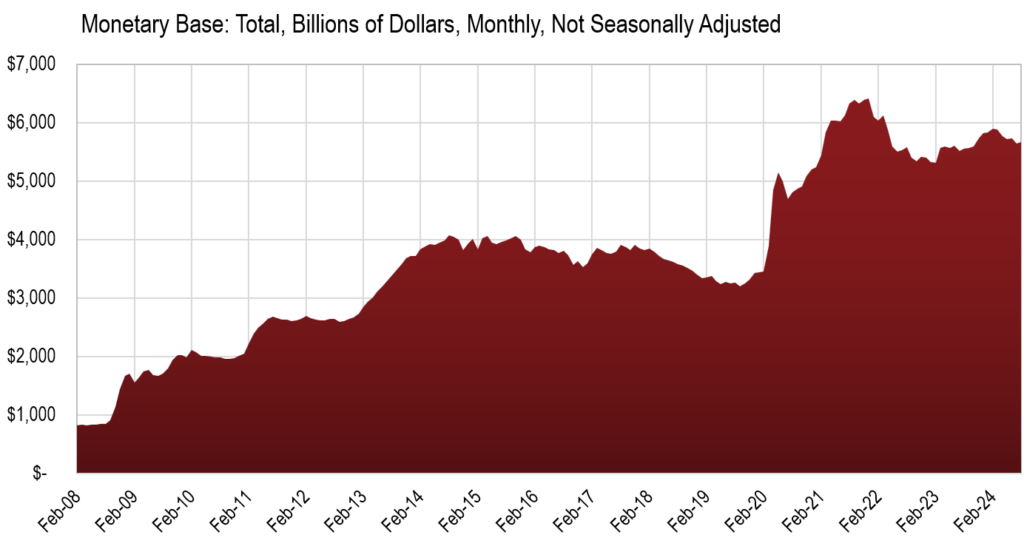

A simple chart says a thousand words…

Since 2008, the Fed has increased the U.S. money supply from $900 billion to $5.7 trillion (as of the end of June 2024). Today’s Fed balance sheet is more than 6 times as large as it was in 2008. This means that money supply has been growing at a 12% cost-adjusted growth rate for the past 16 years.

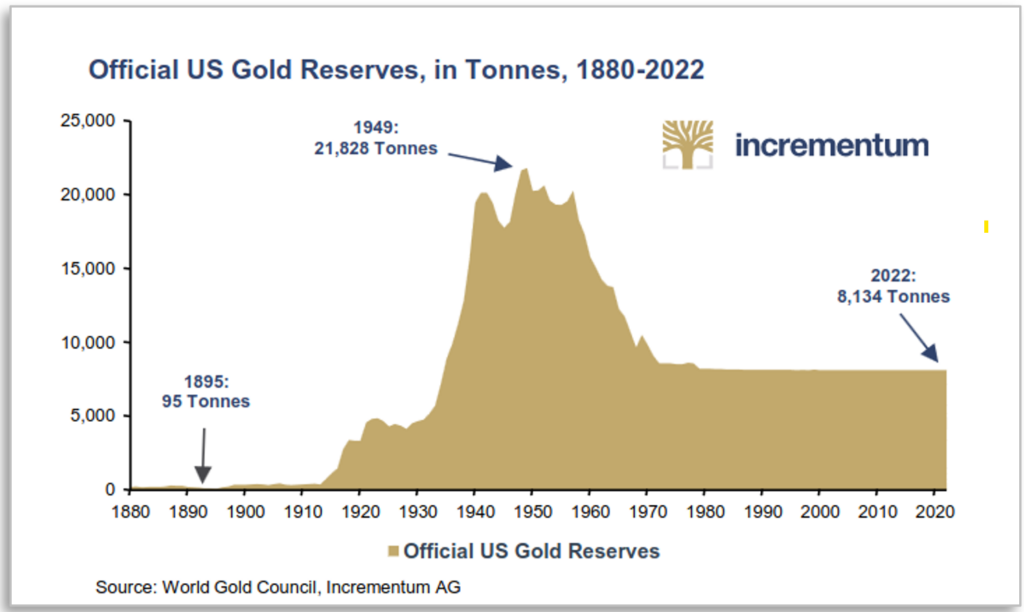

The amount of gold in the world changes by roughly 2% each year. The amount of gold stored in the U.S. Mint has not increased for many years. It has stayed constant at 8,000 tonnes, or 260 million ounces.

