Managing Geopolitical Risk in a Global Portfolio (July 2022)

A discussion on Kopernik’s definition and evaluation of geopolitical risk, and the opportunity it provides.

Evaluating geopolitical risk in a global pandemic is difficult enough, but Russia’s invasion of Ukraine has thrown another wrench into an increasingly complex and connected world. It goes without saying that Kopernik condemns the violence in Ukraine and hopes for a peaceful resolution to this tragic situation. We do not approve of most military actions, and we wish the circumstances were different. We cannot control governments and their decisions, however misguided we may believe them to be, and so we focus on what we do have the power to control: serving our clients and fulfilling our fiduciary responsibility.

Global crises have made our role as the investment manager more crucial than ever, and our mission of being independent thought leaders could not be more pertinent. Kopernik’s team has a long history of maintaining composure in times of panic and steadily analyzing the facts of a situation before making any critical decisions. We take the responsibility of managing people’s money and their life savings seriously. Our role is too important to allow ourselves to be swept away by the emotions of the masses.

Evaluating geopolitical risk has always been a key factor in our global investment process. Our aim here is to break down this process and provide examples of these successes, while openly discussing our losses in a way that gives you a transparent look into our investment philosophy.

What is Risk?

First, it’s important to understand how Kopernik defines risk. Most of the investment industry defines risk as some form of volatility – or the magnitude of swings in the overall prices of assets. But we believe a true measurement of risk – one that people actually care about – is the prospect of a permanent loss of capital or purchasing power. Overpriced markets make this almost an inevitability.

The years surrounding the Great Depression offer a perfect example. In 1929, people who believed that the United States was going to have a great century were more right than they could have imagined. The 90 years that followed were probably the best fiscal years of any country in modern history. Yet investors should also remember that the Dow fell a devastating 90% in the three years following the 1929 crash. Not including dividends, it took nearly 20 years for investors to make up for their losses. There have been many times over the past 50 years when buying grossly overpriced assets did not treat investors well—and these were particularly devastating drops for investors who decided the markets were too risky after the drop and sold. As the old saying goes, price is everything.

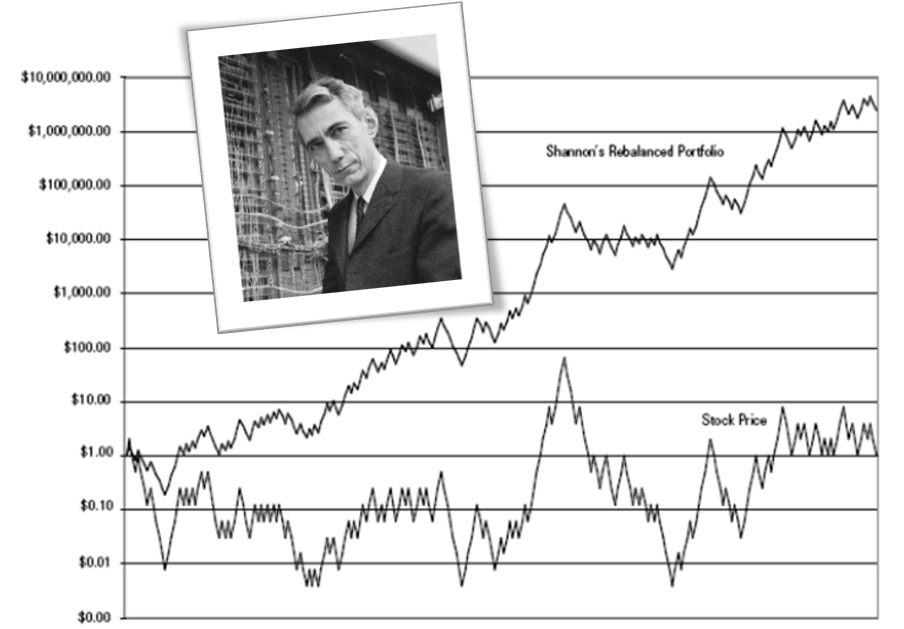

If price is everything, volatility can only be seen as opportunity. According to Fortune’s Formula by William Poundstone, mathematical genius Claude Shannon outlines a scenario in which an investor puts 50% of their money in cash, and 50% into a stock. Each day the investor rebalances the portfolio, trimming the stock when it goes up and buying more when the stock goes down. In the scenario where the stock price is volatile but ultimately stays flat, a buy and hold investor would have no profit at all, while the rebalanced portfolio would have made significant profit.

