Rivers of Babylon (Jan 2025)

During a recent podcast interview with Grant Williams, he asked me a series of questions about value investing: where does the necessary patience come from? Are people born with the requisite skepticism? How does one handle the extreme discomfort that often goes hand-in-hand with owning unpopular stocks? I love thought-provoking questions. In my most recent commentary, Queen Hatshepsut, we discussed how stories change; how people seem to have forgotten the story of “value” and of cycles, in general. In this commentary, we pivot from Egypt to Babylon, simultaneously leaping forward 900 years to the mid-500s B.C. (It is only an illusion that was the last time value investing had a good year 😊). Here we’ll tackle why now is likely the time for value investing to return to its former glory, how one might look for value in the midst of a momentum-based mania of historic magnitude, and the importance of a system of values to underpin financial markets and empires alike.

The Rivers of Babylon is a song by the reggae group The Melodians, released in 1970. It became well-known with its inclusion in the movie The Harder They Come, in 1972. It was re-popularized in 1978 when it was covered by Boney M. The words are based on the book of Psalms, particularly 137, verses 1 – 4.

Per Wikipedia, the psalm forms a regular part of liturgy in Jewish, Eastern Orthodox, Catholic, Lutheran, Anglican and other Protestant traditions. “It is a hymn expressing the lamentations of the Jewish people in exile following the Babylonian conquest of Jerusalem in 586 BC: Previously the Kingdom of Israel, after being united under Kings David and Solomon, had been split in two, with the Kingdom of Israel in the north, conquered by the Assyrians in 722 BC which caused the dispersion of 10 of the 12 tribes of Israel. The southern Kingdom of Judah (hence the name Jews), home of the tribe of Judah and part of the tribes of Levi and Benjamin, was free from foreign domination until the Babylonian conquest to which Rivers of Babylon refers.“

The namesake rivers of Babylon (in present-day Iraq) are the Tigris and Euphrates rivers. The song also has words from Psalm 19:14:

The lyrics, which were changed, in part, from the Bible to appeal to a Rastafarian audience, are here:

By the rivers of Babylon

Where he sat down

And there he wept

When he remembered Zion

Oh, the wicked carried us away in captivity

Required from us a song

How can we sing King Alpha’s song

In a strange land?

So let the words of our mouth

And the meditation of our heart

Be acceptable in Thy sight

Oh, verai!

This, now dated, song seems relevant today with the current turmoil in the Middle East, and protests and conflicts seemingly elsewhere, too. If you are getting nervous that we’re about to delve into the politics of the region, fear not, we have no intention of going there. While the lyrics address an admittedly more important subject (the woe and oppression of subjugated peoples) our story is about empires, and the lack of permanence thereof. To that end, we turn to the great ruler of Babylon, Nebuchadnezzar II.

Wikipedia informs us that “Nebuchadnezzar II, was the second king of the Neo-Babylonian Empire, ruling from the death of his father Nabopolassar in 605 BC to his own death in 562 BC. Historically known as Nebuchadnezzar the Great, he is typically regarded as the empire’s greatest king. Nebuchadnezzar remains famous for his military campaigns in the Levant, for his construction projects in his capital, Babylon, including the Hanging Gardens of Babylon, and for the role he plays in Jewish history. Ruling for 43 years, Nebuchadnezzar was the longest-reigning king of the Babylonian dynasty. By the time of his death, he was among the most powerful rulers in the world.“

Our continuing journey leads us from Wikipedia to the book of Daniel. “According to the Hebrew Bible, Daniel was a noble Jewish youth of Jerusalem taken into captivity by Nebuchadnezzar II of Babylon, serving the king and his successors with loyalty and ability until the time of the Persian conqueror Cyrus, all the while remaining true to the God of Israel. While some conservative scholars hold that Daniel existed and his book was written in the 6th century BCE, most scholars agree that Daniel is not a historical figure and that much of the book is a cryptic allusion to the reign of the 2nd century BCE Hellenistic king Antiochus IV Epiphanes.”

The book informs us that Nebuchadnezzar had some troubling dreams and wanted interpreters. Where everyone else failed, Daniel was able to tell him his dream and then interpret it. “You saw, O king, and behold, a great image. This image, mighty and of exceeding brightness, stood before you, and its appearance was frightening. The head of this image was of fine gold, its chest and arms of silver, its middle and thighs of bronze, its legs of iron, its feet partly of iron and partly of clay” (Editor’s note: the proverbial feet of clay). Now, you are correct to suspect that we’ll be coming back to gold, silver, copper, and iron, but first let’s try to glean a couple more important messages from the story. Let’s begin with the feet of clay. It couldn’t have been easy telling the mighty king that his kingdom was on the verge of collapse.

Daniel continued, “As you looked, a stone was cut out by no human hand, and it struck the image on its feet of iron and clay, and broke them in pieces. Then the iron, the clay, the bronze, the silver, and the gold, all together were broken in pieces, and became like the chaff of the summer threshing floors; and the wind carried them away, so that not a trace of them could be found.” He says the statue symbolizes a sequence of kingdoms, with Babylon as the head. Silver represents a subsequent, but lesser kingdom; bronze a third kingdom, lesser still. The feet of iron and clay represent future kingdoms that are lesser and fragmented.

Daniel was correct about the fall of Babylon, which fell to the Assyrians (The chest of silver?), while Nebuchadnezzar’s sons/grandsons were in power. Soon thereafter, Assyria began to decay. Over the course of history, we’ve witnessed the falls of mighty empires: Assyria, Persia, Syria, Macedonia, Greece, Egypt, Rome, Spain, Portugal, France, England, USSR, etc, etc.

“History doesn’t repeat itself, but it does rhyme.”

As the saying goes, mighty Babylon fell slowly, and then quickly, as the Medes and Persians overran the city in a night attack in 539 BC. But that was a long time ago. Is there a message here for the modern world?

The modern-day world is a thing to behold. Never has there been anything close to the wealth, knowledge, military might, corporate power, technological prowess, and economic strength that we see now. And AI, many believe, will bound us forward toward nirvana. We’ll avoid a conversation as to whether these things are more evidence of utopia or dystopia; certainly there are many elements of both. While Babylon is used here, it is one of thousands of tales warning against hubris and of how in the cyclical world, the mighty rise and eventually fall. Put on your podiatrist hat and let’s look at feet of clay.

China seems to be an excellent place to start. It is a strong country, steeped in education and rich in culture. A dozen years ago everyone feared its power, believing that the economy was poised to surpass that of the USA over the ensuing decade. While this didn’t come close to happening, the country has many strengths, and the West clearly fears it greatly. But this colossal economy seems to have been built upon a foundation of debt (i.e. feet of clay). Their debt has grown, over the past quarter-century, from $1.4 trillion (127% of GDP) to $58 trillion (320% of GDP). The provinces have $14 trillion (76% of GDP). They are struggling to prevent a collapse of their real estate market, and their stock market fell 21% over a lengthy 17-year period (Oct 2007 thru Sep 23, 2024), even as the GDP grew almost six-fold from early ’07 through ’23 (growing further 5% during ’24 [estimated]).