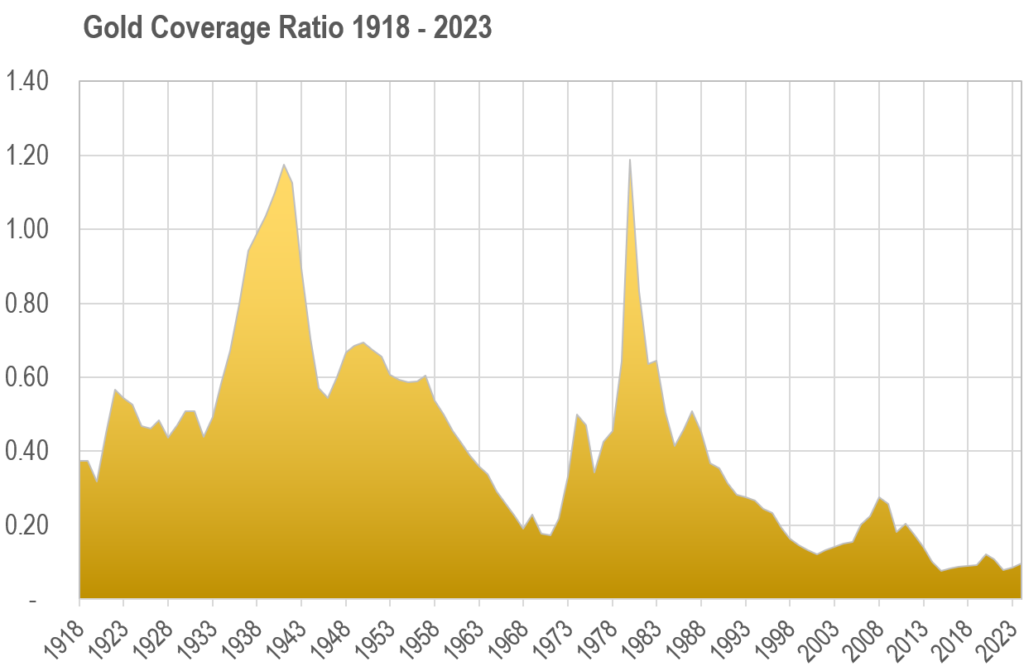

The chart below shows the ratio of U.S. gold holdings (in dollar terms) relative to M0. As we can see, the average gold coverage ratio is about 42%, vs a 2024 ratio of 10%. For this ratio to revert to more normal levels, either the money supply must drop dramatically (the probability of which is extremely low given the amount of debt in the U.S.) or the gold price must rise.

And while the case for owning gold is quite strong, it appears that the case for the other precious metals is even stronger. The gold-to-silver price ratio over the last 50 years has ranged from 16:1 to 90:1—currently, it is approximately 85:1, although its long-term average is 50:1. From a geological abundance perspective, there are 28 ounces of silver to every ounce of gold, much lower than the current market ratio of 85:1 (or even the historical average of 50:1) implies. We anticipate silver will trade at its long-term average gold-to-silver ratio of 50:1, implying an outperformance from current prices versus gold.

Additionally, platinum and palladium are trading well below what they should be, given the current supply deficit. Both metals are rarer than gold; each account for only 0.4ppb (parts per billion) of the earth’s crust. For every 100 ounces of gold, there are only 17 ounces of platinum and 17 ounces of palladium. While mine-level production has mostly remained stable over the last few years, ore grades continue to decline, and overall costs continue to increase. Processing has also been a challenge. The result has been significant supply deficits; with companies losing money at current prices, we would anticipate prices moving higher to incentivize new production.

Over the past 50 years, the gold-to-platinum ratio has ranged from 0.4:1 to 2.2:1; the palladium ratio has varied between 0.2:1 and 5.3:1. We anticipate that both metals will converge along the long-term platinum/gold average, which is 1:1.

How to invest?

We believe that it is prudent for everyone to hold some gold bullion and other precious metals as a safety net/rainy day fund.

While many market participants believe that intrinsic value is derived from cash flow, one of the key tenets of Kopernik is that it is the inverse: cash flows are derived from assets that are intrinsically valuable. A strong case can be made that metal prices will appreciate meaningfully over the long term.

Gold is now fully-priced as a commodity (something we discuss in more detail in our mining whitepaper), but still offers strong upside as a monetary asset. Silver, platinum, and palladium are still significantly undervalued relative to their incentive cost or production and price histories. Additionally, they have strong potential to gain further recognition as monetary metals. This possibility portends tremendous upside. For more on how and why the stocks of the companies that own these metals offer even more upside potential, please refer to our mining white paper, linked above.

The case is strong that every individual ought to have some exposure to precious metals in their portfolio.

As always, thank you for your support.