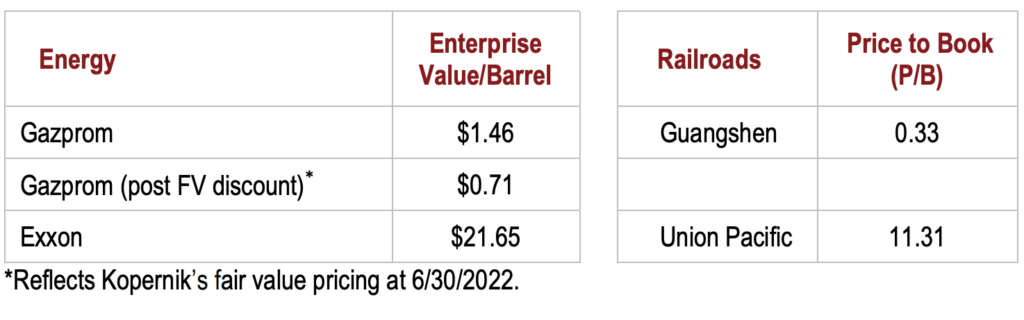

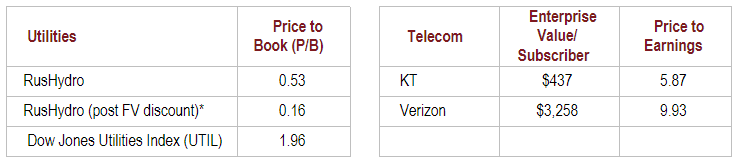

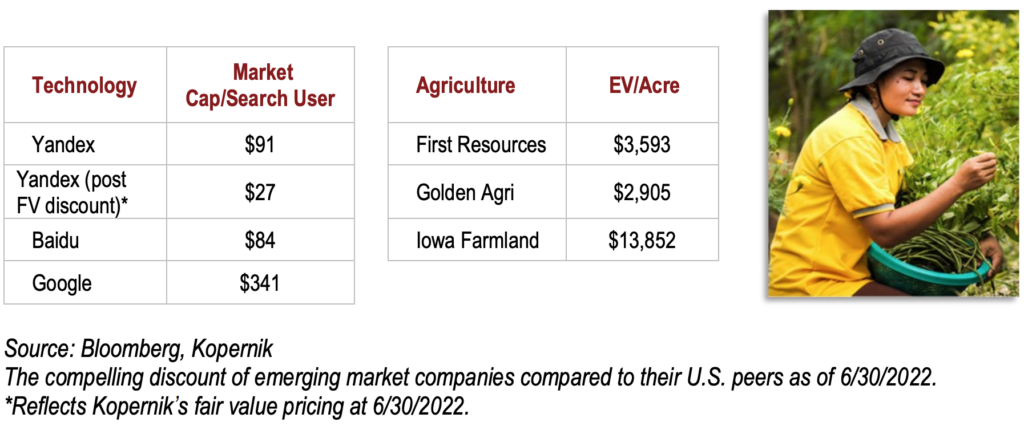

This leads us to our next point. The United States, while a fantastic country with fantastic businesses, has for a while been one of the most expensive major markets in the history of the world. Emerging markets, while typically more volatile due to geopolitical factors, are incredibly well priced. Therefore, it is our belief that examining opportunities in emerging markets is not just an opportunity, but a requirement for those who want to invest intelligently.

Managing the unique risks of emerging markets is a matter of being observant watchers of the world, while understanding history and the importance of owning quality companies—while price is paramount, all of these are key factors in how we evaluate our investments.

Emerging Markets: Wins and Losses

So what are the risks of investing in emerging markets? While it is impossible to account for them all, rule of law and property rights, government corruption, infrastructure issues and issues surrounding labor forces, and currency devaluation are common. However, it’s worth mentioning that these issues aren’t isolated to emerging markets—geopolitical risks are present in every country, every region, and thus every business, but certainly vary substantially region-to-region, regime-to-regime, and geography-to-geography. Managing these risks is not black and white, and Kopernik evaluates each company on a case-by-case basis. Mitigating risk for us means focusing on price, in addition to quality, and only purchasing when a company’s valuation is trading below its risk-adjusted intrinsic value as determined by Kopernik, and utilizing diversification across our portfolio.