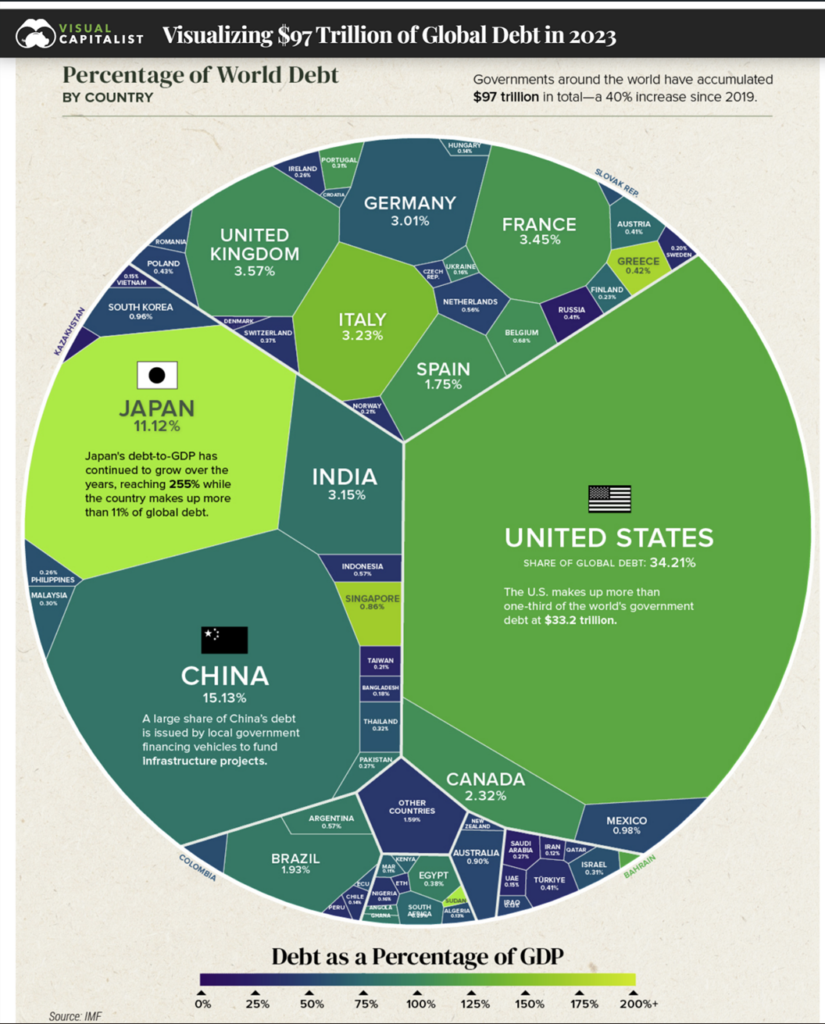

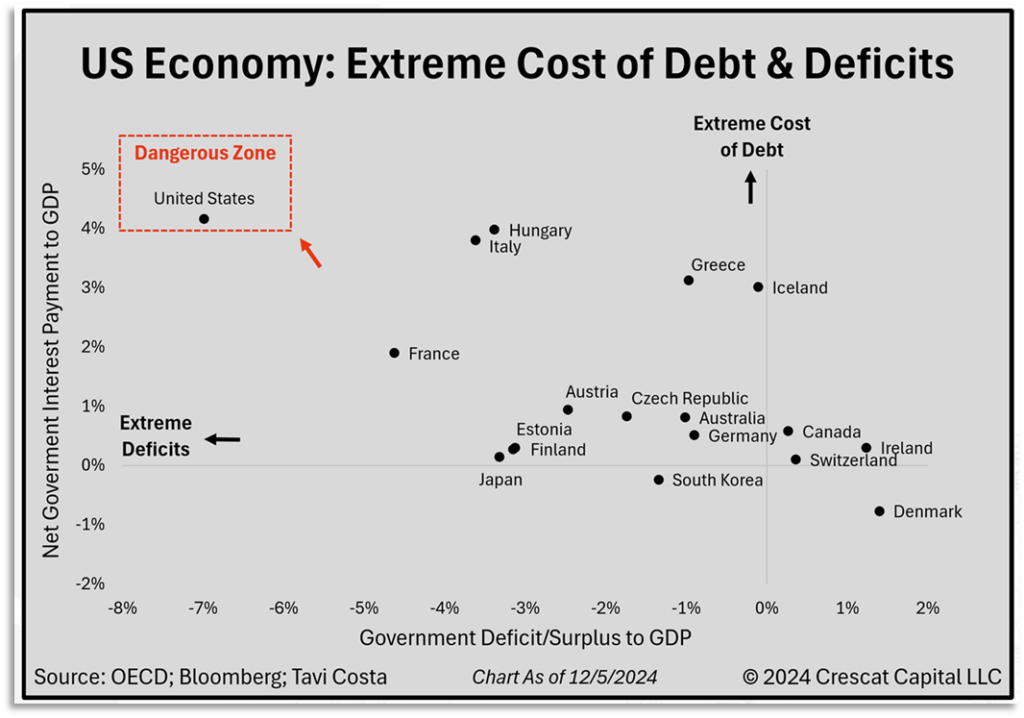

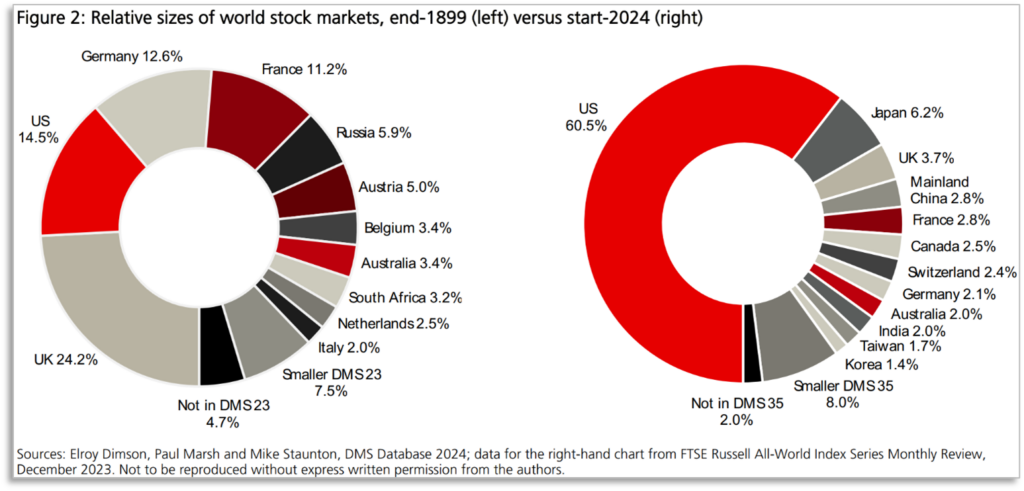

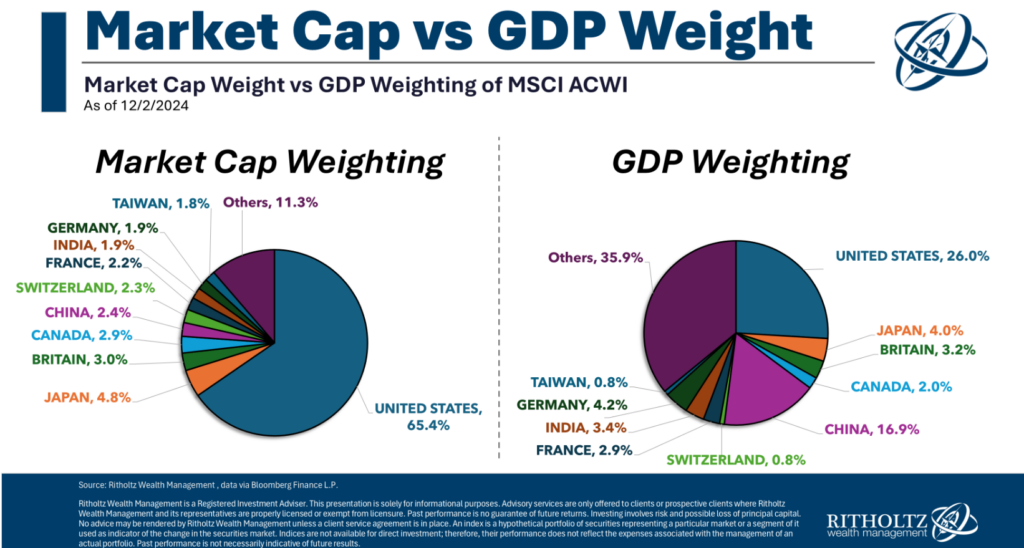

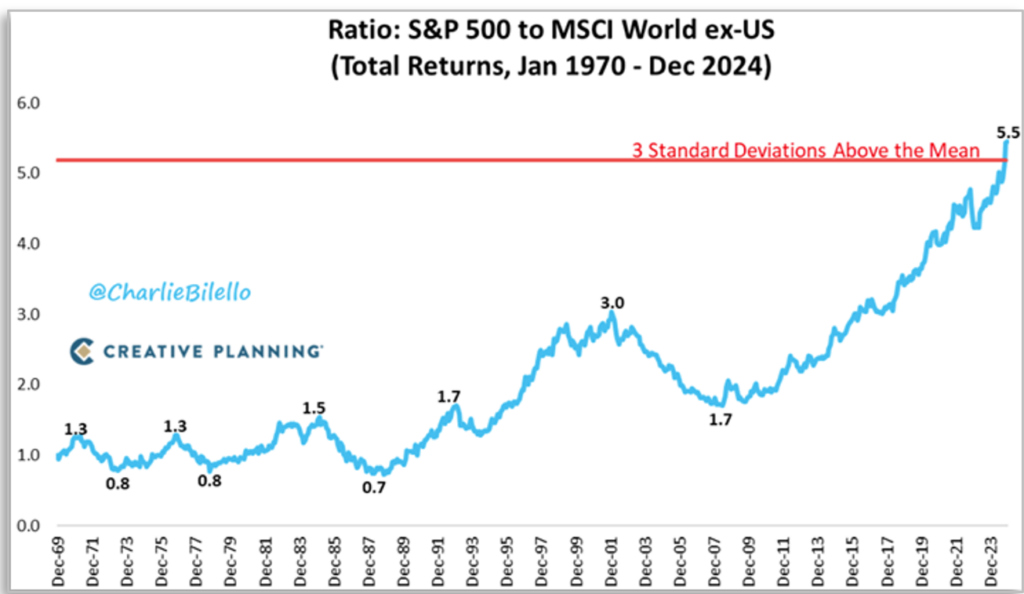

In 1989, Japan was starting to be viewed as having Babylonian economic might. It dominated many businesses: automobiles, TVs and consumer electronics, computers and semiconductors, and finance. The Japanese were buying iconic American properties and their equity and real estate markets reached stunning levels (valued on par with the rest of the world combined). This economic miracle also was built upon a foundation of debt, eventually leading to a collapse over the subsequent quarter-century. But the greatest empire in the history of the world is, arguably, the United States of America. It has had the largest economy in the world consistently since 1890. It has the most awe-inspiring military complex ever imagined. Famed for creativity and entrepreneurship, its industrial, military, and technology companies dominate the world. Its language has become the go to language across the world. And the size of its financial markets has become breathtakingly large. Its economy is about 1/5 of the entire world’s economy. Pretty impressive. Still more impressive, its equity markets are now $63 trillion, or as much as the rest of the world put together. For indexers, the U.S. is worth three times more than the rest of the world put together (75% of the MSCI World index). Keep in mind that equity is subordinate to debt and the U.S. account for a third of the world’s sovereign debt. This does not account for the massive consumer and corporate debt burden.

The U.S. share of private equity, private credit, real estate, venture capital, and crypto currency would be interesting to know, but this missive is long enough already. They clearly add up to a large number. There is an enormous burden that the U.S.’s powerful economy needs to support.

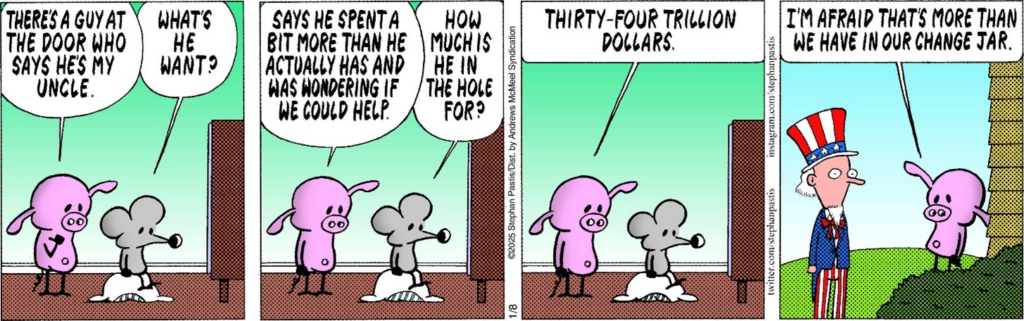

The past several centuries have been a miracle for the U.S. I have been truly blessed to have spent my entire life in the U.S. I love this country and am grateful, yet one can’t help but be concerned that this miracle too is built upon a foundation of debt. Will the high level of debt and deficits prove to be no problem or to be clay-footing? The strength of the economy now is seemly dependent on government spending; spending, in fact, $2 trillion more than it takes in. This stimulates the economy while tacking $2 trillion annually on to a debt that is already $36 trillion. This amounts to a disturbing 125% of GDP. Yet everyone seems to have such confidence in the system. They believe that trillions of dollars can be conjured into existence annually with no inflationary consequences. They believe that good things last forever and surreal things are the norm. They believe that empires never fall.

“By the rivers of Babylon, there we sat down, yea, we wept, when we remembered Zion.

We hanged our harps upon the willows in the midst thereof.”

– Psalm 137

It was surprising to see how many musicians have covered Psalm 137’s account of the fall of the Kingdom of Judah. I recently was able to see Don McLean perform live, more than 50 years after he struck it big with the song American Pie. Many will also know his amazing song Vincent. Interestingly, he also has a song based on this psalm called the Waters of Babylon. The words are, of course, basically the same, though tweaked a bit. He gets the audience to sing in a three-part round. Returning to his big hit, it is about the tragic crash of the airplane carrying Buddy Holly, Richie Valens, and “The Big Bopper,” J.P. Richardson. The date was February 3, 1959, in McLean’s view, that “the music died.”