Kopernik Investment Research Team

October 2024

Postscript

There are times, like now, when investors become singularly focused on a couple economic data points when making their investment decisions. We have seen in years past that investors were willing to lose money because they were obsessed with the idea of certainty (in 2019 there were $17 trillion of negatively nominal yielding bonds worldwide); we have seen investors pile into the hot new technologies, driving up market caps of internet companies in the late 1990s, “blockchain” companies in the late 2010s, and AI companies today. Today we also witness investors’ fixation on any indicator that will confirm their “soft-landing” thesis. It is hard to believe that there was a time when investors were also singularly focused on the slightest suggestion of monetary growth. In the mid-1980s, the mere mention of increasing money supply caused bond investors to dump their holdings. Differently from today, the 1980s zeitgeist was one of fear of inflation.

With the Federal Reserve announcing that it is time to lower rates again, the market is cheering the death of inflation. Never mind the fact that inflation has been above the Fed’s targets for the last 44 months (and remains there). Never mind the fact that commodities have generally been down for the last year. And never mind that CPI doesn’t capture a lot of what most people care about (food, shelter, energy). We believe that a huge increase in the monetary base and an even bigger increase in circulating money (M1 and M2) will have an economic cost.

Important Information and Disclosures

The information presented herein is proprietary to Kopernik Global Investors, LLC. This material is not to be reproduced in whole or in part or used for any purpose except as authorized by Kopernik Global Investors, LLC (“Kopernik”). This material is for informational purposes only and should not be regarded as a recommendation or an offer to buy or sell any product or service to which this information may relate.

This letter may contain forward-looking statements. Use of words such was “believe”, “intend”, “expect”, anticipate”, “project”, “estimate”, “predict”, “is confident”, “has confidence” and similar expressions are intended to identify forward-looking statements. Forward-looking statements are not historical facts and are based on current observations, beliefs, assumptions, expectations, estimates, and projections. Forward-looking statements are not guarantees of future performance and are subject to risks, uncertainties and other factors, some of which are beyond our control and are difficult to predict. As a result, actual results could differ materially from those expressed, implied or forecasted in the forward-looking statements.

Please consider all risks carefully before investing. Investments discussed are subject to certain risks such as market, investment style, interest rate, deflation, and illiquidity risk. Investments in small and mid-capitalization companies also involve greater risk and portfolio price volatility than investments in larger capitalization stocks. Investing in non-U.S. markets, including emerging and frontier markets, involves certain additional risks, including potential currency fluctuations and controls, restrictions on foreign investments, less governmental supervision and regulation, less liquidity, less disclosure, and the potential for market volatility, expropriation, confiscatory taxation, and social, economic and political instability. Investments in energy and natural resources companies are especially affected by developments in the commodities markets, the supply of and demand for specific resources, raw materials, products and services, the price of oil and gas, exploration and production spending, government regulation, economic conditions, international political developments, energy conservation efforts and the success of exploration projects.

Investing involves risk, including possible loss of principal. There can be no assurance that a strategy will achieve its stated objectives. Equity funds are subject generally to market, market sector, market liquidity, issuer, and investment style risks, among other factors, to varying degrees, all of which are more fully described in the fund’s prospectus. Investments in foreign securities or commodities may underperform and may be more volatile than U.S. securities because of the risks involving foreign economies and markets, foreign political systems, foreign regulatory standards, foreign currencies and taxes. Investments in foreign and emerging markets present additional risks, such as increased volatility and lower trading volume.

The topics discussed in this piece should not be considered recommendations to purchase or sell a particular security or asset. It should not be assumed that securities or assets bought or sold in the future will be profitable or will equal the performance of the securities or assets in a Kopernik portfolio. Kopernik and its clients as well as its related persons may (but do not necessarily) have financial interests in securities, issuers, or assets that are discussed.

Commodities may be affected by changes in overall market movements, changes in interest rates, and other factors such as weather, disease, embargoes, or political and regulatory developments, such as trading activity of speculators and arbitrageurs in the commodities. Investing in commodities entails significant risk and is not appropriate for all investors.

- Statista, Gold Demand by Sector ↩︎

- Statista, Total Volume of Gold Shipped from Americas to Europe ↩︎

- James Rickards, Currency Wars: The Making of the Next Global Crisis (2012), 82. ↩︎

- James Rickards, Currency Wars, 84. ↩︎

- Jim Grant, “A Piece of My Mind,” Speech given to the New York Federal Reserve, 2012. ↩︎

- The Silver Institute, “Fabrication Demand Drivers for Silver in the Industrial, Jewelry, and Silverware Sectors Through 2033,” Oxford Economics, November 2023. ↩︎

- David Morgan and Chris Marchese, The Morgan Report: The Silver Manifesto (2015), 124. ↩︎

- David Pietrusza, “With the Dollar in Turmoil, Two Debates on Gold Captivate Manhattan,” New York Sun, May 6, 2011. ↩︎