Representative examples of this idea can be found in our experience in the mining sector. Mining companies are prone to many of the risks we outline—they are particularly captive to regulation, since they can’t simply move their mine, and many extraction businesses are common targets for governments due to their high profit potential. We often hear investors say that they will only invest in “safe” jurisdictions. When investors say a country is “uninvestable,” this is music to our ears. We have made significant returns for our clients owning miners in the Democratic Republic of Congo (DRC), South Africa, Papua New Guinea, and Russia because investors refused to own companies operating in these regions at any price.

Of course, sometimes these geopolitical risks do come to fruition. We expect that not all of our investments will work out. Demanding a significant margin of safety and diversification helps us mitigate those risks. Centerra was a larger mining position for us in the past, and just last year, the Kyrgyz government expropriated the company’s best mine. Due to this, the upside is not nearly as large. However, while this was happening, Ivanhoe and Impala were outperforming by a sizeable amount, as geopolitical outcomes have been much more favorable in South Africa, Zimbabwe, and the DRC. Similarly, there were issues with Rio Tinto, Turquoise Hill, and the Mongolian government. In 2020, Turquoise Hill was hurting portfolio performance, while investments in Russia were performing well. Now it is up almost eight-fold since its troubles in 2020, while Polyus in Russia is down, obviously on the events in Ukraine. Diversification from a portfolio view is absolutely crucial. Similarly, Gazprom is down while its natural gas brethren in Canada and the States have bounced strongly from 2020’s fear-driven lows.

This process has helped us deliver good returns to investors outside of the mining industry as well. One example is Eletrobras, Brazil’s dominant electric utility. 90% of its assets are highly desirable hydroelectric dams and the company controls one half of the country’s transmission capacity. In 2012, Brazil cut the rates to Eletrobras by a third, to the point where Eletrobras was losing money. Eletrobras’ balance sheet was already weak, and the rate cuts forced it to borrow even more debt to fund its operations. Worse, in 2015 an investigation found that money was being siphoned off as one of their nuclear projects was being built. The stock fell 90% from its high.

Foreign investors quickly pulled out and the stock price fell to a low of $1.20. Meanwhile, risk adjusted, we valued the company closer to $20 a share. Thus, the market was pricing this company at a 98% discount to our estimate of theoretical value. The Global-All Cap portfolio held a 4% position in this stock at this time, because we felt that investors were only looking at the bad news, and lost sight of the fact that the company was a monopoly provider of electricity in a fast-growing part of the world. When Brazilian president Dilma Rousseff was impeached, the stock rose seven-fold. As the Eletrobras example demonstrates, investors’ reactions to geopolitical events can result in extreme inefficiencies in the market. Here again, while Eletrobras faced challenges, our French utility rose. Subsequently, Electrobras has rebounded, while our Korean utility has suffered from harmful government policy. Investors who have a long-term investment horizon and rely on independent thought and analysis can use the volatility that comes from uncertain geopolitics opportunistically.