Learning from history, and combining with song, and, of course, looking for rhymes that may extend into the future, could it be said that March 23, 2020 was “the date the ethos died?” The ethos being the American entrepreneurial spirit, and March 23, 2020, being the date that the central bank and government decided to provide unlimited liquidity, primarily to those chosen by the government. In a score for big donors, several trillion were given to Blackrock who provided money to funds that buy the bonds of large corporations, giving them much lower interest rates than their smaller brethren were able to secure. Obviously, this was a huge competitive advantage. This was all in conjunction with ordering most businesses to lock down, effectively putting most of them out of business. The big got bigger. If the commonly held belief that America has prospered due to small businesses is true, this new dynamic may not be as wonderful as many believe. Certainly, the dominant Titans of our corporatocracy are “Babylonian” in terms of their power and wealth. In our title song, it is interesting to note that the Rastafarians use Babylon as representative of an unjust political system. If the current corporate empire has feet of clay, it is not readily apparent. We don’t discount the possibility that they will be around for a very long time. They had better stay very strong and prosperous or the market will be disappointed.

To reiterate, we believe that the USA will be prosperous long after we are gone. Rome was in a state of rapid moral decline after Augustus passed, and the empire endured for almost 5 centuries more. So, while we in no way question the USA or the Western powers, we do question the current valuations of the financial markets, which are the highest in history based upon almost any imaginable metric. And more importantly, if a debasement is underway, how should investors protect their purchasing power and hopefully prosper in the process? We’ll touch on some ideas shortly, but first we’ll see if we can glean any messages for value investors (an increasingly scarce lot) from the book of Daniel.

“Whenever destroyers appear among men, they start by destroying money,

for money is men’s protection and the base of a moral existence.”

– Ayn Rand, Atlas Shrugged

How should investors cope? Joining the party seems to be the answer from almost all corners. It is a mighty trying time for those who think that value still matters. For those few, let’s return to Daniel’s story. His Kingdom of Judah was sacked, and he was captured and brought to Babylon. That kingdom was mighty, the economy was booming, the parties were raging. The pressure to assimilate was immense. But could it be that Daniel had the DNA of a value investor? 😊

The king told Ashpenaz, his chief chamberlain, to bring in some of the Israelites, some of the royal line and of the nobility. They should be young men without any defect, handsome, proficient in wisdom, well informed, and insightful, such as could take their place in the king’s palace; he was to teach them the language and literature of the Chaldeans. The king allotted them a daily portion of food and wine from the royal table. After three years’ training they were to enter the king’s service. Among these were Judeans, Daniel, Hananiah, Mishael, and Azariah. But Daniel was resolved not to defile himself with the king’s food or wine; so he begged the chief chamberlain to spare him this defilement. Though God had given Daniel the favor and sympathy of the chief chamberlain, he said to Daniel, “I am afraid of my lord the king, who allotted your food and drink. If he sees that you look thinner in comparison to the other young men of your age, you will endanger my life with the king.” Then Daniel said to the guardian whom the chief chamberlain had put in charge of Daniel, Hananiah, Mishael, and Azariah, “Please test your servants for ten days. Let us be given vegetables to eat and water to drink. Then see how we look in comparison with the other young men who eat from the royal table and treat your servants according to what you see.” He agreed to this request and tested them for ten days; after ten days they looked healthier and better fed than any of the young men who ate from the royal table. So, the steward continued to take away the food and wine they were to receive, and gave them vegetables. (Daniel 1: 3-17).

While modern day value investors have to put up with derision and some stress, that is easily put into perspective when put next to the trials of Daniel and his friends. They were tossed into an inferno and later in with hungry lions.

“How can we sing King Alpha song in a strange land?

Sing it out loud”

Contemporary active managers must feel like they’ve arrived in a strange land. They must feel the immense pressure to join the raging party. They must feel scorn from the vast majority who long ago came to terms with the futility of strenuously doing fundamental research when easy money is made from trend following, from “hodling,” from price agnostic FOMO-based investment.

Fortunately, we all know that “this too shall pass.” Manias always do. Daniel is one of a plethora of stories that put things into perspective – that our trials are trivial in the grand scheme of things. Having momentarily arrived in this surreal investment arena, it is important that investors stay true to their value system. Kopernik has and fully intends to.

“It just does not seem right to me, that investing should be the only occupation in the world,

where without work, you should yield better results than the man who dedicates his life to it.

Secondly, investing while ignoring fundamentals of the businesses and allocating money just

based on popularity is totally opposite to my understanding of capitalism”

– Axel Krohne

Kopernik believes strongly that fundamental research is paramount and that managers have a fiduciary obligation to undertake it before investing one cent of their client’s money. Our friend Axel Krohne phrases it about as well as we’ve seen it in the quote above. How can this be the only field where hard work, experience, knowledge, dedication, and due diligence are counterproductive?

We believe that price matters immensely. There is a price for everything, no matter how good or bad. The price of entry is a main factor in the returns generated. We believe that integrity is the most important trait of all. We pledge to always do the research and the valuation work, vet and risk-adjust before investing your money. It admittedly makes us feel proud as we are often told that we are one of the few value-focused firms that hasn’t style drifted, and we promise not to. We understand why most do, the pressure is immense. Graham & Dodd discussed in the early 1930s how during the mania of the 1920s, fundamental analysis was not only unhelpful, it was detrimental to one’s career since it would deter one from investing in the overpriced stocks that one must own to not get fired. Certainly, the same dynamics played out in the early ‘70’s and the late ‘90s. It is back in spades at the moment.

Before moving on, we take heed of the fact that there are laws that govern the universe: things that are too high will fall; debt levels that can’t be handled will encounter economic loss; arrogant behavior by empires, governments, corporations, and financial systems will have higher vulnerability to comeuppance. While empires can last for centuries, manias cannot. Caveat Emptor. While it is tempting to “hang our harp” and it is hard to “sing in a strange land’” in which we now find ourselves, we believe that managers have an obligation to “sing it out loud.” There is no more important time to do so than during the height of a mania. We will continue to intone the message. Portfolios are at perils but, fortunately, the flip side of the coin is that assets that are undervalued usually eventually approach their intrinsic value and those that are useful, needed, and scarce will hold their value, rising in conjunction with the diminishing value of proliferating fiat currencies. Where should investors take refuge?

Investment strategy

“Successful investing is anticipating the anticipations of others.”

– John Maynard Keynes

Kopernik disagrees with Keynes’s premise, although it clearly captures the zeitgeist of investors as we enter the second quarter of the 21st century. We believe that in investing, as in life, it is important to adhere to one’s own set of values rather than the perceived values of the investment crowd. When many others blindly follow the herd, it is the most dangerous time to do so—but also the most lucrative time to be a fundamentals-based investor. With that in mind, we resume our narrative.

Returning to Daniel’s interpretation of the dream, he mentioned the head of fine gold, and shoulder and arms of silver, middle and thighs of bronze, and legs of iron. He was talking about the rise and fall of empires, about the diminishment of strength. A commonly held understanding is that one of the main factors contributing to the decay of empires is the waning of sound core values, which manifest themselves in fiscal profligacy and the concurrent debasement of money. How much longer can the dollar maintain its role as the “cleanest dirty shirt” in the currency arena?

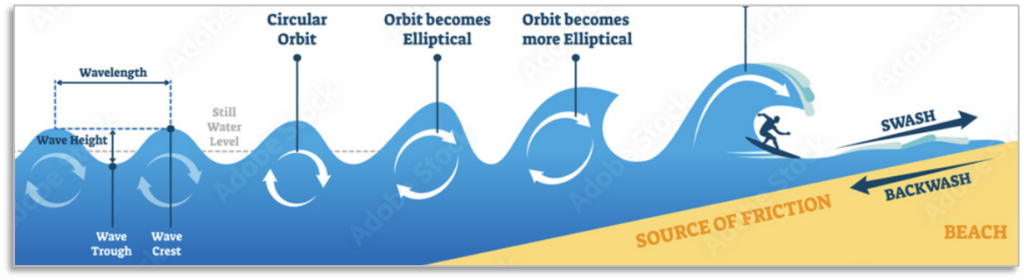

Whether currency debasement debases society, or a debased society tolerates currency debasement, is a “chicken or egg” question that we’ll leave to the philosophers to sort out. Importantly, history shows that they do tend to be joined at the hip. Investors should be cognizant of two points. First, as countries and financial systems decay, over time and from within, the creditworthiness of the system often still looks good to those not “looking under the hood.” Secondly, the torrent of money inevitably printed is not neutral, eventually figuratively migrating from gold to silver to copper, to iron, to a whole host of other things. It does so at different times and different rates. We’ve spent the past four years flooding you with discussions of Richard Cantillon’s analogy of money surging through a river. Get ready for a change of venue, as we leave the river Euphrates for the Cantillon river, once again.

Firstly, since water is obviously a metaphor for money, let’s start by locating the money. Clearly, it is in the United States. As discussed, the U.S. has some stellar attributes and likely will continue to be dominant for many years to come. The world is a large place and there are other special places out there, once great empires and up-and-coming forces to be reckoned with. Perhaps some of them have more to offer than FOMO-focused investors recognize. It’s worth a look.

One and a quarter centuries ago, it behooved investors to anticipate the eventual flow from Europe (where the money was) to the U.S. Now that the money is predominantly in the U.S., one may be well-served to at least consider the likelihood that the current will flow toward Asia, Emerging Markets, and maybe back toward Europe. The chart above shows that the relative sizes of the economies argue in favor of that outcome. Secondly, note that the chart below from December shows how much more out of line the market caps became during 2024, from early in the year.