Investing in Russia

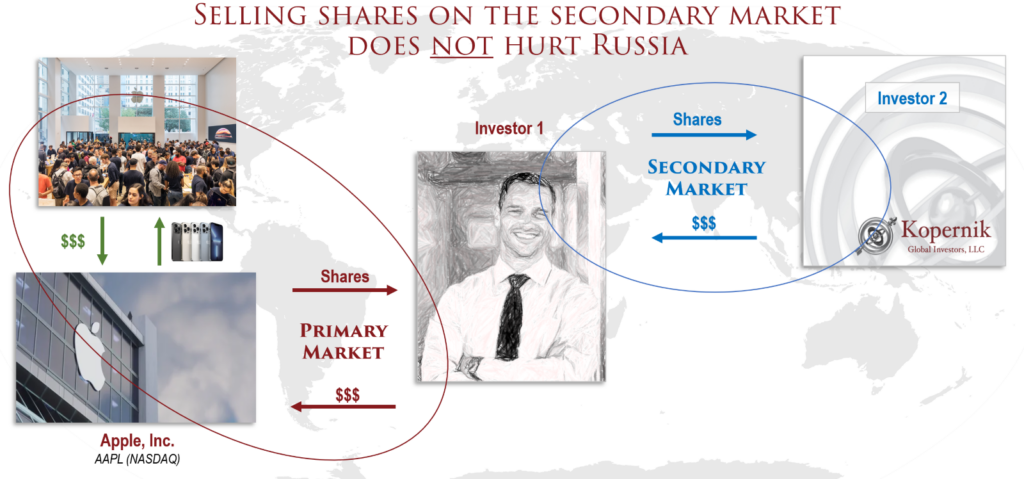

It’s impossible to discuss geopolitical risk without delving into the continuing situation in Ukraine, and why we believe that divesting from Russian stocks at this time makes little moral or investment sense. Many believe that by divesting, investors are voting with their money and showing their disapproval. Thus, many investors say they will sell their Russian holdings when the market fully reopens. Unfortunately, while we wish it could have an impact, divesting doesn’t actually change the situation. Selling Russian stocks does not stop the invasion into Ukraine just as the ESG (Environment, Social and Governance) push to divest from oil companies did not reduce demand for oil. A common misunderstanding is the idea that buying or selling Russian stocks on the secondary market can help or hurt Russia. It is important to remember that when an investor buys on the secondary market the proceeds do not go to the Russian government or Russian companies, but rather to the seller of the stock, whoever that is.

Who wins if we sell the shares at 5 cents on the dollar? Of course, the investor buying valuable assets at a 95% discount wins, while our investors across the globe lose. Moreover, if the Russian government is the buyer, then selling the stock would actually be helping the Russian government. It is important to note that the governments of both Russia and China have suggested that they are eager to be the buyers, if and when investors panic out of shares at fire-sale prices.

When we buy Russian businesses (or businesses in any country for that matter), we distinguish between investing in the Russian government and investing in the people, culture, assets, and franchises of Russia. When we invest in RusHydro, we aren’t investing in the Russian government, we are owning a fractional interest in hydroelectric dams that provide cheap, clean, carbon-free energy to millions of people. When we invest in LSR and Etalon, we are buying companies that are building modern homes, allowing people to move out of depressing Soviet era structures. When we buy Sberbank, we are investing in a company that provides banking services to 100 million people and helping people afford those new homes. When we invest in Gazprom, we are investing in a natural gas company that heats homes, that keeps lights on in many countries around the world. The world simply cannot yet survive without Russian gas.

Kopernik’s Philosophy

We are not strangers to the risks of investing globally. Avoiding risk is impossible, whether we are investing in emerging markets as discussed in this whitepaper or in developed markets like the United States and Canada. Investors should demand to be overcompensated for taking the risk and diversify, thereby enabling positive investment outcomes to much more than offset the ill-fated ones. Kopernik will continue to play the role of the trusted investor and fiduciary, using our experience and independent thought to research and pick companies that truly have the ability to provide significant returns for our investors. Thank you for your continued support.

Kopernik Global Investors

Investment Research Team

July 2022

Important Information and Disclosures

The information presented herein is proprietary to Kopernik Global Investors, LLC. This material is not to be reproduced in whole or in part or used for any purpose except as authorized by Kopernik Global Investors, LLC. This material is for informational purposes only and should not be regarded as a recommendation or an offer to buy or sell any product or service to which this information may relate.

This letter may contain forward-looking statements. Use of words such was “believe”, “intend”, “expect”, anticipate”, “project”, “estimate”, “predict”, “is confident”, “has confidence” and similar expressions are intended to identify forward-looking statements. Forward-looking statements are not historical facts and are based on current observations, beliefs, assumptions, expectations, estimates, and projections. Forward-looking statements are not guarantees of future performance and are subject to risks, uncertainties and other factors, some of which are beyond our control and are difficult to predict. As a result, actual results could differ materially from those expressed, implied or forecasted in the forward-looking statements.

Please consider all risks carefully before investing. Investing involves risk, including possible loss of principal. Investments in a Kopernik strategy are subject to certain risks such as market, investment style, interest rate, deflation, and illiquidity risk. Investments in small and mid-capitalization companies also involve greater risk and portfolio price volatility than investments in larger capitalization stocks. Investing in non-U.S. markets, including emerging and frontier markets, involves certain additional risks, including potential currency fluctuations and controls, restrictions and sanctions on foreign investments, less governmental supervision and regulation, less liquidity, less disclosure, and the potential for market volatility, expropriation, confiscatory taxation, and social, economic and political instability. Investments in energy and natural resources companies are especially affected by developments in the commodities markets, the supply of and demand for specific resources, raw materials, products and services, the price of oil and gas, exploration and production spending, government regulation, economic conditions, international political developments, energy conservation efforts and the success of exploration projects.

The holdings discussed in this piece should not be considered recommendations to purchase or sell a particular security. It should not be assumed that securities bought or sold in the future will be profitable or will equal the performance of the securities in this portfolio. Current and future portfolio holdings are subject to risk.