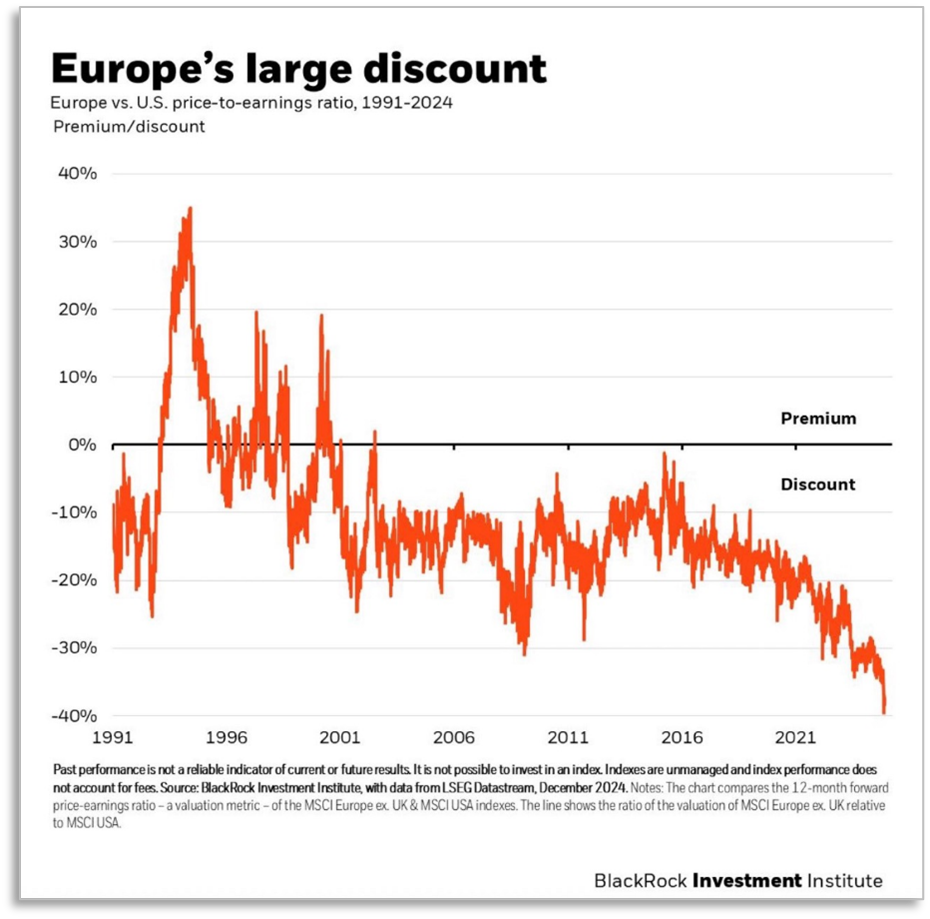

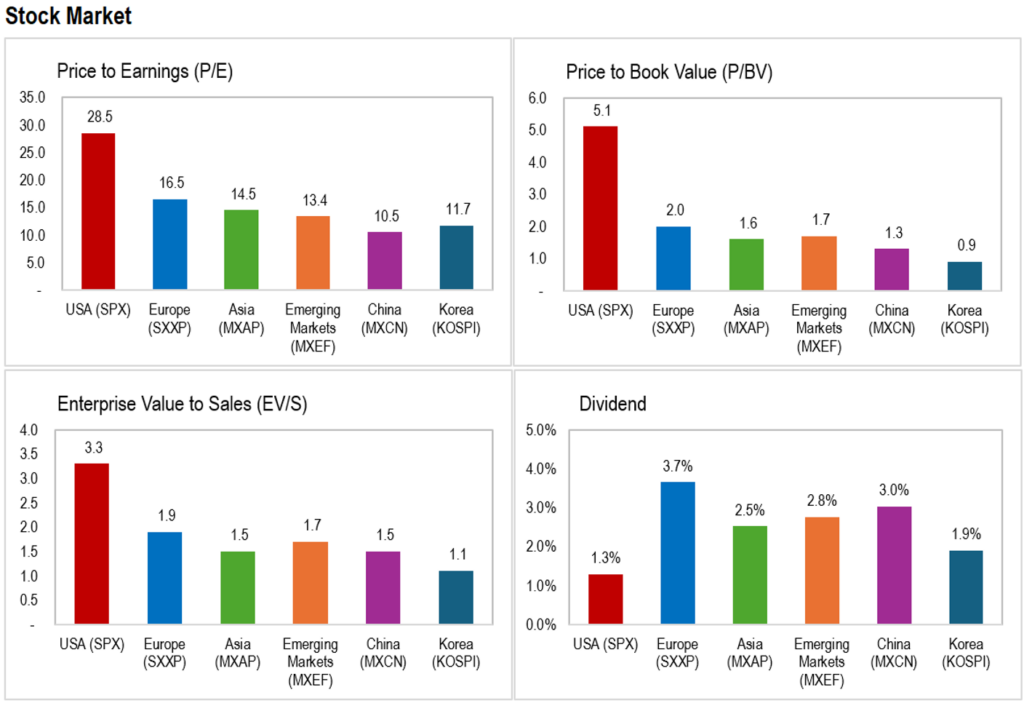

It is interesting that one-and-a-quarter centuries ago, the UK was accorded a much bigger market cap than the U.S. The UK, along with Germany and France cumulatively had four times the market cap of the U.S., whereas now the U.S. has almost nine times the cap of the other three. Is this deserved? Certainly, it is partially deserved. One may even say in good part deserved. But as investors we should look to take advantage of extremes. It is hard to view this as anything other than excessive. The Europeans are weighted at less than their GDP weights whereas the U.S. has an index weight that is two-and-a-half times its comparable GDP weight. More importantly, take a look at the value comparisons below. Water eventually seeks the low ground.

Europe/UK look very interesting to us, and we’ve already made plans for a number of our team members to do in-depth research there this year. Perhaps even more compelling is Asia, and you may be aware that the team spent a lot of time in Japan, Korea, and elsewhere during 2024. Asia is roughly 38% percent of the portfolio currently.

We will continue to highlight the fact that South Korea is a major economy that is “developed” in many ways and is recognized as such by FTSE but not MSCI. (See our whitepaper for more.) They are well respected in technology, telephony, manufacturing, consumer electronics and automobiles. Their economy was fine last year yet their stock market was down 21% (USD) versus +30% for the NASDAQ and +67% for the Mag 7. While Apple stock rose 31%, Samsung Electronics’ stock dove 40%. As a result, Apple is more expensive than Samsung Electronics by 3x, 69x, and 11x based upon price to earnings, tangible book value, and sales (enterprise value), respectively. An ongoing theme herein is what is the proper premium for “exceptionalism.”

A decade and a half ago, in the aftermath of the U.S.-led global financial crisis, many investors wanted out of the U.S. dollar and stock market (that was the buying opportunity), and what they were clamoring for were emerging markets in general and the BRICS (Brazil, Russia, India, China, and South Africa), in particular. China and India would boom, and Brazil, Russia, and South Africa would get rich providing them with the precious resources that that growth would require. Investors still hold India in high esteem, the other four – not so much. Brazil effectively tied Mexico for the worst performing stock market on the globe during 2024, down virtually 30%. The result is that the BOVESPA trades at only 7.5 times earnings, a mere 25% premium to book value, and has a dividend yield of 7.5%. And, yes, they are still endowed with tremendous natural resources and have a temperate climate.

“People are always asking me where the outlook is good, but that’s the wrong question.

The right question is, ‘Where is the outlook most miserable?”

– Sir John Templeton

Earlier it was mentioned that China is dealing with the apparent meltdown of a colossal financial bubble and is trembling under a mountain of debt. They’ve had a devil of a time dealing with the Biden administration and the Trump administration is signaling worse. Yet, people drove the Chinese stock (and real estate) market to obscene levels in the past; believing that the Chinese were hardworking, educated, ambitious people who were destined to grow their economy quickly and succeed in many areas. This proved to be true and over the past one-and-a-half decades their GDP ramped up by sixfold (6.5x in USD 2023). Their stock market didn’t go up sixfold; it fell. It is down 5% from the Oct 2007 peak (down 32% before dividend reinvestment). The problem was that investors were way too bulled-up on China at the top and paid too much and now it appears that they have become way too bearish. Hong Kong fared better a decade ago but is now down 22.7% from its January peak of seven years ago. It now trades at 9.4x earnings, 1x book value, and has a dividend yield of 4.2%. It’s all in the price at entry. This table shows that Europe, Asia, and the Emerging Markets could double and still have lower valuations than the U.S. on almost every metric. Country-wise, China and Korea almost leap off the chart as compelling.

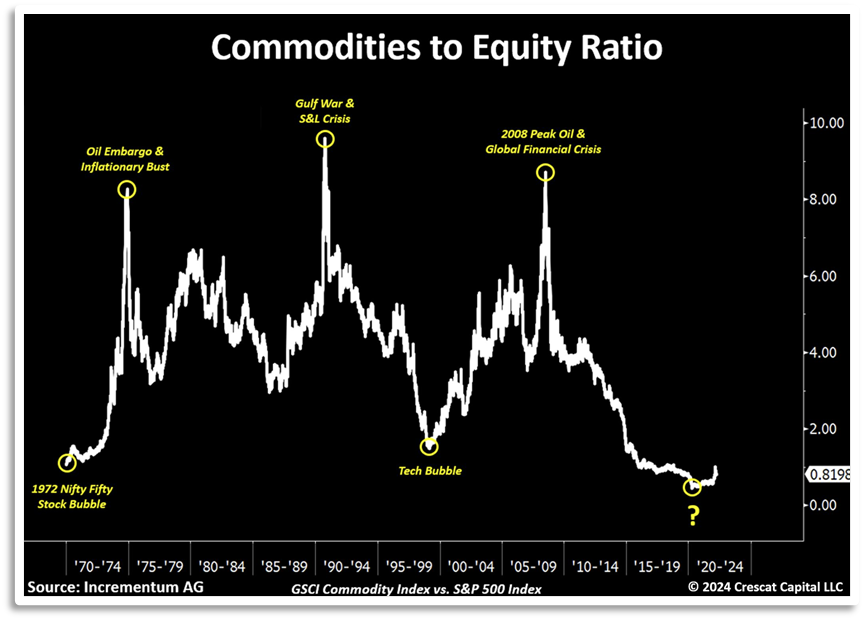

Sticking with Cantillon, but as promised, coming back to Nebuchadnezzar’s dream of the polymetallic statue, let’s quickly touch upon opportunities in real assets. The turbulent waters of Cantillon river are figuratively filled with waves, currents, crosscurrents, eddies, and many ebbs and flows. Over long periods of time commodities tend to be highly correlated. Over short to intermediate time periods, they can get out of whack, sometimes seriously so. Hence, tremendous volatility and mispricings create great money-making opportunities. We are pleased that finally in 2024, the gold market caught a wave.

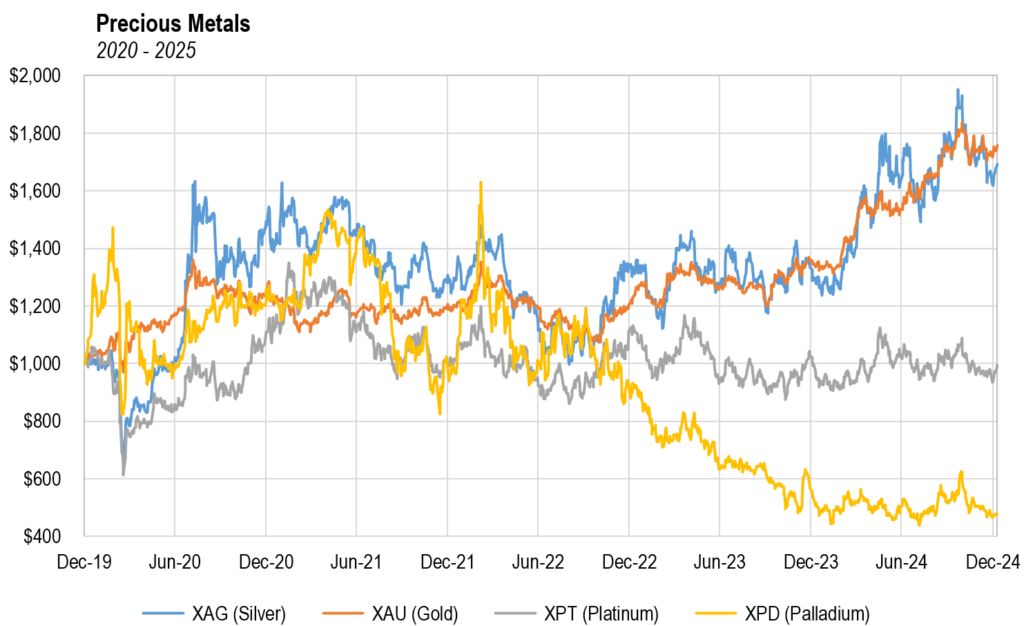

At current (record high) prices we believe that gold still has significant potential upside, but you may be surprised that gold is not the topic today. Per the Cantillon argument being made, the great opportunities may not be in the assets that have already caught a wave but in those assets into which the flows will migrate in the future. It is worth noting that since the peak of 1980, gold is up more than three times, silver is down 40%. Over the past 17 years gold is up 170% while platinum is down 57%.

That’s right, almost two decades have elapsed and the price is down by more than half. In less than four years, palladium prices are down by 70% whereas gold is up by 47%.

While gold is not the topic, miners continue to be compelling. As we have explained ad nauseam, and will continue to emphasize, gold underground trades at a ridiculous discount to the very same element above ground (adjusted for extraction costs and risks). Since the April 2011 peak, the GDX gold miner’s ETF is down 44% and the GDXJ junior gold miner’s index is down 73%. A period of almost 14 years during which gold rose in price by 81% and GDXJ is down by 73%. We are attracted to the enormous value of the reserves, but now is one of those rare times when stocks like Barrick and Newmont trade at discounts to the SPX on earnings and book value, have dividend yields twice as big, and have free cash flow. For more details on metals and on miners, please see our recently released whitepapers (on our website).

Elsewhere, natural gas, which has spent the past quarter-century trading between $2 and $14 (Henry Hub), trades near the low end of the range, at $3.40. Since late 2000 its price has been down 65% while gold is up 10 times. (By comparison, the NASDAQ is up around 20 times since the quarter-century low). Agricultural prices, while double the turn of the century lows, have three times over the past 20 years reached prices 60% above today’s level.

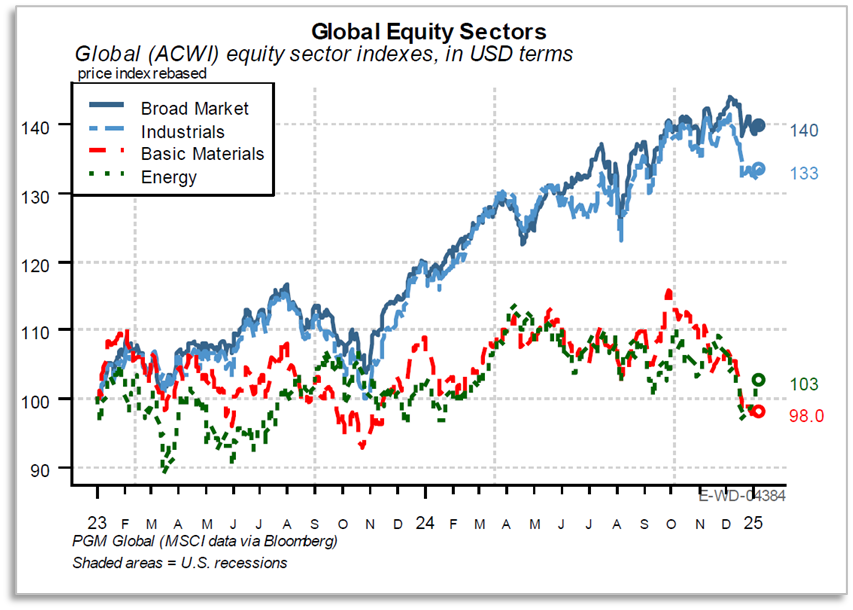

We would be interested in knowing how industrials are going to do well without materials or energy.

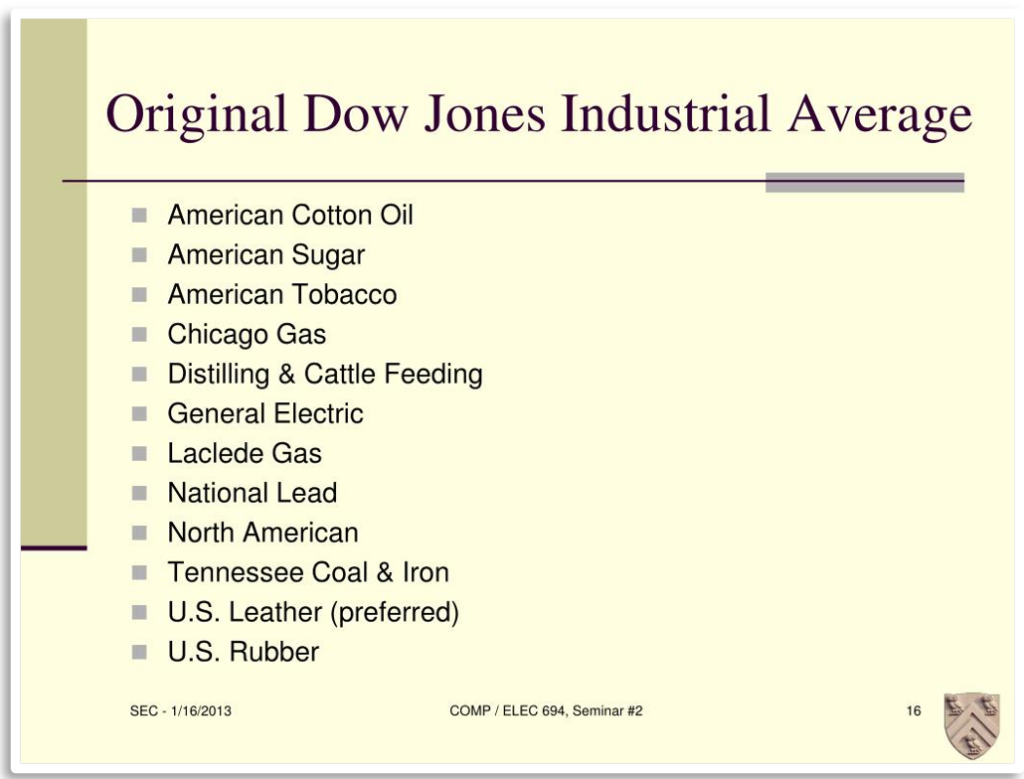

The final area that this paper will touch on is conglomerates. During the 1960s conglomerates were all the rage. A large portion of the U.S. economy was owned by the fast-growing corporate empires during the go-go years. Alas, these empires were shown to have been built on feet of clay. GE built a much admired and esteemed conglomerate during the 1980s and 1990s, eventually being awarded the highest market cap in the history of the world at that time. Its market value of over $600 billion was breathtaking at the time but seems quaint in today’s world of $3 trillion market caps, flirting with $4 trillion. Unfortunately, the light of day showed that GE too was built upon a shaky foundation. They spent much of the past decade staving off bankruptcy. As an interesting aside, highlighting the duration of corporate empires, take a look at the chart below of the original members of the Dow Jones Industrial average. None remain. GE was the longest index survivor. Few have even heard of many of the others. Will AI and the era of the disrupters lead to longer standing empires?

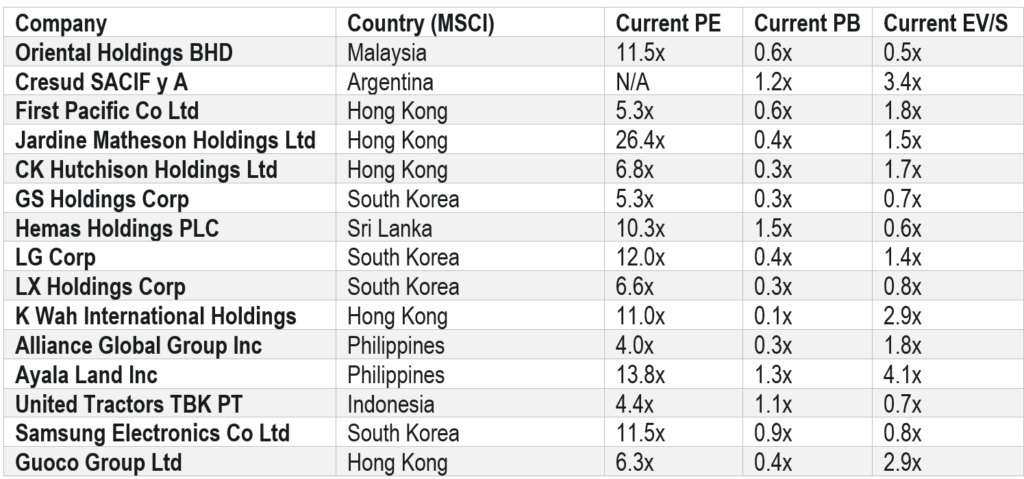

Returning to 2025, if water does indeed seek the lowest level, the lowest valuations in the market can generally be found amongst the world’s conglomerates. For a proper analysis, please see our upcoming white paper. For the purpose of this missive, let’s say that conglomerates are many and varied – they can’t all be bad. Many have large insider ownership for aligned interests. Diverse businesses allow sister companies to help during down times, lowering risk and increasing the opportunity to gain at the expense of undiversified competitors. Investors hear the word “conglomerate” and they move on. When others care more about a portfolio’s ‘wrapper’ than about its quality of the businesses, management, and valuations, opportunities can’t be far behind! While others pay up for PE funds, VC funds, Berkshire and GE (but not most publicly traded conglomerates), we are happily accumulating the solid business that they are shunning. Many are trading at crazy discounts to their intrinsic value. A few are highlighted below. For perspective, the MSCI-ACWI Index trades at 22x, 3.1x, and 2.5x for the price to: earnings, book value, and sales, respectively. The S&P 500 multiples are a much higher 29x, 5.0x, and 3.3x, respectively.

Kopernik has positions in Oriental Holdings BHD, Cresud SACIF y A, First Pacific Co Ltd, CK Hutchison Holdings Ltd, GS Holdings Corp, Hemas Holdings PLC, LG Corp, LX Holdings Corp, K Wah International Holdings, and United Tractors TBK PT.

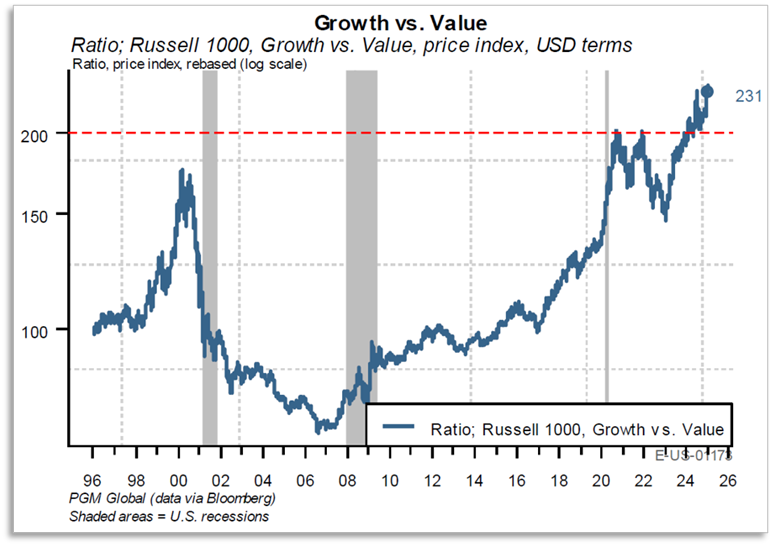

A few more broad categories of assets merit a quick mention. Stocks viewed as having growth prospects deserve to trade at a premium to those that don’t. They generally always do. At times, the premium afforded them becomes much larger than is warranted. Times like 1929, 1972, and especially 1999 come to mind. Those aberrations all ended badly for growth investors. The chart below highlights that the current aberrations are unparalleled in magnitude.

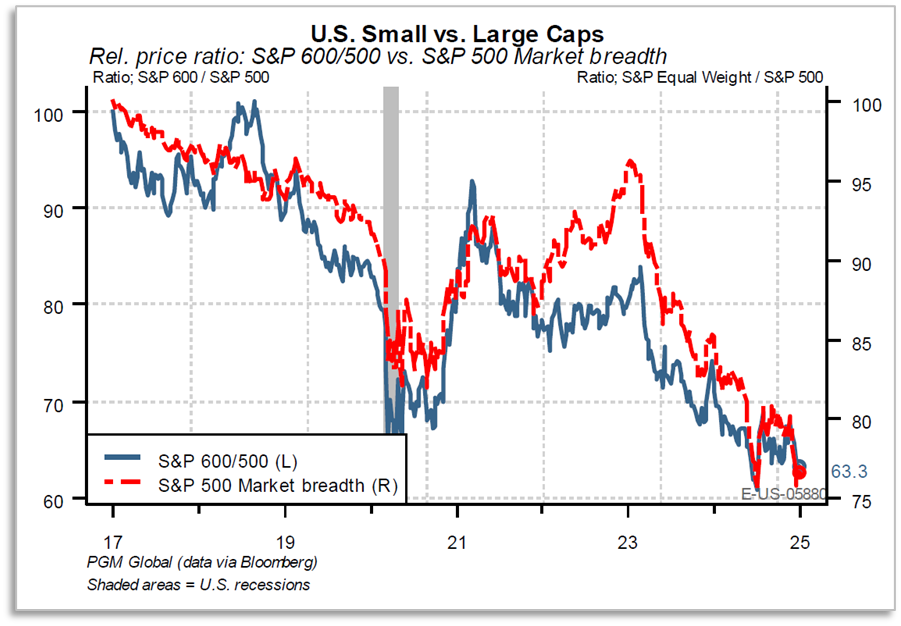

Small companies are arguably at a big disadvantage to their larger brethren in the post antitrust enforcement era. Platform companies, blitz-scalers, and oligopolists have become quite tough to compete with. Still, painting broad categories in one stroke can be misguided. People have no problem with venture capital. All big companies were once small companies. Sometimes large companies have small market caps. There are thousands of unique small companies in the world. And history shows that quite often investors prefer small caps. The discount currently being slapped on small caps relative to large caps is compellingly attractive.

The Tower of Babel & Concluding Thoughts

Babylon is also famous as the home of the Tower of Babel. It is, fittingly, a tale of hubris and of communication breakdown. Anticipating the NASDAQ investors of many millennia in the future, humans agree to build a great city with a tower that would reach the heavens. God, disapproving of their arrogance and disobedience, confounds their speech so that they can no longer understand each other and scatters them around the world, leaving the city unfinished.

Considering the fact that stock prices are all about trust in the future, it is noteworthy and disconcerting to see prices reach so close to the sky even as distrust and mal communications are also at sky-high altitudes. Trust in governments, media of all types, CEOs, and of authority figures in general, seems to be at all-time lows. People don’t know what to believe and label non-consensus views as conspiracy theories. They have forgotten much of history, and the language of “value” is long lost.

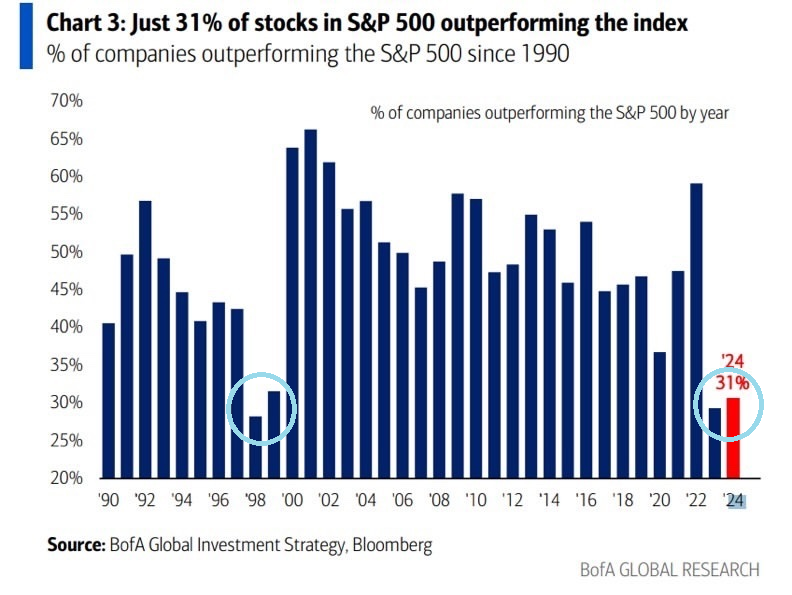

Fortunately, in those who still speak the Value lingo rests the ability to understand the plethora of attractive investment opportunities that the crowds are failing to decipher. Early on, the Fed’s “river” of cash injections went into stocks, bonds, and real estate. It has since been migrating out of bonds sloshing elsewhere, in fits and starts. The uneven path has created volatility and bifurcated valuations in the marketplace, which is now ripe with peril and opportunity. While the S&P 500 towers, Babel-like, at heavenly heights, a host of other opportunities are available at up to 18-year relative lows. Broad categories of assets have been left behind as compelling bargains. These include stocks in: Asia, Europe, Emerging Markets, small capitalizations, and industries such as phones, clean energy, rails, and agriculture. Commodities such as platinum and natural gas are at huge discounts to competitive resources. And commodities held by mining companies trading on Wall Street and Bay Street sell way cheaper than the same elements trade on the spot market. Finally, “value” stocks in general are at a mind-blowing historic discount to the popular market indices.

Identifying bargains is one thing, but to actually buy them, investors need a little Daniel-like resolve. Stocks generally get cheap when they are deeply unpopular and investing requires discipline and intestinal fortitude. We, at Kopernik, believe that we have demonstrated the requisite dedication and resolve to capitalize on current opportunities. We, including at predecessor firms, have a long history of not succumbing to “style drift.” As we enter 2025, it seems like a particularly terrible time to drift toward towering momentum darlings. Conversely, investors should be well served to increase their exposure to pockets of value. Inflation protection is a worthy consideration as well.

We appreciate our partnership with you, and we wish you all a Healthy, Happy, and Prosperous 2025.

Cheers,

David B. Iben, CFA

Chief Investment Officer

Portfolio Manager

January 2025

“So let the words of our mouth

And the meditation of our heart

Be acceptable in Thy sight”

– Rivers of Babylon

Important Information and Disclosures

The information presented herein is proprietary to Kopernik Global Investors, LLC. This material is not to be reproduced in whole or in part or used for any purpose except as authorized by Kopernik Global Investors, LLC. This material is for informational purposes only and should not be regarded as a recommendation or an offer to buy or sell any product or service to which this information may relate.

This letter may contain forward-looking statements. Use of words such was “believe”, “intend”, “expect”, anticipate”, “project”, “estimate”, “predict”, “is confident”, “has confidence” and similar expressions are intended to identify forward-looking statements. Forward-looking statements are not historical facts and are based on current observations, beliefs, assumptions, expectations, estimates, and projections. Forward-looking statements are not guarantees of future performance and are subject to risks, uncertainties and other factors, some of which are beyond our control and are difficult to predict. As a result, actual results could differ materially from those expressed, implied or forecasted in the forward-looking statements.

Please consider all risks carefully before investing. Investments discussed are subject to certain risks such as market, investment style, interest rate, deflation, and illiquidity risk. Investments in small and mid-capitalization companies also involve greater risk and portfolio price volatility than investments in larger capitalization stocks. Investing in non-U.S. markets, including emerging and frontier markets, involves certain additional risks, including potential currency fluctuations and controls, restrictions on foreign investments, less governmental supervision and regulation, less liquidity, less disclosure, and the potential for market volatility, expropriation, confiscatory taxation, and social, economic and political instability. Investments in energy and natural resources companies are especially affected by developments in the commodities markets, the supply of and demand for specific resources, raw materials, products and services, the price of oil and gas, exploration and production spending, government regulation, economic conditions, international political developments, energy conservation efforts and the success of exploration projects.

Investing involves risk, including possible loss of principal. There can be no assurance that a strategy will achieve its stated objectives. Equity funds are subject generally to market, market sector, market liquidity, issuer, and investment style risks, among other factors, to varying degrees, all of which are more fully described in the fund’s prospectus. Investments in foreign securities may underperform and may be more volatile than comparable U.S. securities because of the risks involving foreign economies and markets, foreign political systems, foreign regulatory standards, foreign currencies and taxes. Investments in foreign and emerging markets present additional risks, such as increased volatility and lower trading volume.

The holdings and topics discussed in this piece should not be considered recommendations to purchase or sell a particular security. It should not be assumed that securities bought or sold in the future will be profitable or will equal the performance of the securities in this portfolio. Kopernik and its clients as well as its related persons may (but do not necessarily) have financial interests in securities, issuers, or assets that are discussed. Current and future portfolio holdings are subject to risk. Commodities may be affected by changes in overall market movements, changes in interest rates, and other factors such as weather, disease, embargoes, or political and regulatory developments, such as trading activity of speculators and arbitrageurs in the commodities. Investing in commodities entails significant risk and is not appropriate for all investors.